Schedule CT 1041 K 1, Beneficiary's Share of Certain 2019

What is the Schedule CT 1041 K-1, Beneficiary's Share Of Certain Income

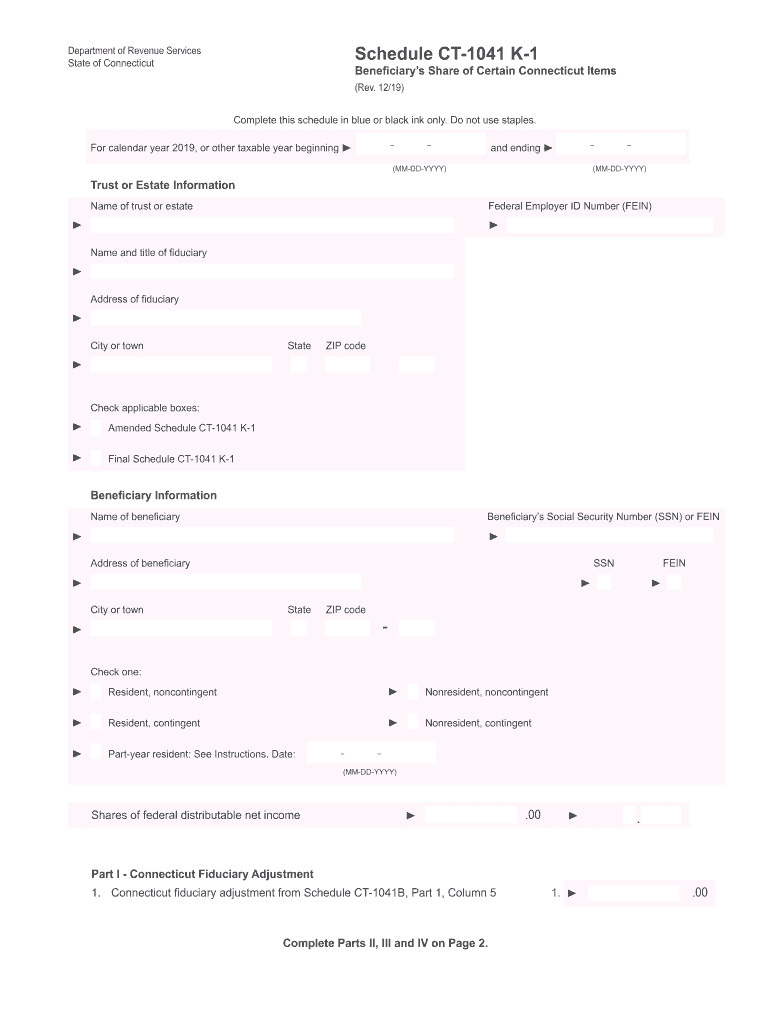

The Schedule CT 1041 K-1 is a tax form used in Connecticut to report a beneficiary's share of income, deductions, and credits from an estate or trust. This form is essential for beneficiaries who receive distributions from estates or trusts, as it provides the necessary information to accurately report income on their personal tax returns. The Schedule CT 1041 K-1 includes details such as the beneficiary's name, address, and the amount of income allocated to them, ensuring compliance with state tax regulations.

Steps to complete the Schedule CT 1041 K-1, Beneficiary's Share Of Certain Income

Completing the Schedule CT 1041 K-1 involves several key steps:

- Gather necessary information, including the estate or trust's federal tax return and any prior K-1 forms.

- Fill out the beneficiary's information, including name, address, and taxpayer identification number.

- Report the income types allocated to the beneficiary, such as interest, dividends, and capital gains.

- Include any deductions or credits that apply to the beneficiary's share of income.

- Review the completed form for accuracy before submitting it with the estate or trust's tax return.

Legal use of the Schedule CT 1041 K-1, Beneficiary's Share Of Certain Income

The Schedule CT 1041 K-1 is legally recognized as a valid document for reporting income from estates and trusts. To ensure its legal standing, the form must be completed accurately and submitted in accordance with Connecticut tax laws. Beneficiaries must use the information provided on the K-1 to report income on their individual tax returns, thereby fulfilling their tax obligations. Failure to properly report this income may result in penalties or additional scrutiny from tax authorities.

How to obtain the Schedule CT 1041 K-1, Beneficiary's Share Of Certain Income

To obtain the Schedule CT 1041 K-1, beneficiaries can request it directly from the estate or trust administrator. The administrator is responsible for preparing and distributing the K-1 forms to all beneficiaries. Additionally, the form can be accessed through the Connecticut Department of Revenue Services website, where it is available for download. It is important for beneficiaries to ensure they receive their K-1 in a timely manner to facilitate accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CT 1041 K-1 align with the tax return deadlines for estates and trusts. Typically, the estate or trust must file its tax return by the fifteenth day of the fourth month following the close of its tax year. Beneficiaries should expect to receive their K-1 forms shortly thereafter, allowing them to file their personal tax returns on time. It is crucial to stay informed about any changes in deadlines, as these can vary from year to year.

Examples of using the Schedule CT 1041 K-1, Beneficiary's Share Of Certain Income

Examples of using the Schedule CT 1041 K-1 include situations where a beneficiary receives income from a family trust or an estate following the death of a relative. For instance, if a beneficiary inherits a portion of a trust that generates dividends, the K-1 will detail the amount of those dividends for tax reporting purposes. Similarly, if a beneficiary receives capital gains distributions from an estate, these will also be reported on the K-1, ensuring the beneficiary can accurately report their income to the IRS.

Quick guide on how to complete schedule ct 1041 k 1 beneficiarys share of certain

Complete Schedule CT 1041 K 1, Beneficiary's Share Of Certain effortlessly on any device

Web-based document management has become increasingly popular with businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly without delays. Manage Schedule CT 1041 K 1, Beneficiary's Share Of Certain on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest approach to modify and electronically sign Schedule CT 1041 K 1, Beneficiary's Share Of Certain with ease

- Locate Schedule CT 1041 K 1, Beneficiary's Share Of Certain and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Schedule CT 1041 K 1, Beneficiary's Share Of Certain and guarantee outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ct 1041 k 1 beneficiarys share of certain

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 1041 k 1 beneficiarys share of certain

How to make an electronic signature for the Schedule Ct 1041 K 1 Beneficiarys Share Of Certain online

How to generate an electronic signature for your Schedule Ct 1041 K 1 Beneficiarys Share Of Certain in Chrome

How to make an eSignature for signing the Schedule Ct 1041 K 1 Beneficiarys Share Of Certain in Gmail

How to create an electronic signature for the Schedule Ct 1041 K 1 Beneficiarys Share Of Certain straight from your smartphone

How to create an eSignature for the Schedule Ct 1041 K 1 Beneficiarys Share Of Certain on iOS devices

How to generate an electronic signature for the Schedule Ct 1041 K 1 Beneficiarys Share Of Certain on Android devices

People also ask

-

What is the online CT 1041 K-1 form and why do I need it?

The online CT 1041 K-1 form is a tax document required for reporting income, deductions, and credits for beneficiaries of estates and trusts in Connecticut. By using airSlate SignNow to complete and eSign this form online, you ensure accurate reporting and timely submission, making tax season easier for you and your beneficiaries.

-

How does airSlate SignNow simplify the process of completing the online CT 1041 K-1?

airSlate SignNow streamlines the process of filling out the online CT 1041 K-1 form by providing an intuitive interface and pre-built templates. This means you can quickly populate fields and ensure that all necessary information is accurately captured, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow to handle the online CT 1041 K-1?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs, allowing you to choose a solution that best aligns with your usage. You can easily sign up for a plan that includes features specifically for managing online CT 1041 K-1 forms and other document workflows.

-

Can I integrate airSlate SignNow with other accounting software for the online CT 1041 K-1 process?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your ability to manage the online CT 1041 K-1 efficiently. This integration allows you to automatically populate tax documents and streamline your workflow further.

-

What features does airSlate SignNow offer for eSigning the online CT 1041 K-1?

airSlate SignNow includes a range of eSigning features, such as multi-party signing, audit trails, and customizable templates. These features ensure that your online CT 1041 K-1 is securely signed by all necessary parties, providing peace of mind during tax submissions.

-

Is airSlate SignNow secure for submitting sensitive tax forms like the online CT 1041 K-1?

Absolutely! airSlate SignNow prioritizes security with bank-level encryption and compliance with industry standards. This means your online CT 1041 K-1 and any other sensitive documents are protected throughout the signing and submission process.

-

How can airSlate SignNow benefit my business when handling the online CT 1041 K-1?

Using airSlate SignNow for the online CT 1041 K-1 can signNowly reduce the time and effort required for tax compliance. The platform's ease of use, combined with its robust features for document management and eSigning, helps you stay organized and ensures timely compliance, letting you focus more on your business.

Get more for Schedule CT 1041 K 1, Beneficiary's Share Of Certain

- Transfer ownership formpdffillercom

- Absent owner treatment consent form the bark

- Hair removal consent form

- Downloadable esthetician consent forms

- Employee profile format

- Va form 21 0960c 10 peripheral nerves disability benefits questionnaire

- Radiesse consent form facey medical group

- Confidential request gallatin county montana gallatin mt form

Find out other Schedule CT 1041 K 1, Beneficiary's Share Of Certain

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation