M1X, Amended Income Tax Return Use This Form to Report Policies Purchased in Revenue State Mn

Understanding the M1X, Amended Income Tax Return

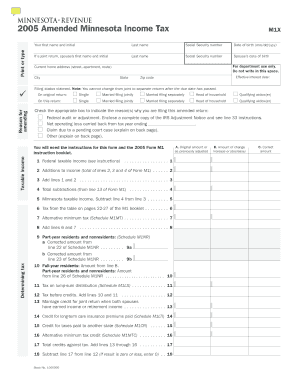

The M1X form is specifically designed for individuals in Minnesota who need to amend their income tax returns. This form allows taxpayers to report any changes in their income, deductions, or credits that may have occurred after the original return was filed. It is essential for ensuring that the tax records accurately reflect the taxpayer's financial situation, particularly when policies have been purchased that affect tax liability.

Steps to Complete the M1X Form

Completing the M1X form involves several key steps:

- Gather all relevant documents, including your original tax return and any new information that necessitates the amendment.

- Fill out the M1X form, ensuring that all sections are completed accurately.

- Clearly indicate the changes being made and provide explanations where necessary.

- Review the completed form for accuracy before submission.

It is crucial to follow these steps carefully to avoid delays or complications in processing your amended return.

Required Documents for the M1X Form

When filing the M1X form, certain documents are required to support your amendments. These may include:

- Your original M1 income tax return.

- Any additional forms or schedules that were included with the original return.

- Documentation for new deductions or credits claimed.

- Proof of any policy purchases that affect your tax situation.

Having these documents ready will streamline the filing process and help ensure that your amendments are processed smoothly.

Filing Methods for the M1X Form

The M1X form can be submitted through various methods, allowing taxpayers flexibility in how they choose to file:

- Online Submission: Many taxpayers prefer to file electronically through the Minnesota Department of Revenue’s online portal.

- Mail: You can also print the completed form and mail it to the appropriate address provided on the form.

- In-Person: For those who prefer face-to-face assistance, visiting a local Department of Revenue office is an option.

Choosing the right submission method can depend on personal preference and the complexity of the amendments being made.

Legal Considerations for the M1X Form

Filing an M1X form is not just a matter of preference; it is a legal requirement when changes to your tax return are necessary. Failure to file an amended return when required can result in penalties or interest on unpaid taxes. It is essential to understand that the amended return must be filed within the statute of limitations, which is typically three years from the due date of the original return.

IRS Guidelines Related to the M1X Form

While the M1X form is specific to Minnesota, it is important to be aware of IRS guidelines that may impact your state tax return. The IRS allows taxpayers to amend their federal tax returns using Form 1040-X, and similar principles apply when amending state returns. Always ensure that any changes made on the M1X form are consistent with federal tax laws to avoid discrepancies.

Common Scenarios for Using the M1X Form

There are various scenarios in which a taxpayer might need to file an M1X form, including:

- Reporting additional income that was not included in the original return.

- Claiming new deductions or credits based on policy purchases.

- Correcting errors made in the original filing.

Understanding these scenarios can help taxpayers recognize when it is necessary to amend their returns, ensuring compliance with tax regulations.

Quick guide on how to complete m1x amended income tax return use this form to report policies purchased in revenue state mn

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the m1x amended income tax return use this form to report policies purchased in revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn?

The M1X form is specifically designed for individuals in Minnesota to amend their income tax returns. This form allows taxpayers to report any policies purchased in Revenue State Mn that may affect their tax obligations. Using the M1X ensures that your amended return is processed correctly and efficiently.

-

How can airSlate SignNow help with the M1X, Amended Income Tax Return?

airSlate SignNow provides a streamlined platform for eSigning and sending documents, including the M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn. Our solution simplifies the process, making it easy to manage your tax documents securely and efficiently.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and enterprises. Each plan provides access to essential features for managing documents like the M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the efficiency of handling forms like the M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn. With airSlate SignNow, you can ensure that your documents are managed effectively.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that your documents, including the M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn, are handled in accordance with legal standards. Our platform prioritizes security and compliance to protect your sensitive information.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software and tools. This allows you to seamlessly incorporate the M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn into your existing workflow, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn, provides numerous benefits. These include faster processing times, reduced paperwork, and enhanced security for your sensitive information. Our user-friendly interface makes it easy for anyone to manage their tax documents.

Get more for M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn

Find out other M1X, Amended Income Tax Return Use This Form To Report Policies Purchased In Revenue State Mn

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online