Amended Sales and Use Tax and E911 Surcharge Return Amended Sales and Use Tax and E911 Surcharge Return Form

Understanding the Amended Sales and Use Tax and E911 Surcharge Return

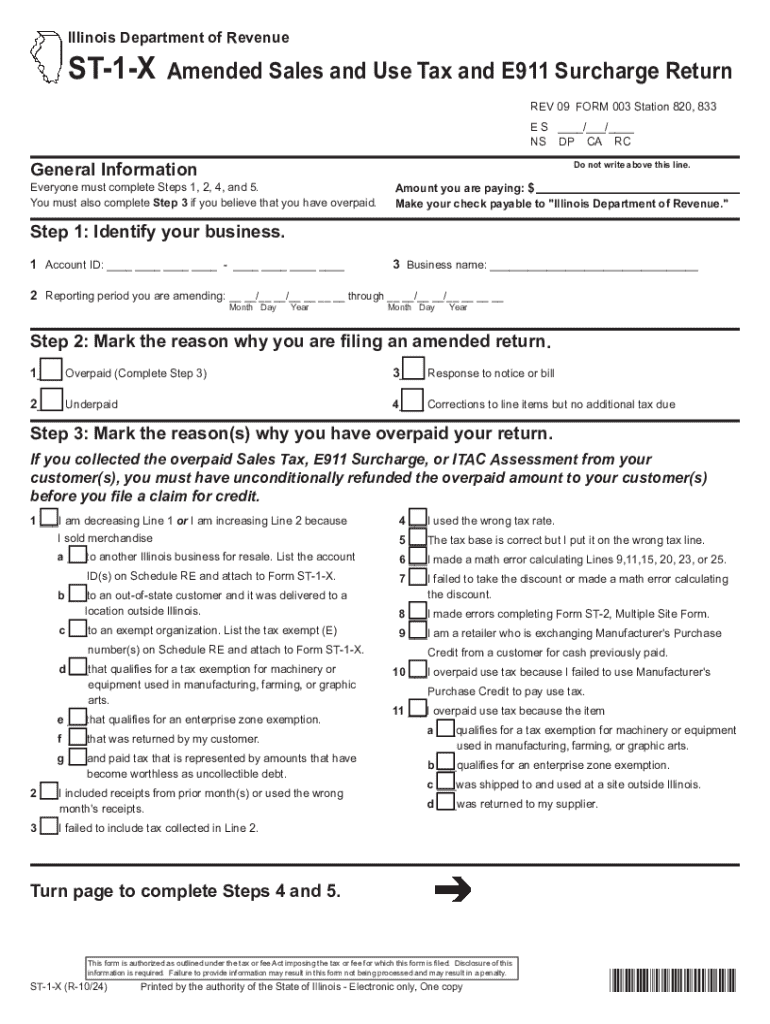

The Amended Sales and Use Tax and E911 Surcharge Return, commonly referred to as the Illinois ST-1 form, is essential for businesses in Illinois that need to report and amend their sales tax and E911 surcharge liabilities. This form allows taxpayers to correct previously filed returns, ensuring compliance with state regulations. It is particularly important for businesses that have made errors in their initial filings or need to adjust their reported sales figures.

Steps to Complete the Amended Sales and Use Tax and E911 Surcharge Return

Completing the Illinois ST-1 form involves several key steps:

- Gather all relevant financial documents, including previous sales tax returns and supporting records.

- Clearly indicate the reason for amending the return on the form.

- Fill out the form accurately, ensuring that all figures reflect the corrected amounts.

- Review the completed form for accuracy before submission.

Properly following these steps can help avoid penalties and ensure that the amended return is processed smoothly.

Filing Deadlines and Important Dates

Timely filing of the amended ST-1 form is crucial to avoid penalties. Generally, the amended return must be submitted within three years of the original filing date. It is important to stay informed about specific deadlines that may apply to your situation, especially if there are changes in tax law or filing procedures.

Required Documents for Filing

When submitting the Illinois ST-1 form, you will need to provide certain documents to support your amendment. These may include:

- Copies of the original sales tax returns.

- Documentation of any adjustments made, such as invoices or receipts.

- Any correspondence with the Illinois Department of Revenue regarding previous filings.

Having these documents ready can facilitate the review process and help resolve any issues that may arise.

Penalties for Non-Compliance

Failure to file the amended ST-1 form or inaccuracies in reporting can lead to significant penalties. The Illinois Department of Revenue may impose fines based on the amount of tax due, and interest may accrue on unpaid balances. It is essential for businesses to ensure compliance to avoid these financial repercussions.

Who Issues the Form

The Illinois Department of Revenue is responsible for issuing the ST-1 form. This state agency oversees the collection of sales and use taxes in Illinois and provides resources and guidance for businesses to comply with tax regulations. For any questions or clarifications regarding the form, businesses can contact the department directly.

Digital vs. Paper Version of the Form

The Illinois ST-1 form is available in both digital and paper formats. The digital version allows for easier completion and submission, while the paper form can be mailed in. Choosing the format that best suits your business needs can streamline the filing process and enhance efficiency.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amended sales and use tax and e911 surcharge return amended sales and use tax and e911 surcharge return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 1 form Illinois and why is it important?

The st 1 form Illinois is a crucial document used for sales tax exemption in the state. It allows eligible organizations to make tax-exempt purchases, which can signNowly reduce costs. Understanding how to properly fill out and submit the st 1 form Illinois is essential for businesses looking to maximize their savings.

-

How can airSlate SignNow help with the st 1 form Illinois?

airSlate SignNow streamlines the process of completing and eSigning the st 1 form Illinois. Our platform allows users to easily fill out the form, add signatures, and send it securely to the necessary parties. This not only saves time but also ensures compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the st 1 form Illinois?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution provides access to features that simplify the management of documents like the st 1 form Illinois. You can choose a plan that fits your budget while enjoying the benefits of our eSigning capabilities.

-

What features does airSlate SignNow offer for managing the st 1 form Illinois?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for documents like the st 1 form Illinois. These tools enhance efficiency and ensure that your forms are completed accurately and promptly. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for the st 1 form Illinois?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the st 1 form Illinois alongside your existing tools. Whether you use CRM systems or accounting software, our platform can enhance your workflow and improve document management.

-

What are the benefits of using airSlate SignNow for the st 1 form Illinois?

Using airSlate SignNow for the st 1 form Illinois provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime, anywhere. This convenience allows businesses to focus on their core operations while managing essential forms effortlessly.

-

Is airSlate SignNow compliant with Illinois regulations for the st 1 form?

Yes, airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to the st 1 form Illinois. Our platform adheres to industry standards for security and data protection, ensuring that your documents are handled in accordance with state laws. You can trust us to keep your information safe and compliant.

Get more for Amended Sales And Use Tax And E911 Surcharge Return Amended Sales And Use Tax And E911 Surcharge Return

- Government school tc download form

- Transfer form for learners

- Cognitive triangle pdf form

- Polmed cancellation form

- Application form for limpopo traffic training college pdf application form for limpopo traffic training college pdf

- Formulario arivu ministerio de hacienda transparenciafiscal gob

- Student field trip emergency medical template form

- Maintenance checklist boxstercayman 987 911 carreras 997 12 form

Find out other Amended Sales And Use Tax And E911 Surcharge Return Amended Sales And Use Tax And E911 Surcharge Return

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document