RI 1040 This Booklet Contains RI 1040 RI Schedule EIC RI Schedule OT RI 8615 RI Schedule FT RI Deduction Schedules RI Schedule I Form

Overview of the RI 1040 and Related Schedules

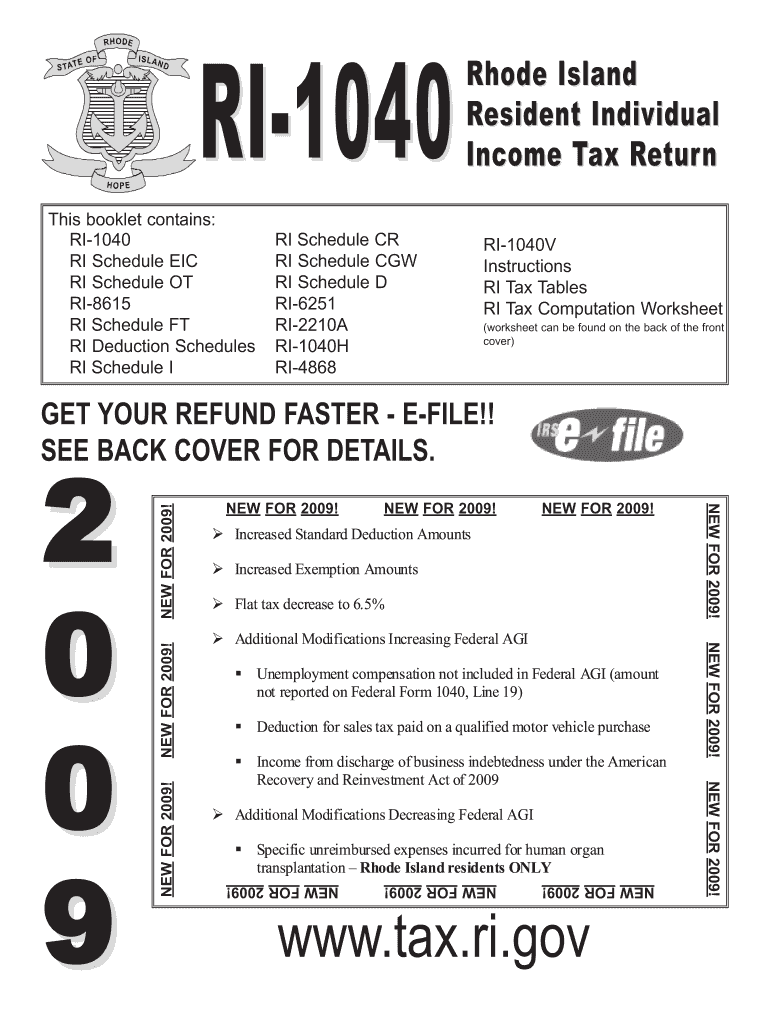

The RI 1040 is the primary tax form used by Rhode Island residents to report their income and calculate their state tax liability. This booklet contains essential schedules and forms that assist in completing the RI 1040 accurately. Key components include the RI Schedule EIC, which provides information on the Earned Income Credit, and the RI Schedule OT, which details other income types. The RI 8615 form is used for calculating tax on unearned income for certain children, while the RI Schedule FT addresses the calculation of fiduciary income tax. Additional schedules, such as the RI Deduction Schedules and RI Schedule I, help taxpayers identify applicable deductions and credits, ensuring a comprehensive tax filing process.

Steps to Complete the RI 1040

To complete the RI 1040, follow these structured steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Fill out the RI 1040 form, starting with personal information and income details.

- Complete applicable schedules, such as the RI Schedule EIC for credits and the RI Schedule D for capital gains.

- Review all entries for accuracy, ensuring that all income and deductions are correctly reported.

- Calculate your total tax liability using the provided instructions and tables.

- Sign and date the form before submission.

Key Elements of the RI 1040

Understanding the key elements of the RI 1040 is crucial for effective tax filing. Important sections include:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: Report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: Identify any deductions you qualify for, such as those listed on the RI Deduction Schedules.

- Tax Calculation: Use the provided tax tables to determine your tax obligation based on your taxable income.

State-Specific Rules for the RI 1040

Rhode Island has specific rules that differ from federal tax regulations. For instance, certain deductions may only be available to state residents, such as the RI Schedule CR for credits. Additionally, the state has unique tax rates and brackets that must be adhered to when calculating your tax liability. Familiarizing yourself with these rules is essential to ensure compliance and maximize your tax benefits.

Filing Deadlines and Important Dates

Timely filing of the RI 1040 is crucial to avoid penalties. The standard deadline for submitting the RI 1040 is typically April fifteenth, aligning with federal tax deadlines. However, if you require additional time, you may file for an extension using the RI 4868 form, which grants an automatic six-month extension. It is important to note that while an extension allows for more time to file, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents for Filing

When preparing to file the RI 1040, ensure you have all required documents on hand. Essential documents include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation for any additional income sources.

- Records of deductible expenses, such as medical bills or educational expenses.

Quick guide on how to complete ri 1040 this booklet contains ri 1040 ri schedule eic ri schedule ot ri 8615 ri schedule ft ri deduction schedules ri schedule

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring excellent communication at every stage of your form creation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to RI 1040 This Booklet Contains RI 1040 RI Schedule EIC RI Schedule OT RI 8615 RI Schedule FT RI Deduction Schedules RI Schedule I

Create this form in 5 minutes!

How to create an eSignature for the ri 1040 this booklet contains ri 1040 ri schedule eic ri schedule ot ri 8615 ri schedule ft ri deduction schedules ri schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in the RI 1040 booklet?

The RI 1040 booklet contains essential forms such as RI Schedule EIC, RI Schedule OT, RI 8615, RI Schedule FT, and various deduction schedules. It also includes RI Schedule I, RI Schedule CR, RI Schedule CGW, RI Schedule D, RI 6251, RI 2210A, RI 1040H, and RI 4868. This comprehensive guide is designed for Rhode Island residents to ensure accurate tax filing.

-

How can airSlate SignNow help with RI 1040 tax forms?

airSlate SignNow provides an easy-to-use platform for sending and eSigning RI 1040 tax forms. Users can streamline their document management process, ensuring that all necessary forms, including RI Schedule EIC and RI Schedule OT, are completed and submitted efficiently. This saves time and reduces the risk of errors in tax filing.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while accessing features that support RI 1040 and other tax-related documents. Contact our sales team for detailed pricing information.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect it with popular tools like Google Drive, Dropbox, and CRM systems, making it easier to manage your RI 1040 documents and other forms. This integration helps streamline the process of eSigning and document sharing.

-

What benefits does airSlate SignNow provide for tax professionals?

For tax professionals, airSlate SignNow offers a reliable solution to manage client documents efficiently. With features tailored for handling RI 1040 and related schedules, professionals can ensure compliance and accuracy in tax filings. The platform also enhances collaboration with clients through secure eSigning capabilities.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including the RI 1040 booklet. Users can confidently send and eSign documents, knowing that their information is safeguarded against unauthorized access.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing users to manage their RI 1040 documents on the go. The mobile app provides the same features as the desktop version, ensuring that you can send, eSign, and track documents anytime, anywhere.

Get more for RI 1040 This Booklet Contains RI 1040 RI Schedule EIC RI Schedule OT RI 8615 RI Schedule FT RI Deduction Schedules RI Schedule I

- 2018 2020 form az dor 140ez fill online printable fillable

- 2019 m1x amended income tax return minnesota form

- Transaction privilege use and severance tax return tpt 2 transaction privilege use and severance tax return tpt 2 form

- Uc 018 unemployment tax and wage report unemployment tax and wage report form

- How can i assemble my tax return like schedued a or c etc form

- Serious security the decade ending y2k bug that wasnt form

- Schedule ct 1041 k 1 beneficiarys share of certain form

- Internal revenue service locations ampamp hours near hartford ct form

Find out other RI 1040 This Booklet Contains RI 1040 RI Schedule EIC RI Schedule OT RI 8615 RI Schedule FT RI Deduction Schedules RI Schedule I

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF