IL 8453, Illinois Individual Income Tax Electronic Filing Declaration Form

Understanding the IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

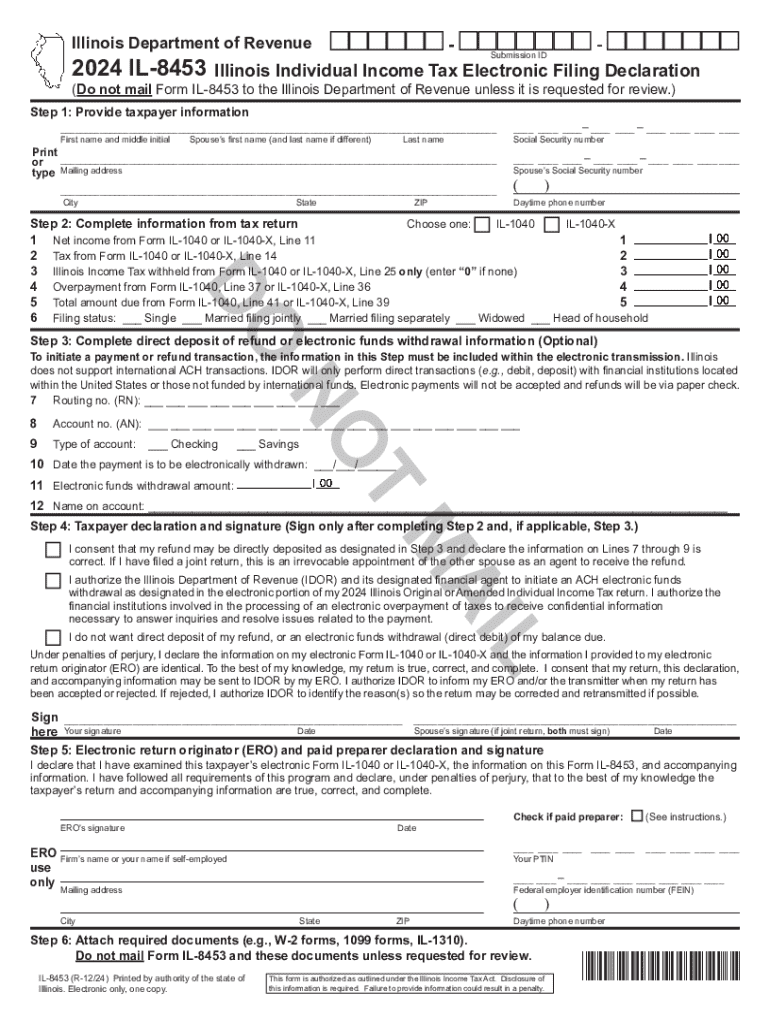

The IL 8453 is a crucial form for individuals filing their income tax electronically in Illinois. This form serves as a declaration that verifies the taxpayer's identity and confirms that the information submitted through electronic filing is accurate. It is essential for ensuring compliance with state tax regulations and provides a digital signature that holds the same weight as a handwritten signature on paper forms.

Steps to Complete the IL 8453

Completing the IL 8453 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including your federal tax return and any supporting documents. Next, fill out the form with your personal information, including your name, address, and Social Security number. After entering the required details, review the form for any errors. Finally, sign and date the form electronically, ensuring that you have completed all sections before submission.

Obtaining the IL 8453

The IL 8453 can be obtained through the Illinois Department of Revenue's official website or through tax preparation software that supports electronic filing. Most tax software will automatically generate the IL 8453 when you are preparing your Illinois income tax return. If you prefer a paper version, you can download and print it directly from the state’s website. Ensure you are using the correct version for the tax year you are filing.

Legal Use of the IL 8453

The IL 8453 is legally recognized as a valid signature for electronic tax filings in Illinois. By signing this form, you are affirming that the information provided is true and complete to the best of your knowledge. This form helps to prevent fraud and ensures that the electronic filing process adheres to state laws. It is important to keep a copy of the signed IL 8453 for your records, as it may be requested by the Illinois Department of Revenue for verification purposes.

Key Elements of the IL 8453

Several key elements are included in the IL 8453 that are important for taxpayers to understand. These include the taxpayer's name, address, Social Security number, and the electronic filing identification number. Additionally, the form requires a declaration of the taxpayer's intent to file electronically and acknowledgment of the penalties for false statements. Understanding these elements can help ensure that the form is completed correctly and submitted in compliance with state regulations.

Filing Deadlines and Important Dates

Filing deadlines for the IL 8453 align with the general income tax filing deadlines set by the IRS. Typically, individual income tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should stay informed of any changes to deadlines and ensure that their electronic filings, along with the IL 8453, are submitted on time to avoid penalties.

Examples of Using the IL 8453

Using the IL 8453 is straightforward for various taxpayer scenarios. For instance, self-employed individuals can use this form to file their income tax electronically, ensuring they report their earnings accurately. Students filing their taxes for the first time can also benefit from the IL 8453, as it simplifies the process and provides a clear declaration of their tax filing. Understanding how different taxpayers can utilize the IL 8453 helps to clarify its importance in the electronic filing process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 8453 illinois individual income tax electronic filing declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Illinois electronic filing and how does it work?

Illinois electronic filing is a digital process that allows users to submit legal documents to the court online. With airSlate SignNow, you can easily prepare, sign, and send documents electronically, streamlining the filing process. This method not only saves time but also reduces the risk of errors associated with paper filing.

-

What are the benefits of using airSlate SignNow for Illinois electronic filing?

Using airSlate SignNow for Illinois electronic filing offers numerous benefits, including increased efficiency and reduced costs. The platform allows for quick document preparation and signing, ensuring that you meet filing deadlines without hassle. Additionally, it enhances security and compliance, giving you peace of mind.

-

Is airSlate SignNow compliant with Illinois electronic filing regulations?

Yes, airSlate SignNow is fully compliant with Illinois electronic filing regulations. Our platform is designed to meet all legal requirements, ensuring that your documents are filed correctly and securely. This compliance helps you avoid potential legal issues and ensures your filings are accepted by the courts.

-

What features does airSlate SignNow offer for Illinois electronic filing?

airSlate SignNow provides a range of features for Illinois electronic filing, including customizable templates, secure e-signatures, and real-time tracking of document status. These features simplify the filing process and enhance collaboration among team members. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

How much does airSlate SignNow cost for Illinois electronic filing?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses engaging in Illinois electronic filing. Our pricing is transparent, with no hidden fees, allowing you to choose a plan that fits your budget. We also provide a free trial, so you can experience the benefits before committing.

-

Can I integrate airSlate SignNow with other software for Illinois electronic filing?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your Illinois electronic filing experience. Whether you use CRM systems, document management tools, or other business applications, our integrations help streamline your workflow and improve productivity.

-

How secure is airSlate SignNow for Illinois electronic filing?

Security is a top priority for airSlate SignNow, especially for Illinois electronic filing. Our platform employs advanced encryption and security protocols to protect your sensitive information. Additionally, we comply with industry standards to ensure that your documents remain confidential and secure throughout the filing process.

Get more for IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

- Tcx pantone book pdf download form

- Hesi admission assessment exam review 5th edition pdf download form

- Fire department run sheet template form

- Player registration form 2022

- You squared pdf form

- How to print out cpap compliance report form

- Rev 415 application for child care subsidy form

- Recording cover sheet marion county oregon form

Find out other IL 8453, Illinois Individual Income Tax Electronic Filing Declaration

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament