SA103F Self Employment Full If You're Self Employed, Have More Complex Tax Affairs and Your Annual Business Turnover Was 73,000 2020

Understanding the SA103F Self Employment Full Form

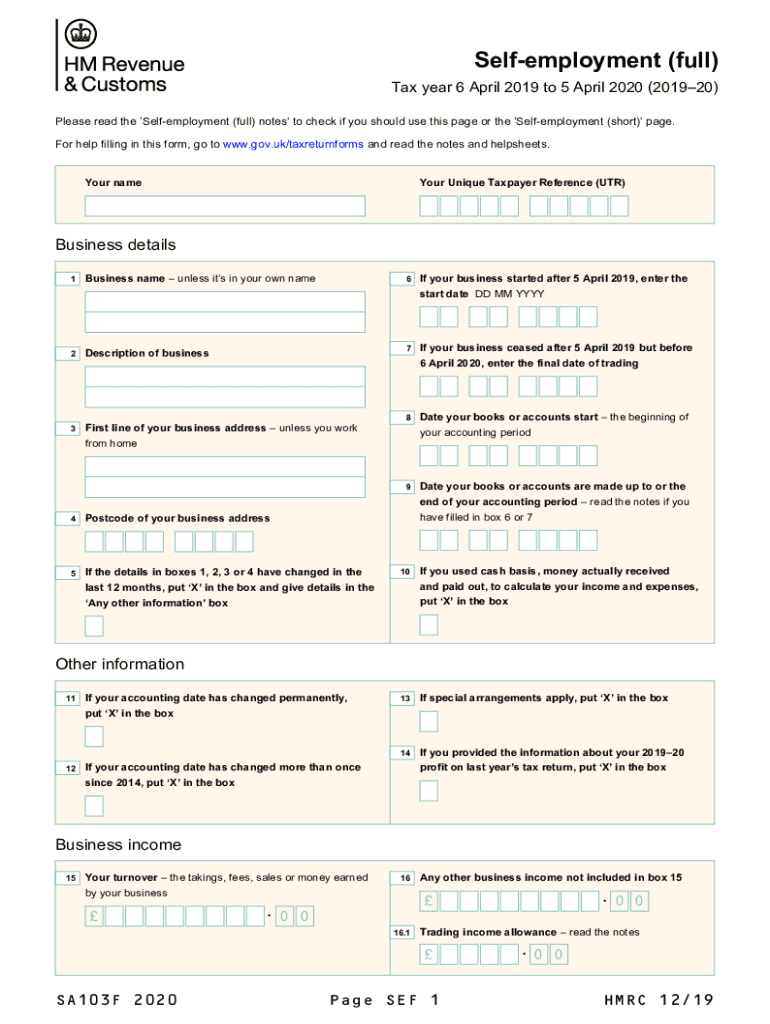

The SA103F form is a critical document for self-employed individuals in the United Kingdom who have more complex tax affairs. Specifically, it is used when your annual business turnover exceeds seventy-three thousand dollars. This form serves as a supplementary page to the main tax return, allowing you to report your income and expenses accurately. Completing the SA103F is essential to ensure compliance with tax regulations and to avoid potential penalties.

Steps to Complete the SA103F Self Employment Full Form

Completing the SA103F form involves several steps to ensure that all necessary information is accurately reported. Here’s a concise guide:

- Gather financial records, including income statements and expense receipts.

- Begin filling out the form by providing your personal details, such as name and address.

- Report your total income from self-employment, ensuring all sources are included.

- Detail your allowable expenses, which may include costs related to business operations.

- Calculate your profit by subtracting total expenses from total income.

- Review all entries for accuracy before submission.

Legal Use of the SA103F Self Employment Full Form

The SA103F form must be completed and submitted in accordance with legal requirements set forth by HMRC. It is essential that the information provided is truthful and accurate, as any discrepancies could lead to legal repercussions. The form is designed to ensure that self-employed individuals meet their tax obligations, and its proper use supports the integrity of the tax system.

Key Elements of the SA103F Self Employment Full Form

Several key elements are integral to the SA103F form:

- Personal Information: Basic details about the taxpayer, including name, address, and National Insurance number.

- Income Reporting: A comprehensive account of all income generated from self-employment.

- Expense Declaration: A detailed list of allowable business expenses that can be deducted from income.

- Profit Calculation: The final figure representing the taxable profit after expenses are accounted for.

Obtaining the SA103F Self Employment Full Form

To obtain the SA103F form, individuals can visit the official HMRC website where it is available for download. The form can be filled out electronically or printed for manual completion. It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Filing Deadlines for the SA103F Self Employment Full Form

Filing deadlines for the SA103F form are critical to avoid penalties. Typically, the deadline for submitting your self-assessment tax return, including the SA103F, is January thirty-first following the end of the tax year. For example, for the tax year ending April fifth, the form must be submitted by January thirty-first of the following year. It is advisable to plan ahead to ensure timely submission.

Quick guide on how to complete sa103f self employment full 2020 if youre self employed have more complex tax affairs and your annual business turnover was

Complete SA103F Self employment full If You're Self employed, Have More Complex Tax Affairs And Your Annual Business Turnover Was 73,000 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage SA103F Self employment full If You're Self employed, Have More Complex Tax Affairs And Your Annual Business Turnover Was 73,000 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign SA103F Self employment full If You're Self employed, Have More Complex Tax Affairs And Your Annual Business Turnover Was 73,000 without hassle

- Find SA103F Self employment full If You're Self employed, Have More Complex Tax Affairs And Your Annual Business Turnover Was 73,000 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that function.

- Create your eSignature using the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign SA103F Self employment full If You're Self employed, Have More Complex Tax Affairs And Your Annual Business Turnover Was 73,000 and ensure clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa103f self employment full 2020 if youre self employed have more complex tax affairs and your annual business turnover was

Create this form in 5 minutes!

How to create an eSignature for the sa103f self employment full 2020 if youre self employed have more complex tax affairs and your annual business turnover was

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is sa103f and how can it benefit my business?

The sa103f form is a self-assessment tax return specific to businesses in the UK. Using airSlate SignNow, you can easily eSign and send this document, streamlining your tax submission process. This not only saves time but also enhances accuracy, ensuring that your business stays compliant with tax regulations.

-

Is airSlate SignNow a cost-effective solution for managing sa103f forms?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes. By digitizing the management of your sa103f forms, you can reduce printing and shipping costs. Additionally, the time saved on document processing can lead to signNow savings overall.

-

What features of airSlate SignNow support the sa103f document process?

AirSlate SignNow provides a suite of features that enhance the handling of sa103f forms, including document templates, seamless eSigning, and secure storage. These features allow users to efficiently fill out, sign, and manage their tax documents. Moreover, custom workflows can be created to suit specific business needs.

-

How does airSlate SignNow ensure the security of my sa103f documents?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and secure access protocols to protect your sa103f documents from unauthorized access. Regular audits and compliance with data protection regulations further ensure that your information is kept safe.

-

Can I integrate airSlate SignNow with other software for sa103f management?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software solutions, making the management of sa103f forms more efficient. You can connect it with accounting platforms, CRMs, and more, allowing for a cohesive workflow that centralizes your document handling.

-

How easy is it to eSign my sa103f forms using airSlate SignNow?

eSigning your sa103f forms is straightforward with airSlate SignNow. The platform provides an intuitive interface that guides users through the signing process. You can eSign documents from any device, ensuring that you can manage your tax forms on the go.

-

What customer support options does airSlate SignNow provide for sa103f users?

AirSlate SignNow offers comprehensive customer support to assist users with their sa103f-related queries. Support options include live chat, email assistance, and an extensive knowledge base. This ensures that help is available whenever you need guidance in managing your documents.

Get more for SA103F Self employment full If You're Self employed, Have More Complex Tax Affairs And Your Annual Business Turnover Was 73,000

- Azdorgovformstax credits formscredit for contributions to qualifying charitable azdor

- Arizona form 348 credit for contributions to certified school tuition

- Arizona form 301 nonrefundable individual tax credits andarizona form 301 nonrefundable individual tax credits andindividual

- Do not use this form for contributions to private school tuition organizations

- Arizona a1 form

- Azdorgovformsindividualinnocent spouse reliefarizona department of revenue azdor

- For the calendar year 2022 or fiscal year beginning m m d d 2 0 2 2 and ending m m d d y y y y form

- Dr 501sc form fill out and sign printable pdf templatesignnow

Find out other SA103F Self employment full If You're Self employed, Have More Complex Tax Affairs And Your Annual Business Turnover Was 73,000

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form