Instructions for Form M 1PRX Minnesota Department of Revenue Revenue State Mn

What is the Instructions For Form M-1PRX

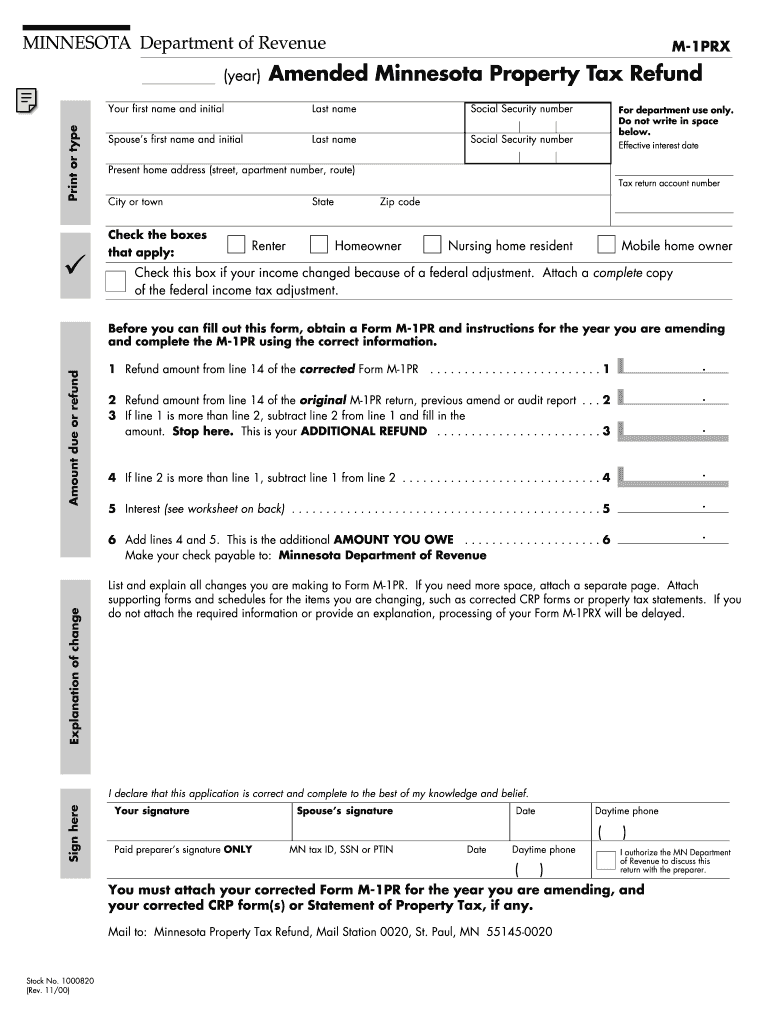

The Instructions For Form M-1PRX is a document provided by the Minnesota Department of Revenue that guides taxpayers on how to complete the M-1PRX form. This form is specifically designed for individuals and businesses to report certain tax-related information to the state of Minnesota. Understanding these instructions is essential for ensuring accurate completion and compliance with state tax laws.

Steps to Complete the Instructions For Form M-1PRX

Completing the Instructions For Form M-1PRX involves several key steps:

- Read the entire set of instructions carefully to understand the requirements.

- Gather all necessary documents, including financial records and previous tax returns.

- Fill out the M-1PRX form as directed, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Key Elements of the Instructions For Form M-1PRX

Several key elements are essential for understanding the Instructions For Form M-1PRX:

- Eligibility Criteria: Information on who is required to file the form.

- Required Documents: A list of documents needed to complete the form.

- Filing Deadlines: Important dates to remember for timely submission.

- Submission Methods: Options available for submitting the form, including online, by mail, or in person.

Legal Use of the Instructions For Form M-1PRX

The Instructions For Form M-1PRX must be used in accordance with Minnesota state tax laws. It is important for taxpayers to adhere to these instructions to ensure compliance and avoid potential legal issues. Incorrect use of the form or failure to follow the guidelines may result in penalties or audits by the Minnesota Department of Revenue.

Filing Deadlines / Important Dates

Timely submission of the M-1PRX form is crucial. The Minnesota Department of Revenue specifies certain deadlines for filing, which may vary based on the taxpayer's situation. It is recommended to check the latest updates from the department to ensure compliance with all filing deadlines.

Form Submission Methods

Taxpayers have several options for submitting the M-1PRX form. These include:

- Online Submission: Many taxpayers prefer to submit their forms electronically through the Minnesota Department of Revenue's online portal.

- Mail: Forms can be printed and mailed to the appropriate address provided in the instructions.

- In-Person: Taxpayers may also choose to deliver their forms in person at designated state offices.

Quick guide on how to complete instructions for form m 1prx minnesota department of revenue revenue state mn

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and electronically sign [SKS] without any hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, either by email, SMS, or invite link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] to guarantee excellent communication at every stage of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form m 1prx minnesota department of revenue revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for handling Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn?

airSlate SignNow offers a user-friendly platform that simplifies the process of sending and eSigning documents, including Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn. Key features include customizable templates, real-time tracking, and secure cloud storage, ensuring that your documents are managed efficiently and securely.

-

How does airSlate SignNow ensure compliance with Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn?

Compliance is a top priority for airSlate SignNow. The platform is designed to meet the legal requirements for electronic signatures, ensuring that your Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn are processed in accordance with state regulations. This helps businesses avoid potential legal issues while streamlining their document workflows.

-

What is the pricing structure for using airSlate SignNow for Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while efficiently managing Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn. Each plan includes essential features to help you maximize your document management capabilities.

-

Can I integrate airSlate SignNow with other software for Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn?

Yes, airSlate SignNow provides seamless integrations with various software applications, enhancing your workflow for Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for a streamlined document management process across platforms.

-

What benefits does airSlate SignNow offer for businesses handling Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn?

Using airSlate SignNow for Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. The platform allows businesses to manage their documents electronically, saving time and resources while ensuring compliance with state regulations.

-

Is airSlate SignNow user-friendly for completing Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn. The intuitive interface allows users to quickly send, sign, and manage documents without extensive training or technical knowledge.

-

What support options are available for airSlate SignNow users dealing with Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn?

airSlate SignNow provides comprehensive support options for users, including a detailed knowledge base, live chat, and email support. Whether you have questions about Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn or need assistance with the platform, the support team is ready to help you resolve any issues promptly.

Get more for Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn

Find out other Instructions For Form M 1PRX Minnesota Department Of Revenue Revenue State Mn

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors