When Do I Make Self Assessment Payments and File My Tax 2023

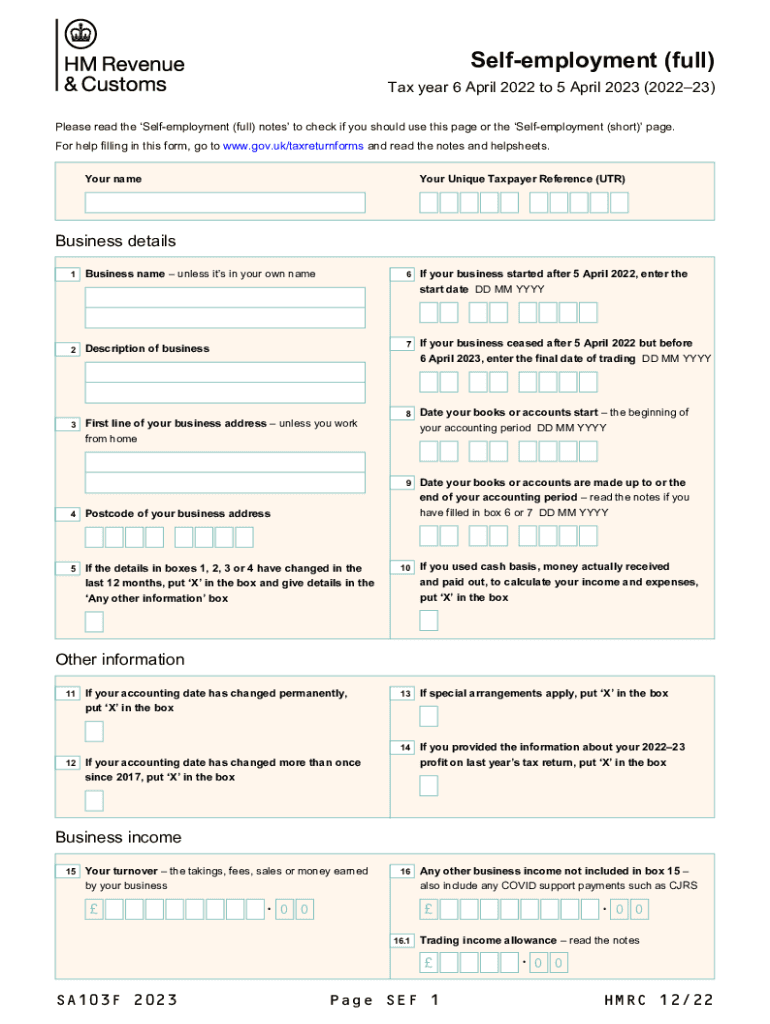

Understanding the sa103f Form

The sa103f form is a self-employed tax form used by individuals in the United States to report their income and expenses. This form is essential for those who operate as sole traders or freelancers, allowing them to declare their earnings accurately to the IRS. It captures various details, including income from self-employment, allowable business expenses, and any other relevant financial information necessary for tax assessment.

Filing Deadlines and Important Dates

Filing the sa103f form requires awareness of specific deadlines to avoid penalties. Typically, self-assessment tax returns are due by April fifteenth of the following tax year. If you are filing your return online, you may have until October fifteenth to submit your form. It is crucial to mark these dates on your calendar to ensure timely submission and compliance with IRS regulations.

Steps to Complete the sa103f Form

Completing the sa103f form involves several key steps:

- Gather all necessary financial documents, including income statements and receipts for business expenses.

- Accurately fill out the income section, detailing all earnings from self-employment.

- List allowable business expenses, ensuring you have supporting documentation for each claim.

- Calculate your total taxable income by subtracting your expenses from your income.

- Review the completed form for accuracy before submission.

Legal Use of the sa103f Form

The sa103f form is legally recognized by the IRS as a valid document for reporting self-employment income. To ensure its legal standing, it must be completed accurately and submitted on time. E-signatures are acceptable, provided they comply with the necessary eSignature regulations, ensuring that the document is binding and recognized in legal contexts.

Required Documents for Filing

When preparing to file the sa103f form, certain documents are required to substantiate the information provided. These include:

- Income statements from all sources of self-employment.

- Receipts and invoices for business expenses.

- Bank statements that reflect income deposits and expenses.

- Any previous tax returns that may provide context for your current filing.

Penalties for Non-Compliance

Failing to file the sa103f form on time or submitting inaccurate information can lead to significant penalties. The IRS may impose fines based on the amount owed and the length of time the return is late. Additionally, interest may accrue on any unpaid taxes, adding to the overall financial burden. Awareness of these penalties can motivate timely and accurate filing.

Taxpayer Scenarios for the sa103f Form

Understanding how the sa103f form applies to different taxpayer scenarios can aid in its proper use. Common scenarios include:

- Self-employed individuals operating as sole proprietors.

- Freelancers providing services in various industries.

- Independent contractors who receive income from multiple sources.

Each scenario may have unique considerations regarding income reporting and allowable deductions, making it essential for taxpayers to understand their specific situations when completing the form.

Quick guide on how to complete when do i make self assessment payments and file my tax

Complete When Do I Make Self Assessment Payments And File My Tax effortlessly on any device

Digital document management has become favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without delays. Manage When Do I Make Self Assessment Payments And File My Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign When Do I Make Self Assessment Payments And File My Tax with ease

- Locate When Do I Make Self Assessment Payments And File My Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as an original wet ink signature.

- Review the information and then click the Done button to preserve your modifications.

- Select how you wish to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign When Do I Make Self Assessment Payments And File My Tax and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct when do i make self assessment payments and file my tax

Create this form in 5 minutes!

How to create an eSignature for the when do i make self assessment payments and file my tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SA103F and how can airSlate SignNow help with it?

SA103F is a self-assessment tax return form in the UK for self-employed individuals. airSlate SignNow simplifies the process by allowing you to prepare, sign, and securely send your SA103F documents electronically, ensuring compliance and reducing paperwork.

-

Is there a pricing plan specifically for SA103F document handling?

Yes, airSlate SignNow offers flexible pricing plans that cater to various needs, including managing SA103F forms. Whether you're a solo entrepreneur or a larger business, our cost-effective solutions provide value while making document management seamless.

-

What features does airSlate SignNow offer for managing SA103F forms?

airSlate SignNow includes features like document templates, electronic signatures, and real-time tracking for SA103F forms. These tools help streamline the process, ensuring that your documents are handled efficiently and securely.

-

How do I eSign my SA103F using airSlate SignNow?

To eSign your SA103F using airSlate SignNow, simply upload your document, add the required signers, and place signature fields as needed. The platform guides you through the entire process, making it easy and quick to finalize your document.

-

Can I integrate airSlate SignNow with other software for my SA103F processes?

Absolutely! airSlate SignNow supports integrations with various platforms like Google Drive, Dropbox, and accounting software. This helps streamline your workflow and makes it easier to manage your SA103F documentation alongside other business processes.

-

What are the benefits of using airSlate SignNow for my SA103F documentation?

Using airSlate SignNow for your SA103F documentation allows for faster processing, enhanced security, and improved collaboration. Our user-friendly interface ensures you can manage your self-assessment forms with ease, leading to greater productivity.

-

Is airSlate SignNow compliant with regulations for handling SA103F documents?

Yes, airSlate SignNow is designed to comply with industry standards and regulations for document handling, including those relevant to SA103F forms. This compliance adds an extra layer of security and trust when you manage sensitive information.

Get more for When Do I Make Self Assessment Payments And File My Tax

Find out other When Do I Make Self Assessment Payments And File My Tax

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure