M500, Reporting of JOBZ Tax Benefits for Tax Year Revenue State Mn Form

What is the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn

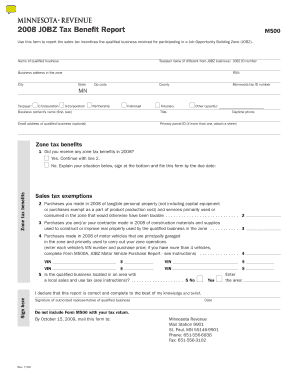

The M500 form is a tax document used in Minnesota for reporting Job Opportunity Building Zone (JOBZ) tax benefits. This form is specifically designed for businesses that have established operations in designated JOBZ zones, allowing them to claim various tax incentives. The JOBZ program aims to stimulate economic growth by providing tax relief to eligible businesses, thereby encouraging job creation and investment in specific areas of the state. Completing the M500 accurately is essential for businesses to take full advantage of these benefits during the tax year.

Steps to complete the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn

To complete the M500 form, businesses should follow these steps:

- Gather necessary information, including business identification details, financial records, and any prior year tax returns.

- Review the eligibility criteria for JOBZ benefits to ensure compliance with state requirements.

- Fill out the M500 form by providing accurate data related to the business operations within the JOBZ zone.

- Calculate the tax benefits based on the guidelines provided by the Minnesota Department of Revenue.

- Double-check all entries for accuracy and completeness before submission.

- Submit the completed form by the designated filing deadline, ensuring that all supporting documentation is included.

Eligibility Criteria

Eligibility for the JOBZ tax benefits reported on the M500 form is contingent upon several factors:

- The business must be located within a designated JOBZ zone.

- Eligible businesses include those that are engaged in manufacturing, warehousing, and certain service activities.

- The business must meet specific investment and job creation thresholds as outlined by the Minnesota Department of Revenue.

- Compliance with all local, state, and federal regulations is required to maintain eligibility for the benefits.

Required Documents

When filing the M500 form, businesses need to prepare and submit several supporting documents:

- Proof of business location within the JOBZ zone, such as a lease agreement or property deed.

- Financial statements that demonstrate the business's income and expenses related to the JOBZ activities.

- Records of job creation and retention, including employee payroll information.

- Any previous tax returns that may impact the current filing.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the M500 form:

- The M500 must be filed by the due date of the business's income tax return for the respective tax year.

- Extensions may be available, but they must be requested in accordance with state guidelines.

- Businesses should keep track of any changes in deadlines announced by the Minnesota Department of Revenue, especially in light of any tax law updates.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the M500 form:

- The form can be filed electronically through the Minnesota Department of Revenue's online portal, which is often the fastest method.

- Alternatively, businesses may choose to mail the completed form to the appropriate address provided by the state.

- In-person submissions may also be accepted at designated state offices, although this option may vary based on current public health guidelines.

Quick guide on how to complete m500 reporting of jobz tax benefits for tax year revenue state mn

Complete M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow provides every tool required to create, alter, and eSign your documents quickly without hold-ups. Handle M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn effortlessly

- Find M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m500 reporting of jobz tax benefits for tax year revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

The M500 form is used for reporting JOBZ tax benefits in Minnesota for a specific tax year. It helps businesses claim tax incentives under the JOBZ program, which is designed to encourage economic development in designated areas. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow assist with the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

airSlate SignNow simplifies the process of preparing and submitting the M500 form by providing an easy-to-use platform for eSigning and document management. Our solution ensures that all necessary documents are securely signed and stored, making it easier to comply with reporting requirements. This streamlines your workflow and helps you focus on your business.

-

What features does airSlate SignNow offer for managing the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage, which are essential for managing the M500 form. These tools help you efficiently gather signatures and track document status, ensuring that your reporting is timely and accurate. Our platform is designed to enhance your productivity.

-

Is there a cost associated with using airSlate SignNow for M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to all the necessary features for managing the M500 form efficiently. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to streamline your workflow for the M500 form. This integration capability ensures that you can manage your documents and data efficiently across different platforms, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

Using airSlate SignNow for the M500 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your documents digitally, which saves time and minimizes errors. This ultimately leads to a smoother reporting process for your JOBZ tax benefits.

-

How secure is airSlate SignNow when handling the M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including the M500 form. You can trust that your sensitive information is safe while using our platform for reporting JOBZ tax benefits.

Get more for M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn

- Demand letter small claims form

- Pampered chef order form 402213976

- Winemaking log harvest year nashwood winery form

- Trip inspection report mv2930 form

- Form 4b nomination for dcrg

- Padi quiz 4 answers form

- Il 8453 illinois individual income tax electronic filing declaration form

- Amended sales and use tax and e911 surcharge return amended sales and use tax and e911 surcharge return form

Find out other M500, Reporting Of JOBZ Tax Benefits For Tax Year Revenue State Mn

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed