M2, Income Tax Return for Estates and Trusts Fiduciaries M2, Income Tax Return for Estates and Trusts Fiduciaries Revenue State Form

What is the M2, Income Tax Return For Estates And Trusts Fiduciaries

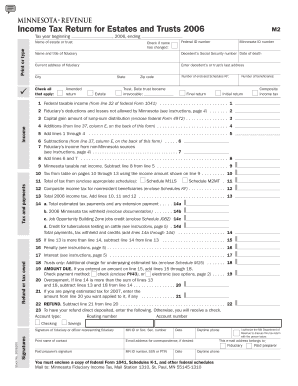

The M2, Income Tax Return For Estates And Trusts Fiduciaries, is a tax form used in Minnesota for reporting income generated by estates and trusts. This form is specifically designed for fiduciaries, who are responsible for managing the assets of the estate or trust. It allows these individuals to report income, deductions, and credits associated with the estate or trust, ensuring compliance with state tax regulations.

Fiduciaries must accurately complete the M2 to reflect the financial activities of the estate or trust during the tax year. This form is essential for calculating the tax liability owed by the estate or trust, which can impact the distribution of assets to beneficiaries.

Steps to complete the M2, Income Tax Return For Estates And Trusts Fiduciaries

Completing the M2 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and any relevant tax documents. This information will provide a clear picture of the estate or trust's financial activities.

Next, begin filling out the form by entering the estate or trust's identifying information, such as the name, address, and federal employer identification number (EIN). Following this, report all sources of income, including interest, dividends, and capital gains. Deductible expenses, such as administrative costs and legal fees, should also be recorded.

Finally, calculate the total income and applicable deductions to determine the taxable income. After completing the form, review it for accuracy before submission.

Legal use of the M2, Income Tax Return For Estates And Trusts Fiduciaries

The M2 form serves a critical legal function in the management of estates and trusts. It is required by the state of Minnesota to ensure that fiduciaries fulfill their tax obligations. By filing this form, fiduciaries demonstrate transparency and accountability in their management of the estate or trust's finances.

Failure to file the M2 can result in legal penalties, including fines or additional scrutiny from tax authorities. Therefore, understanding the legal implications of this form is essential for fiduciaries to protect themselves and the interests of the beneficiaries.

State-specific rules for the M2, Income Tax Return For Estates And Trusts Fiduciaries

Each state may have unique rules governing the filing of the M2 form. In Minnesota, fiduciaries must adhere to specific guidelines regarding income reporting, deductions, and deadlines. It is important for fiduciaries to familiarize themselves with these state-specific regulations to ensure compliance.

For example, Minnesota may have particular requirements regarding the types of income that must be reported and the allowable deductions. Understanding these nuances can help fiduciaries avoid common pitfalls and ensure that the M2 is completed correctly.

Required Documents

To complete the M2, fiduciaries need to gather several important documents. These typically include:

- Financial statements showing income generated by the estate or trust

- Records of expenses incurred in managing the estate or trust

- Previous tax returns for the estate or trust, if applicable

- Any relevant legal documents, such as the trust agreement or will

Having these documents on hand will streamline the process of filling out the M2 and help ensure that all necessary information is accurately reported.

Filing Deadlines / Important Dates

Fiduciaries must be aware of the filing deadlines associated with the M2 form to avoid penalties. In Minnesota, the M2 is typically due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due by April 15.

It is important to keep track of any changes in deadlines or extensions that may be applicable, especially in light of any special circumstances or changes in tax law. Adhering to these deadlines is crucial for maintaining compliance and avoiding potential fines.

Quick guide on how to complete m2 income tax return for estates and trusts fiduciaries m2 income tax return for estates and trusts fiduciaries revenue state mn

Prepare [SKS] effortlessly on any device

Web-based document management has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m2 income tax return for estates and trusts fiduciaries m2 income tax return for estates and trusts fiduciaries revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M2, Income Tax Return For Estates And Trusts Fiduciaries?

The M2, Income Tax Return For Estates And Trusts Fiduciaries is a tax form used in Minnesota for reporting income generated by estates and trusts. This form is essential for fiduciaries to ensure compliance with state tax regulations. Understanding this form is crucial for effective tax management and planning.

-

How can airSlate SignNow assist with the M2, Income Tax Return For Estates And Trusts Fiduciaries?

airSlate SignNow provides a streamlined solution for preparing and eSigning the M2, Income Tax Return For Estates And Trusts Fiduciaries. Our platform simplifies document management, allowing fiduciaries to focus on compliance and accuracy. With our user-friendly interface, you can efficiently handle your tax documents.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the M2, Income Tax Return For Estates And Trusts Fiduciaries. Our cost-effective solutions ensure you get the best value while managing your tax documents efficiently. Explore our plans to find the one that fits your requirements.

-

What features does airSlate SignNow offer for managing tax documents?

Our platform includes features such as document templates, eSigning, and secure storage, specifically designed for handling the M2, Income Tax Return For Estates And Trusts Fiduciaries. These tools enhance productivity and ensure that your documents are compliant with state regulations. Experience seamless document workflows with airSlate SignNow.

-

Is airSlate SignNow compliant with Minnesota state regulations for tax documents?

Yes, airSlate SignNow is designed to comply with Minnesota state regulations, including those related to the M2, Income Tax Return For Estates And Trusts Fiduciaries. Our platform ensures that all documents meet the necessary legal standards, providing peace of mind for fiduciaries. Trust us to keep your tax processes compliant and efficient.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easier to manage the M2, Income Tax Return For Estates And Trusts Fiduciaries alongside your financial records. This integration streamlines your workflow and enhances data accuracy, allowing for a more efficient tax preparation process.

-

What are the benefits of using airSlate SignNow for fiduciaries?

Using airSlate SignNow provides fiduciaries with a secure, efficient way to manage the M2, Income Tax Return For Estates And Trusts Fiduciaries. Our platform reduces the time spent on paperwork and enhances collaboration among stakeholders. Experience the benefits of a cost-effective solution that simplifies your tax management.

Get more for M2, Income Tax Return For Estates And Trusts Fiduciaries M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State

- Jv 222 input on application for psychotropi medication fillable editable and saveable california judicial council forms

- Ccp 446 form

- Fl 800 joint petition for summary dissolution fillable editable and saveable california judicial council forms

- Mediation data sheet fcs002 form

- Los angeles county conservatorship re evaluation physicians declaration form

- Subp 020 deposition subpoena for personal appearance and form

- Post office box 14710 form

- Self help the superior court of california county of orange form

Find out other M2, Income Tax Return For Estates And Trusts Fiduciaries M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT