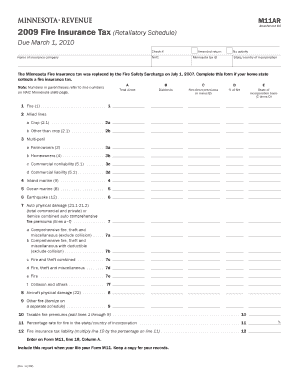

M11AR, Fire Insurance Tax Retaliatory Schedule Form

What is the M11AR, Fire Insurance Tax Retaliatory Schedule

The M11AR, Fire Insurance Tax Retaliatory Schedule, is a specific tax form used by insurance companies in the United States. It is designed to report the retaliatory tax liabilities that arise when an insurance company operates in multiple states. This schedule helps ensure compliance with state tax laws and provides a framework for calculating taxes owed based on the premiums collected in various jurisdictions. The form is essential for maintaining transparency and accountability in the insurance industry.

How to use the M11AR, Fire Insurance Tax Retaliatory Schedule

To use the M11AR, Fire Insurance Tax Retaliatory Schedule effectively, insurance companies must first gather all relevant data regarding their operations. This includes information about premiums written in each state and any applicable tax rates. The form requires detailed entries, including calculations of retaliatory taxes owed based on the premiums collected. Once completed, the M11AR must be submitted to the appropriate state tax authority, ensuring that all figures are accurate and in compliance with state regulations.

Steps to complete the M11AR, Fire Insurance Tax Retaliatory Schedule

Completing the M11AR involves several key steps:

- Gather necessary documents, including premium statements and tax information from each state where the company operates.

- Calculate the total premiums written in each state and determine the applicable tax rates.

- Fill out the M11AR form, ensuring all entries reflect accurate calculations of retaliatory taxes.

- Review the completed form for accuracy and completeness before submission.

- Submit the M11AR to the relevant state tax authority by the specified deadline.

Key elements of the M11AR, Fire Insurance Tax Retaliatory Schedule

The M11AR includes several key elements that are crucial for accurate reporting. These elements typically encompass:

- Identification of the insurance company, including name and address.

- Breakdown of premiums collected by state.

- Calculation of retaliatory tax liabilities based on state-specific tax rates.

- Any credits or deductions applicable to the company.

- Signature of an authorized representative certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the M11AR vary by state, but it is generally required to be submitted annually. Insurance companies should be aware of specific due dates to avoid penalties. It is advisable to check with the state tax authority for the exact filing dates, as they can differ based on the company's fiscal year and local regulations.

Penalties for Non-Compliance

Failure to submit the M11AR, Fire Insurance Tax Retaliatory Schedule on time or inaccuracies in the form can result in significant penalties. These may include:

- Fines imposed by state tax authorities.

- Interest charges on unpaid taxes.

- Potential legal action for continued non-compliance.

It is crucial for insurance companies to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete m11ar fire insurance tax retaliatory schedule

Easily Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS apps and enhance any document-driven process today.

How to Edit and eSign [SKS] Effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from your preferred device. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M11AR, Fire Insurance Tax Retaliatory Schedule

Create this form in 5 minutes!

How to create an eSignature for the m11ar fire insurance tax retaliatory schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M11AR, Fire Insurance Tax Retaliatory Schedule?

The M11AR, Fire Insurance Tax Retaliatory Schedule is a form used by insurance companies to report their tax liabilities related to fire insurance premiums. This schedule helps ensure compliance with state tax regulations and provides a clear overview of the taxes owed. Understanding this schedule is crucial for accurate financial reporting and tax planning.

-

How can airSlate SignNow assist with the M11AR, Fire Insurance Tax Retaliatory Schedule?

airSlate SignNow streamlines the process of preparing and submitting the M11AR, Fire Insurance Tax Retaliatory Schedule by allowing users to easily eSign and send documents. Our platform simplifies document management, ensuring that all necessary forms are completed accurately and efficiently. This reduces the risk of errors and helps maintain compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for the M11AR, Fire Insurance Tax Retaliatory Schedule?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to choose a plan that fits your needs, whether you are a small business or a large enterprise. By using our platform for the M11AR, Fire Insurance Tax Retaliatory Schedule, you can save time and resources while ensuring compliance.

-

What features does airSlate SignNow provide for managing the M11AR, Fire Insurance Tax Retaliatory Schedule?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing the M11AR, Fire Insurance Tax Retaliatory Schedule. These tools enhance efficiency and ensure that all documents are handled securely and in compliance with regulations. Additionally, our user-friendly interface makes it easy to navigate the process.

-

Are there any integrations available with airSlate SignNow for the M11AR, Fire Insurance Tax Retaliatory Schedule?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the M11AR, Fire Insurance Tax Retaliatory Schedule. These integrations allow for automatic data transfer and reduce the need for manual entry, minimizing errors. This connectivity enhances your overall workflow and ensures that your tax documents are always up to date.

-

What are the benefits of using airSlate SignNow for the M11AR, Fire Insurance Tax Retaliatory Schedule?

Using airSlate SignNow for the M11AR, Fire Insurance Tax Retaliatory Schedule offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document sharing, which speeds up the filing process. Additionally, our secure environment ensures that sensitive information is protected throughout the process.

-

Is airSlate SignNow user-friendly for preparing the M11AR, Fire Insurance Tax Retaliatory Schedule?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to prepare the M11AR, Fire Insurance Tax Retaliatory Schedule. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively. This accessibility helps businesses focus on compliance without the hassle of complicated software.

Get more for M11AR, Fire Insurance Tax Retaliatory Schedule

Find out other M11AR, Fire Insurance Tax Retaliatory Schedule

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast