140 Es Form 2020

What is the Arizona Estimated Payment Form?

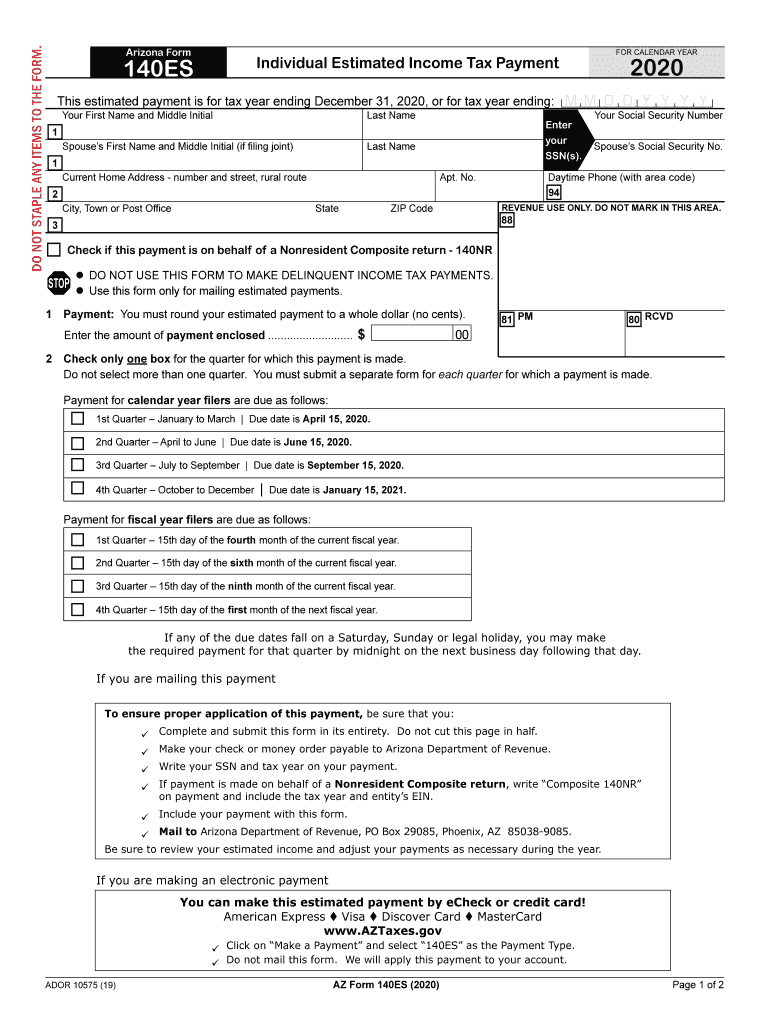

The Arizona estimated payment form, commonly referred to as the 140ES form, is a tax document used by individuals and businesses to report and pay estimated income taxes to the state of Arizona. This form is essential for those who expect to owe tax of more than five hundred dollars when they file their annual tax return. The 140ES allows taxpayers to make quarterly payments throughout the year, ensuring they meet their tax obligations and avoid penalties associated with underpayment.

Steps to Complete the Arizona Estimated Payment Form

Completing the Arizona estimated payment form involves several clear steps:

- Gather your financial information, including your expected income, deductions, and credits for the year.

- Calculate your estimated tax liability using the current Arizona tax rates and guidelines.

- Fill out the 140ES form with your personal information, including your name, address, and Social Security number.

- Indicate the amount of estimated tax you plan to pay for each quarter.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the completed form along with your payment to the Arizona Department of Revenue.

Legal Use of the Arizona Estimated Payment Form

The 140ES form serves a critical legal function in the tax system. By submitting this form, taxpayers are complying with Arizona state tax laws, which require estimated payments for individuals and businesses that expect to owe significant tax amounts. Proper use of the form helps to establish a taxpayer's compliance with state regulations and can prevent penalties for underpayment. It is important to ensure that all information provided is accurate and submitted on time to maintain legal standing.

Filing Deadlines / Important Dates

Understanding the deadlines for submitting the Arizona estimated payment form is crucial for taxpayers. The estimated payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should mark these dates on their calendars to avoid late fees and interest charges.

Form Submission Methods

Taxpayers in Arizona have several options for submitting the estimated payment form. The 140ES form can be filed in the following ways:

- Online through the Arizona Department of Revenue's eServices portal, allowing for quick processing and confirmation.

- By mail, where taxpayers can send the completed form along with their payment to the appropriate address provided by the Arizona Department of Revenue.

- In-person at designated tax offices, which may offer assistance and immediate confirmation of submission.

Required Documents

To accurately complete the Arizona estimated payment form, taxpayers should prepare the following documents:

- Previous year’s tax return, which provides a baseline for estimating current year taxes.

- Income statements, such as W-2s or 1099s, to help calculate expected income.

- Documentation of any deductions or credits that may apply to the current tax year.

Having these documents on hand can streamline the process and ensure accurate reporting.

Quick guide on how to complete how can i assemble my tax return like schedued a or c etc

Effortlessly Prepare 140 Es Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, alter, and electronically sign your documents without any hassle. Manage 140 Es Form on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Modify and Electronically Sign 140 Es Form with Ease

- Locate 140 Es Form and then click Obtain Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click the Finish button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, and the need to print new copies due to errors. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign 140 Es Form to ensure effective communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how can i assemble my tax return like schedued a or c etc

Create this form in 5 minutes!

How to create an eSignature for the how can i assemble my tax return like schedued a or c etc

How to create an electronic signature for your How Can I Assemble My Tax Return Like Schedued A Or C Etc in the online mode

How to make an eSignature for the How Can I Assemble My Tax Return Like Schedued A Or C Etc in Chrome

How to generate an electronic signature for signing the How Can I Assemble My Tax Return Like Schedued A Or C Etc in Gmail

How to make an electronic signature for the How Can I Assemble My Tax Return Like Schedued A Or C Etc straight from your smartphone

How to make an electronic signature for the How Can I Assemble My Tax Return Like Schedued A Or C Etc on iOS devices

How to generate an eSignature for the How Can I Assemble My Tax Return Like Schedued A Or C Etc on Android OS

People also ask

-

What is the process for calculating my Arizona estimated payment?

To calculate your Arizona estimated payment, you'll want to consider your expected income for the year. Utilizing tools and resources, such as online calculators, can help determine this payment based on your current financial situation and tax obligations. Accurately estimating your payment can also prevent underpayment penalties.

-

How does airSlate SignNow assist with managing Arizona estimated payments?

airSlate SignNow provides a reliable platform for businesses to send and eSign documents related to Arizona estimated payments quickly. By streamlining the document management process, you can ensure timely submissions, which is crucial in meeting payment deadlines. This efficiency can ultimately help you better manage your financial planning.

-

Are there specific features in airSlate SignNow that support Arizona estimated payments?

Yes, airSlate SignNow offers features specifically designed for financial documentation, including templates for tax estimates and tracking payment deadlines. These features enable you to maintain organization and keep all your essential documents in one secure location. This ensures you stay compliant with your Arizona estimated payment requirements.

-

What are the benefits of using airSlate SignNow for Arizona estimated payments?

Using airSlate SignNow for Arizona estimated payments allows for seamless eSignature capabilities, reducing the time spent on paperwork. Additionally, the platform’s user-friendly interface enables you to manage your documents more efficiently. This can save you not only time but also reduce the potential for errors in your financial submissions.

-

Is there a cost associated with using airSlate SignNow for Arizona estimated payments?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for managing your Arizona estimated payments. Pricing packages cater to various business sizes and needs, allowing you to choose the plan that fits your budget and requirements. Consider the potential savings this tool can provide by streamlining your payment process.

-

Can airSlate SignNow integrate with other financial tools for Arizona estimated payments?

Absolutely! airSlate SignNow integrates seamlessly with various financial and accounting software, making the handling of Arizona estimated payments more efficient. This capability allows you to synchronize your financial data and automate many processes. By leveraging these integrations, you can enhance your overall workflow and reduce manual input.

-

How secure is airSlate SignNow when handling Arizona estimated payment documents?

airSlate SignNow prioritizes security with advanced encryption and secure storage methods for your Arizona estimated payment documents. This ensures that sensitive financial data is protected from unauthorized access. Trusting airSlate SignNow means you can focus on your business while having peace of mind regarding document security.

Get more for 140 Es Form

- Physical examination formate pdf

- Parentconnect paper application south river high school meade hs enschool form

- Absence form lincoln park high school

- Project crash treatment information vermont department of health healthvermont

- Cafc102 motion to modify child support family court forms for

- Petition for dissolution of marriage form

- Form cafc721 notice of hearing 2009

- Cafc001 petition for dissolution of marriage family court forms

Find out other 140 Es Form

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself