AFF Affiliations for Combined Returns Enter the Designated Filer S Name and Address in Block B1 Form

Understanding the AFF Affiliations for Combined Returns

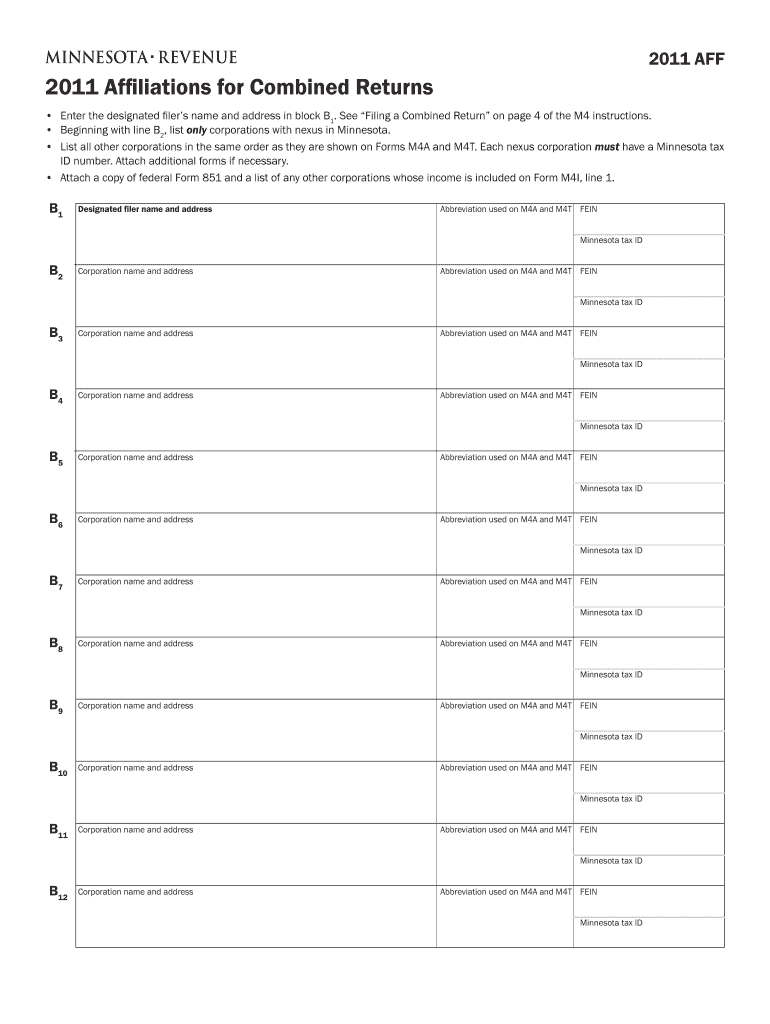

The AFF Affiliations for Combined Returns is a specific tax form used by businesses to report their affiliations when filing combined tax returns. This form is essential for organizations that are part of a group of related entities, allowing them to consolidate their tax reporting. By accurately completing this form, businesses can ensure compliance with IRS regulations and avoid potential penalties. The designated filer, typically the primary entity in the group, must provide their name and address in Block B1 to identify the entity responsible for filing the combined return.

Steps to Complete the AFF Affiliations for Combined Returns

Filling out the AFF Affiliations for Combined Returns involves several key steps. First, gather all necessary information about the affiliated entities, including their names, addresses, and tax identification numbers. Next, in Block B1, enter the designated filer's name and address accurately. Ensure that all other required blocks are filled out with the correct details of each affiliated entity. Finally, review the completed form for accuracy before submission to avoid any errors that could lead to compliance issues.

Legal Use of the AFF Affiliations for Combined Returns

The legal use of the AFF Affiliations for Combined Returns is crucial for compliance with tax laws in the United States. This form must be filed by businesses that meet specific criteria set by the IRS, particularly those operating as part of a consolidated group. Failure to use the form correctly can lead to penalties, including fines or additional scrutiny from tax authorities. It is important for businesses to understand the legal implications of their filings and ensure that all information provided is both accurate and complete.

Filing Deadlines for the AFF Affiliations for Combined Returns

Filing deadlines for the AFF Affiliations for Combined Returns are typically aligned with the regular tax filing deadlines for corporations. Businesses must be aware of these dates to ensure timely submissions. Missing the deadline can result in penalties and interest on unpaid taxes. It is advisable for businesses to mark these dates on their calendars and prepare their documentation in advance to facilitate a smooth filing process.

Examples of Using the AFF Affiliations for Combined Returns

Examples of using the AFF Affiliations for Combined Returns can help clarify its application. For instance, a corporation that owns several subsidiaries may use this form to report all entities under one combined return. Each subsidiary's details would be included, allowing for a streamlined tax reporting process. This approach not only simplifies filing but also can lead to potential tax benefits for the entire group, making it a valuable tool for tax planning.

Required Documents for the AFF Affiliations for Combined Returns

To successfully complete the AFF Affiliations for Combined Returns, businesses need to gather several required documents. These include the tax identification numbers for each affiliated entity, financial statements, and any previous tax returns related to the entities involved. Having these documents ready will facilitate the accurate completion of the form and ensure all necessary information is provided to the IRS.

Quick guide on how to complete aff affiliations for combined returns enter the designated filer s name and address in block b1

Complete [SKS] effortlessly on any device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and eSign [SKS] and guarantee excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aff affiliations for combined returns enter the designated filer s name and address in block b1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are AFF Affiliations For Combined Returns?

AFF Affiliations For Combined Returns refer to the necessary details required for filing combined tax returns. Specifically, you need to enter the designated filer's name and address in Block B1 to ensure compliance with tax regulations. This process simplifies the filing for businesses with multiple entities.

-

How does airSlate SignNow assist with AFF Affiliations For Combined Returns?

airSlate SignNow provides a streamlined platform for businesses to manage their document signing needs, including those related to AFF Affiliations For Combined Returns. By using our service, you can easily prepare and eSign documents, ensuring that the designated filer's name and address in Block B1 are accurately captured and submitted.

-

What features does airSlate SignNow offer for document management?

Our platform offers a variety of features including customizable templates, real-time tracking, and secure cloud storage. These features enhance your ability to manage documents related to AFF Affiliations For Combined Returns efficiently. Additionally, our user-friendly interface makes it easy for anyone to navigate the process.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to various needs, making it easier for you to manage AFF Affiliations For Combined Returns without breaking the bank. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. This means you can easily incorporate our solution into your existing systems to manage AFF Affiliations For Combined Returns and other document-related tasks efficiently.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. When dealing with AFF Affiliations For Combined Returns, our platform ensures that all documents are signed and stored securely, allowing for easy access and compliance.

-

How secure is airSlate SignNow for handling sensitive documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including those related to AFF Affiliations For Combined Returns. You can trust that your sensitive information is safe while using our platform.

Get more for AFF Affiliations For Combined Returns Enter The Designated Filer S Name And Address In Block B1

Find out other AFF Affiliations For Combined Returns Enter The Designated Filer S Name And Address In Block B1

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy