M11L, Premium Tax for Life Insurance Companies Revenue State Mn Form

Understanding the M11L, Premium Tax For Life Insurance Companies Revenue State Mn

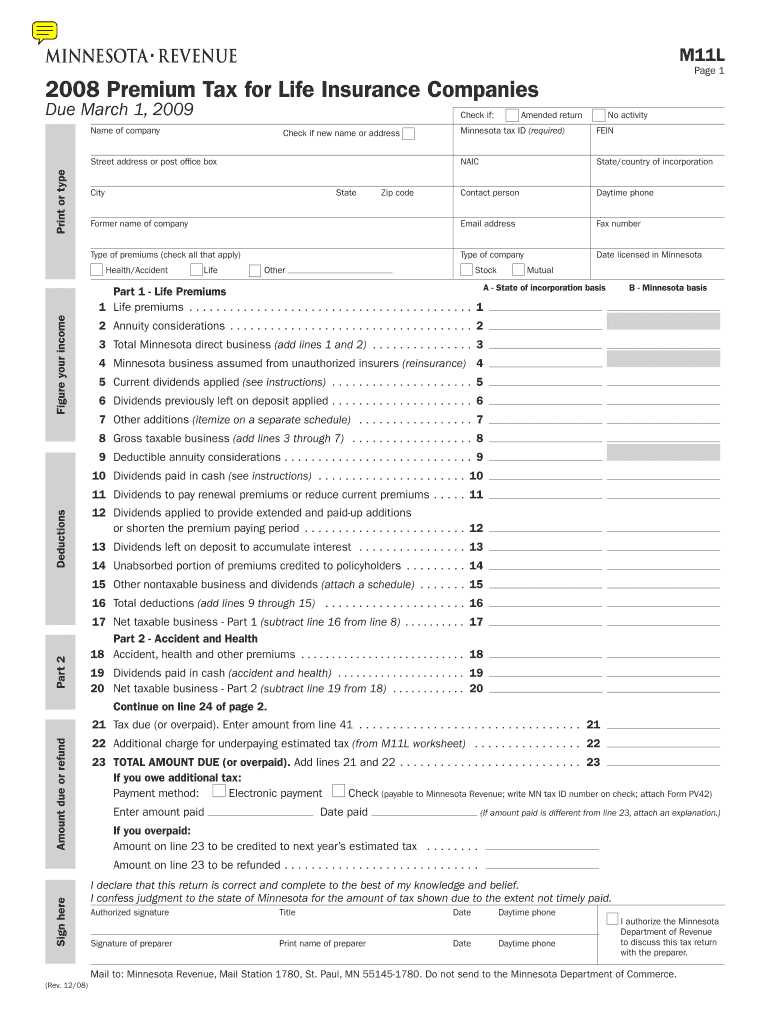

The M11L form is a tax document specifically designed for life insurance companies operating in Minnesota. This form is used to report and pay the premium tax imposed by the state on life insurance premiums collected. The tax is calculated based on the total premiums received from policyholders, and it is crucial for compliance with Minnesota state tax regulations. Understanding the M11L form is essential for life insurance companies to ensure they meet their tax obligations accurately and on time.

Steps to Complete the M11L, Premium Tax For Life Insurance Companies Revenue State Mn

Completing the M11L form involves several key steps:

- Gather necessary information: Collect data on all premiums received during the reporting period.

- Calculate the premium tax: Use the appropriate tax rate set by the state of Minnesota to determine the total tax owed based on the premiums collected.

- Fill out the form: Accurately enter the calculated tax amount and any other required information on the M11L form.

- Review for accuracy: Double-check all entries to ensure there are no errors before submission.

- Submit the form: Choose the preferred submission method, whether online, by mail, or in person, to file the form with the Minnesota Department of Revenue.

Required Documents for the M11L, Premium Tax For Life Insurance Companies Revenue State Mn

When preparing to file the M11L form, certain documents are necessary to ensure accurate reporting:

- Premium records: Detailed records of all premiums collected during the reporting period.

- Financial statements: Recent financial statements may be required to support the figures reported on the form.

- Previous tax returns: Having past M11L forms can help in ensuring consistency and accuracy in reporting.

Filing Deadlines for the M11L, Premium Tax For Life Insurance Companies Revenue State Mn

Timely filing of the M11L form is crucial to avoid penalties. The filing deadline typically aligns with the end of the fiscal year for life insurance companies. It is essential to check the Minnesota Department of Revenue's official guidelines for specific dates, as they may vary annually. Companies should plan to submit their forms well in advance of the deadline to ensure compliance.

Penalties for Non-Compliance with the M11L, Premium Tax For Life Insurance Companies Revenue State Mn

Failure to file the M11L form or to pay the required premium tax can result in significant penalties. These may include:

- Late filing penalties: Fees imposed for not submitting the form by the deadline.

- Interest charges: Accrued interest on unpaid taxes can increase the total amount owed over time.

- Legal action: In severe cases, the state may take legal action against companies that fail to comply with tax obligations.

State-Specific Rules for the M11L, Premium Tax For Life Insurance Companies Revenue State Mn

Each state has its own regulations regarding premium taxes for life insurance companies. In Minnesota, it is important to be aware of specific rules that may affect how the M11L form is completed and submitted. These rules may include variations in tax rates, exemptions, or additional reporting requirements. Consulting the Minnesota Department of Revenue or a tax professional can provide clarity on these state-specific regulations.

Quick guide on how to complete m11l premium tax for life insurance companies revenue state mn

Complete [SKS] effortlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign [SKS] seamlessly

- Locate [SKS] and then click Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Mark key sections of the documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which is instantaneous and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to secure your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m11l premium tax for life insurance companies revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is M11L, Premium Tax For Life Insurance Companies Revenue State Mn?

M11L, Premium Tax For Life Insurance Companies Revenue State Mn refers to the specific tax regulations that apply to life insurance companies operating in Minnesota. Understanding this tax is crucial for compliance and financial planning. It ensures that companies are aware of their obligations and can effectively manage their tax liabilities.

-

How can airSlate SignNow help with M11L, Premium Tax For Life Insurance Companies Revenue State Mn?

airSlate SignNow provides a streamlined solution for managing documents related to M11L, Premium Tax For Life Insurance Companies Revenue State Mn. With our eSigning capabilities, you can easily send, sign, and store important tax documents securely. This helps ensure compliance and reduces the risk of errors in your submissions.

-

What features does airSlate SignNow offer for life insurance companies?

airSlate SignNow offers features tailored for life insurance companies, including customizable templates, automated workflows, and secure cloud storage. These features facilitate the efficient handling of documents related to M11L, Premium Tax For Life Insurance Companies Revenue State Mn. Our platform is designed to enhance productivity and ensure compliance with industry regulations.

-

Is airSlate SignNow cost-effective for managing M11L, Premium Tax For Life Insurance Companies Revenue State Mn?

Yes, airSlate SignNow is a cost-effective solution for managing M11L, Premium Tax For Life Insurance Companies Revenue State Mn. Our pricing plans are designed to fit various business sizes and needs, allowing you to choose the best option for your budget. Investing in our platform can save you time and reduce costs associated with document management.

-

Can airSlate SignNow integrate with other software used by life insurance companies?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions commonly used by life insurance companies. This includes CRM systems, accounting software, and more, allowing you to manage documents related to M11L, Premium Tax For Life Insurance Companies Revenue State Mn efficiently. Our integrations enhance workflow and improve overall productivity.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including enhanced security, ease of use, and improved compliance. Our platform simplifies the process of handling documents related to M11L, Premium Tax For Life Insurance Companies Revenue State Mn, ensuring that you can focus on your core business activities. Additionally, our user-friendly interface makes it easy for all team members to adopt.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow prioritizes the security of your sensitive tax documents by employing advanced encryption and secure cloud storage. We comply with industry standards to protect your data, especially when dealing with M11L, Premium Tax For Life Insurance Companies Revenue State Mn. You can trust that your documents are safe and accessible only to authorized users.

Get more for M11L, Premium Tax For Life Insurance Companies Revenue State Mn

Find out other M11L, Premium Tax For Life Insurance Companies Revenue State Mn

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free