Dav Form 2019-2026

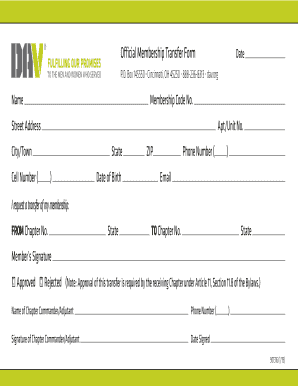

What is the DAV Form?

The DAV form, or Disabled American Veterans form, is a crucial document designed for veterans seeking membership in the Disabled American Veterans organization. This form facilitates the process of applying for membership and ensures that veterans receive the support and resources they need. The DAV organization is dedicated to empowering veterans through advocacy, assistance, and community engagement. By completing the DAV form, veterans can access various services, including benefits counseling, claims assistance, and local chapter involvement.

How to Obtain the DAV Form

To obtain the DAV form, individuals can visit the official Disabled American Veterans website, where the form is available for download in a fillable PDF format. This allows veterans to complete the form digitally, ensuring ease of use and accessibility. Additionally, veterans can request a physical copy of the form through their local DAV chapter or by contacting the DAV national office. It is essential to ensure that the most current version of the form is used to avoid any issues during the application process.

Steps to Complete the DAV Form

Completing the DAV form involves several straightforward steps:

- Download the fillable DAV form from the official website or obtain a physical copy.

- Fill in the required personal information, including name, address, and service details.

- Provide any necessary documentation, such as proof of military service or disability.

- Review the completed form for accuracy and completeness.

- Sign and date the form to certify the information provided.

- Submit the form through the preferred method, whether online, by mail, or in person at a local chapter.

Legal Use of the DAV Form

The DAV form is legally binding once completed and signed by the applicant. It is essential to adhere to all legal requirements when filling out the form to ensure its validity. The form must comply with relevant eSignature regulations, such as the ESIGN Act and UETA, which govern the use of electronic signatures in the United States. By following these regulations, veterans can ensure that their completed DAV form is recognized as a legitimate document for membership purposes.

Key Elements of the DAV Form

Several key elements are essential to include when completing the DAV form:

- Personal Information: Full name, address, and contact details.

- Service Information: Branch of service, dates of service, and any relevant military identification numbers.

- Disability Status: Information regarding any service-connected disabilities.

- Signature: The applicant's signature, confirming the accuracy of the provided information.

Form Submission Methods

Veterans have several options for submitting the DAV form, ensuring flexibility and convenience. The form can be submitted:

- Online: Through the DAV website, where the completed form can be uploaded securely.

- By Mail: Printed and sent to the appropriate DAV chapter or national office address.

- In-Person: Delivered directly to a local DAV chapter for immediate processing.

Quick guide on how to complete download this form pdf

Learn how to effortlessly complete the Dav Form with this simple tutorial

Submitting and signNowing forms digitally is becoming more common and the preferred choice for numerous clients. It offers various advantages over conventional paper documents, including convenience, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can find, edit, sign, and enhance and send your Dav Form without the hassle of constant printing and scanning. Follow this brief guide to initiate and complete your form.

Follow these steps to access and complete Dav Form

- Begin by clicking the Get Form button to open your document in our editor.

- Observe the green label on the left that indicates mandatory fields to ensure they are not missed.

- Utilize our advanced features to annotate, edit, sign, secure, and enhance your document.

- Protect your file or convert it into a fillable format using the appropriate tab tools.

- Review the document and verify it for errors or inconsistencies.

- Press DONE to complete your edits.

- Change the name of your document or keep it as is.

- Select the storage option you wish to use to save your document, mail it using USPS, or click the Download Now button to save your file.

If Dav Form doesn’t match what you were looking for, explore our comprehensive library of pre-loaded templates that you can fill out with minimal effort. Try our solution today!

Create this form in 5 minutes or less

Find and fill out the correct download this form pdf

FAQs

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How can I download a free PDF of any book?

Just Google it

-

What service can I use to have a website visitor fill out a form, put the data in the form into a prewritten PDF, then charge the visitor to download the PDF with the data provided filled in?

You can use signNow to set up PDF templates, which can be filled out with an online form. signNow doesn’t support charging people to download the PDF, but you could use Stripe for this (would require some programming.)

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

What other forms besides PDF can you download I-797 forms?

PDF may be the dominant format for sharing print-perfect documents, but it's not ideal for filling out forms. The better solution is to convert PDF forms to HTML forms so the form can be viewed in any web browser and filled out on any device. The challenge a consumer faces is how to convert a PDF to HTML without losing the integrity of the original PDF.Although I don't intend to pitch my company on Quora, I do want to inform you that my company uniquely converts PDFs into HTML forms that can be filled out, saved to PDF (for printing and archiving), e-signed and electronically submitted. We are already working with a customer for a large number of immigration forms and can equally help anyone automate their forms.

-

What is the best thing you've looked forward to in your life?

Getting my medical license.The process is so painful that sometimes I feel like stabbing myself in the heart and gouging my eye out, and jumping off a bridge at the same time. And the most frustrating part of it is that there’s not a single thing I can do to speed things up.The website isn’t very user friendly.They request way too many documents. Like, you need to submit 6 different things to prove your citizenship. Can’t it be assumed that if the Federal Government gave me a passport, they know that it’s because I’m a citizen? Can’t it also safely be assumed that if I graduated from a residency program, I must have graduated from a medical school at some point?The website doesn’t tell you everything you need to send. After you’ve filled out the application online, there is a PDF you’re supposed to find somewhere. The PDF was the old application form. You’d fill it out by hand or by editing the PDF. If you did that, you’d see an number of appendices that told you what other documentation you were supposed to supply. But if you apply online, there’s nothing to let you know what you’re missing. So, you have to call them. When you do, they tell you that you need a bunch of stuff you’d never have guessed: a background check, forms you’re supposed to submit to your residency programs, etc. Why not put that in the online application?Then, after you do all that, you might wonder if your file is complete. So, you call. They’ll tell you that your application hasn’t been processed yet. How long till it gets processed? 3 to 4 weeks! So, they won’t even look at your file for 3 to 4 weeks. And, 3 to 4, of course, means 4. Then, when they look at your file, it might even be week 5 by the time they respond to you. At that point, they’ll tell your that your file is missing some stuff.You ask for clarification about the missing stuff, because you’re pretty sure you’ve already sent it. You hear nothing back for a week. You call them, only to hear that they thought they’d emailed you what you were supposed to fill out… You submit what they’re asking for, having wasted another week waiting. Then, they tell you that your file has been submitted for final approval. YAY!Then you’re told that, since you used to be a nurse, you should also submit a nursing license verification. Okay, no biggie, you think. You did a similar thing for Iowa a few years back. You’ll just go online and have the state of Michigan send the state of Tennessee some information about the nursing license that expired 6 years ago.You get on the Michigan website, and things are so disorganized that you can’t for the life of you figure out how to submit the verification request. Oh, and the process has changed. In 2015, you could use the Nursys verification site. But Michigan has pulled out of this process, because… just because. Now, you have to call during business hours, realize that you’re supposed to download and fill out a form, attach a money order (you can’t pay online anymore), and mail it to a P.O. Box.You do that, sending it by express mail. You call the next day to see if it’s been received. Now you’re told that if you want to send things by express mail, there’s another address you should have sent it to, an address that was never communicated to you when you talked to the Michigan people on the phone. You learn that sending mail to the P.O. Box means that it will sit there for a week, after which it will be processed by the Cashier’s office/Finance office/Treasury office, then slowly make its way to the Bureau of Licensing… this process might take 2 weeks. At this point, you’ve sent your initial application 8 weeks before. You wonder why it is that the process couldn’t be more streamlined. Why couldn’t they be a uniform process for all states? Why couldn’t they at least be a central database where healthcare providers could send their documentation, so that whenever they apply for licensing in a new state, that state can immediately receive all the relevant documentation. You’re powerless. You try to think of other things you might do.You remember that Iowa must have a copy of your nursing verification license. You wonder if you could talk to them and see if they’d share it with you. You’re told that they will emphatically not release the document to you. Why? Who knows. Anyway, they might consider releasing it to the Tennessee people if they are contacted directly by their Medical Board. You sheepishly ask the people in Tennessee if they’d be willing to contact Iowa, giving them a phone number, email, and fax number, knowing full well that it will be to no avail.You decide that maybe, if you were to track down the cashier’s office in Michigan, you could fly there and make the payment in person, in a bid to speed up the processing of your license verification request. It’s after hours now, so you can’t be sure. There’s a plane early in the morning. You could fly to Detroit, rent a car, drive to Lansing, and give it a shot. But… what if it doesn’t work? You decide to wait until the morning and call the office to see if getting there in person would make a difference. You are told that it is impossible to make a payment in person, because… rules. There’s literally not a damn thing you can do.And that, my friends, is the story of my life right now. The most frustrating part of this saga is that not only can I not work, but I’m sort of homeless right now. Let me explain. A while back, I bid on a house. I used what is called a physician loan. What my lender did not tell me is that you need an active medical license. So, we were a week from the closing date before I learned this. At this point, I had three options:Walk away from the home purchase and rent. This wouldn’t have been a terrible idea.Prolong my temporary lease at the place I was renting. I would not do this because I hated, hated, hated them with their nickle-and-diming tactics.Wait for my license.I opted for number 3, because I thought it couldn’t take much longer until I’d get my license. My belongings are currently in storage. I’m staying with my sister in Florida. It’s not the worst thing that’s ever happened to anyone in human life, but it’s still really frustrating. The only bright spot is that I get to spend time with my family. I have a nephew and two nieces here that I hadn’t seen in 9 months. They’re growing so very fast. I am constantly peppering them with mental math questions, but they seem to love me for some reason. So, all in all, things could be worse.

-

What is the password to open an e-Aadhaar card?

The e-aadhaar is password protected document. To open an e-aadhaar, Aadhaar Holder has to enter the Postal code as password which he has provided with his address details during enrollment.

-

How do you fill out the 'undertaking by candidate' and 'class XII performance check' forms at the time of JoSAA counselling?

Take a print out of the formats from the Annexures of the Business Rules given in the JoSAA website and fill up the portions Undertaking by the Candidate and the required portions of the Performance Check.If you have doubts in specific portions, please mention in the question.

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

Create this form in 5 minutes!

How to create an eSignature for the download this form pdf

How to create an eSignature for your Download This Form Pdf online

How to create an electronic signature for the Download This Form Pdf in Google Chrome

How to make an electronic signature for putting it on the Download This Form Pdf in Gmail

How to make an eSignature for the Download This Form Pdf right from your mobile device

How to create an eSignature for the Download This Form Pdf on iOS devices

How to make an electronic signature for the Download This Form Pdf on Android devices

People also ask

-

What is a Dav Form and how does it work with airSlate SignNow?

A Dav Form is a specific document format that can be easily signed and shared using airSlate SignNow. Our platform allows users to upload, edit, and eSign Dav Forms seamlessly, ensuring a smooth workflow for both individuals and businesses. With airSlate SignNow, you can automate the signing process for Dav Forms, saving time and reducing paperwork.

-

How much does it cost to use airSlate SignNow for Dav Forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs when managing Dav Forms. You can choose from individual, team, or enterprise plans, each designed to provide maximum value. Check our pricing page for detailed information on features included with each plan.

-

Can I integrate airSlate SignNow with other applications for Dav Forms?

Yes, airSlate SignNow supports integrations with a variety of applications, making it easy to manage your Dav Forms alongside your favorite tools. Whether you need to connect with CRMs, cloud storage, or collaboration software, our API and pre-built integrations streamline the process. This enhances your workflow and ensures your Dav Forms are always accessible.

-

What are the benefits of using airSlate SignNow for Dav Forms?

Using airSlate SignNow for your Dav Forms offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform allows you to eSign documents quickly and track the signing process in real-time. Plus, the user-friendly interface ensures that anyone can manage Dav Forms without extensive training.

-

Is airSlate SignNow secure for handling Dav Forms?

Absolutely! airSlate SignNow prioritizes the security of your Dav Forms by employing advanced encryption and compliance with industry standards. We implement strict access controls and audit trails to ensure that your documents are safe and secure throughout the signing process.

-

Can I customize my Dav Forms with airSlate SignNow?

Yes, you can easily customize your Dav Forms using airSlate SignNow's intuitive editing features. Add fields, text, images, and even your branding to ensure that your documents meet your specific requirements. Customizing Dav Forms enhances your professional appearance and improves user experience.

-

What types of documents can I create from Dav Forms using airSlate SignNow?

airSlate SignNow allows you to create various documents from your Dav Forms, including contracts, agreements, and consent forms. Our versatile platform supports multiple document types, making it easy to convert your Dav Forms into legally binding agreements. Enjoy the flexibility of managing all your documentation in one place.

Get more for Dav Form

- Sample of expungement papers form

- New mexico state board of social work examiners form

- Cheer sponsorship form 315057180

- Federal student aid authorization form mcphs university my mcphs

- Mcps emergency information

- Id card designs washington state department of licensing form

- Nysdoh 5077 medical exemption form ada pdf

- Temp event multi event vendor permit application pdf form

Find out other Dav Form

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form