Form 668 W 2003

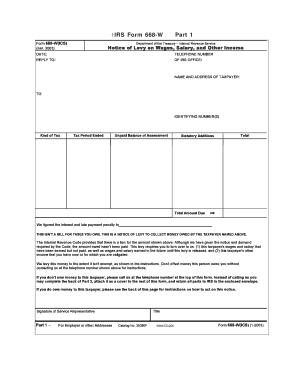

What is the Form 668 W

The Form 668 W is a legal document used by the Internal Revenue Service (IRS) in the United States. It serves as a notice of a federal tax lien and is typically issued when a taxpayer has unpaid taxes. This form is crucial for both the IRS and taxpayers, as it officially records the government's claim against the taxpayer's property. Understanding the implications of this form is essential for anyone who receives it, as it can affect credit ratings and property ownership.

How to use the Form 668 W

Using the Form 668 W involves several steps. First, it is important to review the information provided on the form to ensure its accuracy. The form outlines the amount owed and the taxpayer's details. If the taxpayer believes there is an error, they should contact the IRS immediately. If the form is accurate, the taxpayer may need to address the tax liability to avoid further legal consequences. This may include setting up a payment plan or negotiating a settlement with the IRS.

Steps to complete the Form 668 W

Completing the Form 668 W requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information, including taxpayer identification and details of the tax liability.

- Fill out the form accurately, ensuring all fields are complete.

- Review the form for any errors or omissions.

- Submit the form to the appropriate IRS office, either electronically or via mail.

It is advisable to keep a copy of the completed form for personal records.

Legal use of the Form 668 W

The legal use of the Form 668 W is governed by IRS regulations. It is essential that the form is filled out correctly and submitted in accordance with IRS guidelines. This ensures that the lien is valid and enforceable. The form must be filed in a timely manner to avoid penalties. Additionally, understanding the legal implications of a tax lien is critical, as it can lead to further actions by the IRS, including asset seizure.

Key elements of the Form 668 W

Several key elements are included in the Form 668 W that are important for taxpayers to understand:

- Taxpayer Information: This includes the name, address, and taxpayer identification number.

- Amount Owed: The total tax liability that has resulted in the lien.

- Date of Filing: The date the form is filed with the IRS, which establishes priority for the lien.

- Property Description: Details about the property subject to the lien, if applicable.

IRS Guidelines

The IRS provides specific guidelines for the use and filing of the Form 668 W. Taxpayers should familiarize themselves with these guidelines to ensure compliance. This includes understanding the circumstances under which the form is issued, the rights of the taxpayer, and the processes for contesting the lien if necessary. Adhering to IRS guidelines is crucial for avoiding additional legal complications.

Quick guide on how to complete form 668 w

Prepare Form 668 W effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 668 W on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Form 668 W with ease

- Locate Form 668 W and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Adjust and eSign Form 668 W and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 668 w

Create this form in 5 minutes!

How to create an eSignature for the form 668 w

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 668 w?

The form 668 w is a legal document used by the IRS to inform taxpayers of their outstanding tax liabilities. It serves as a notice of levy for property such as wages, bank accounts, or other financial assets. Understanding the form 668 w is crucial for individuals facing tax-related challenges.

-

How can airSlate SignNow help with form 668 w?

AirSlate SignNow offers a seamless solution for businesses to manage and eSign important documents like the form 668 w efficiently. With its user-friendly interface, users can easily prepare, send, and store tax forms securely online. This ensures that all communications regarding the form 668 w are efficient and legally binding.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides flexible pricing plans tailored to fit different business needs, starting from an affordable monthly subscription. Each plan includes essential features that allow users to handle documents, including the form 668 w, effectively. Contact us to learn more about our pricing and which plan suits you.

-

Is airSlate SignNow compliant with legal standards for form 668 w?

Yes, airSlate SignNow complies with all necessary legal standards to ensure the integrity of documents like the form 668 w. This includes secure storage solutions and compliance with eSignature laws such as the ESIGN Act and UETA. Our platform guarantees that your signed documents hold up in court.

-

What features does airSlate SignNow offer for managing form 668 w?

AirSlate SignNow includes features such as customizable templates, document tracking, and automated reminders to help manage forms like the 668 w. The platform simplifies the workflow, allowing users to focus on important aspects of their business while reducing manual overhead. Try our intuitive features for efficient document management.

-

Can I integrate airSlate SignNow with other applications for form 668 w management?

Absolutely! AirSlate SignNow offers integration capabilities with various applications, making it easy to manage the form 668 w alongside your existing tools. You can connect with CRM systems, cloud storage providers, and other platforms to streamline your workflow. Our integrations help enhance productivity and document management.

-

What are the benefits of using airSlate SignNow for form 668 w?

Using airSlate SignNow for the form 668 w brings numerous benefits, including quicker turnaround times for document signing and improved accuracy. The platform reduces the risk of errors and missed deadlines by providing reminders and electronic signatures. This ensures that you're always on top of your tax obligations.

Get more for Form 668 W

Find out other Form 668 W

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure