M1CRN, Credit for Nonresident Partner on Taxes Paid to Home State Form

Understanding the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

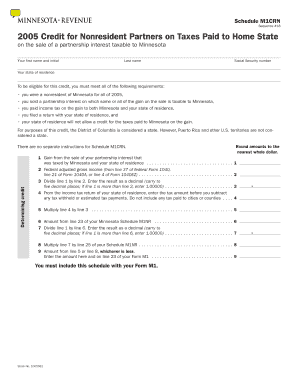

The M1CRN is a tax form used by nonresident partners in partnerships to claim a credit for taxes paid to their home state. This credit is essential for ensuring that nonresident partners are not taxed twice on the same income. The form allows these partners to report the income earned from the partnership and the taxes that have already been paid to their home state, thereby reducing their tax liability in the state where the partnership operates. Understanding the M1CRN is crucial for nonresident partners to navigate their tax responsibilities effectively.

Steps to Complete the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

Completing the M1CRN involves several key steps:

- Gather necessary documents, including your partnership income information and proof of taxes paid to your home state.

- Fill out the M1CRN form, ensuring that all income and tax payment details are accurately reported.

- Attach any required documentation that supports your claim for the credit.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate state tax authority by the specified deadline.

Eligibility Criteria for the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

To be eligible for the M1CRN credit, nonresident partners must meet specific criteria:

- You must be a nonresident partner in a partnership that operates in a state different from your home state.

- Taxes must have been paid to your home state on the income earned from the partnership.

- You must have documentation proving the amount of taxes paid to your home state.

Required Documents for the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

When filing the M1CRN, certain documents are necessary to support your claim:

- Proof of income earned from the partnership, such as K-1 forms.

- Documentation of taxes paid to your home state, including tax returns or payment receipts.

- Any additional forms or schedules that may be required by the state tax authority.

State-Specific Rules for the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

Each state may have unique rules regarding the M1CRN credit. It is important to be aware of these differences:

- Some states may have specific eligibility requirements or limitations on the amount of credit that can be claimed.

- Filing deadlines can vary by state, so it is essential to check the local regulations.

- Additional forms or information may be required depending on the state’s tax laws.

Examples of Using the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

Understanding practical examples can clarify how to utilize the M1CRN effectively:

- A nonresident partner in a New York partnership who pays taxes to California can use the M1CRN to claim a credit for those California taxes.

- If a partner earns income from a partnership in Texas but resides in Florida, they can file the M1CRN to avoid double taxation on their earnings.

Quick guide on how to complete m1crn credit for nonresident partner on taxes paid to home state

Prepare [SKS] seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

Create this form in 5 minutes!

How to create an eSignature for the m1crn credit for nonresident partner on taxes paid to home state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State?

The M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State, is a tax credit that allows nonresident partners to claim a credit for taxes paid to their home state. This credit helps reduce the tax burden for nonresidents who earn income in another state, ensuring they are not taxed twice on the same income.

-

How can airSlate SignNow assist with the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State?

airSlate SignNow provides an efficient platform for managing and eSigning tax documents related to the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State. Our solution simplifies the process, allowing users to easily prepare, send, and sign necessary forms, ensuring compliance and accuracy.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses and individuals handling tax documents, including those related to the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State. Our plans are cost-effective, ensuring you get the best value for your document management needs.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State. These features streamline the process, making it easier to handle complex tax situations.

-

Can airSlate SignNow integrate with other tax software?

Yes, airSlate SignNow can seamlessly integrate with various tax software solutions, enhancing your ability to manage documents related to the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State. This integration allows for a more efficient workflow, reducing the time spent on document preparation and submission.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including those related to the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State, offers numerous benefits. These include increased efficiency, reduced errors, and enhanced security, ensuring that your sensitive tax information is protected while simplifying the signing process.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals unfamiliar with eSigning. Our intuitive interface guides users through the process, ensuring that even those dealing with the M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State can easily navigate and complete their tasks.

Get more for M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

Find out other M1CRN, Credit For Nonresident Partner On Taxes Paid To Home State

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document