Submission of the Attached State Retirement Form 170 is Mandatory 2022-2026

Understanding the Submission of the Attached State Retirement Form 170

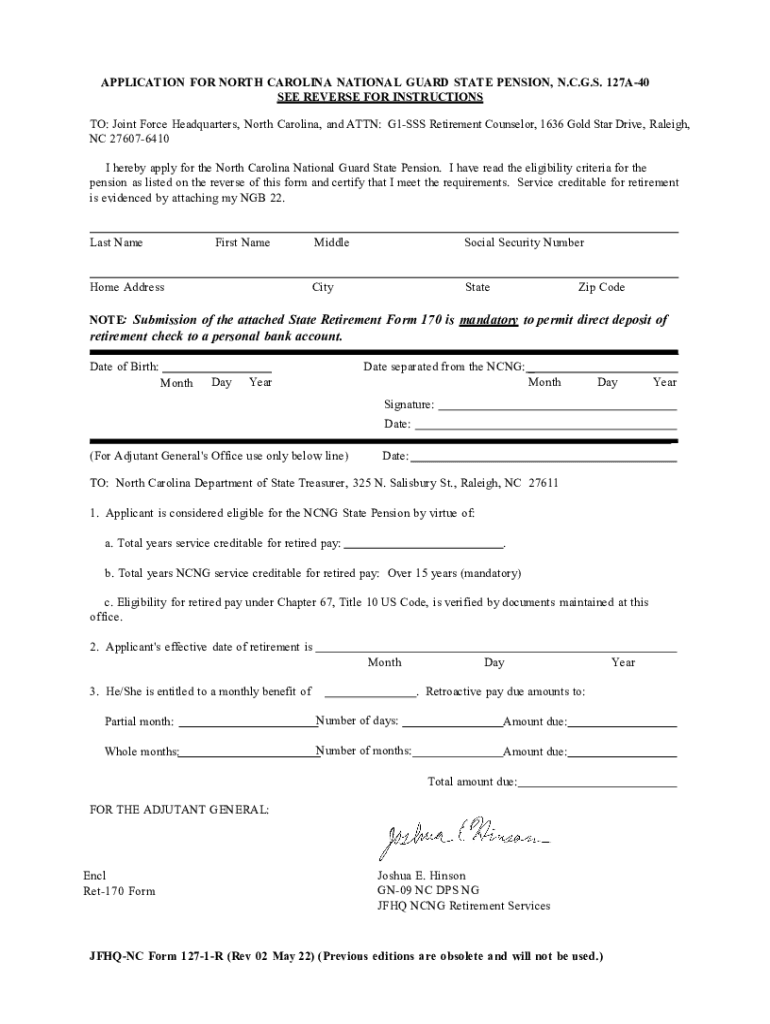

The Submission of the Attached State Retirement Form 170 is a crucial requirement for individuals seeking to access their state retirement benefits. This form serves as a formal declaration of intent to retire and is essential for processing retirement claims. By submitting this form, applicants ensure that their retirement benefits are calculated and disbursed accurately, in accordance with state regulations.

Steps to Complete the Submission of the Attached State Retirement Form 170

Completing the Submission of the Attached State Retirement Form 170 involves several key steps:

- Gather necessary personal information, including your Social Security number and employment history.

- Review the form carefully to understand the required sections and any supporting documentation needed.

- Fill out the form completely, ensuring all information is accurate and up to date.

- Attach any required documents, such as proof of age or employment verification.

- Submit the form through the designated method, whether online, by mail, or in person.

Required Documents for the Submission of the Attached State Retirement Form 170

When submitting the Attached State Retirement Form 170, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a driver's license or passport.

- Employment records, including pay stubs or tax documents.

- Proof of age, which may be a birth certificate or other legal documents.

- Any additional forms or documentation specified by your state’s retirement system.

Form Submission Methods for the Attached State Retirement Form 170

The Submission of the Attached State Retirement Form 170 can often be completed through various methods, providing flexibility for applicants. Common submission methods include:

- Online: Many states offer an online portal for submitting retirement forms, allowing for quick processing.

- Mail: Applicants can print the form and send it via postal service to the designated retirement office.

- In-Person: Some individuals may choose to submit the form in person at their local retirement office for immediate assistance.

Legal Use of the Submission of the Attached State Retirement Form 170

The Submission of the Attached State Retirement Form 170 is governed by state laws and regulations. Understanding the legal implications is essential for ensuring compliance and securing your retirement benefits. This form must be completed accurately and submitted within the designated time frames to avoid delays or penalties. Additionally, it is important to retain copies of all submitted documents for your records.

Quick guide on how to complete submission of the attached state retirement form 170 is mandatory

Effortlessly Complete Submission Of The Attached State Retirement Form 170 Is Mandatory on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the needed form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Submission Of The Attached State Retirement Form 170 Is Mandatory on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Submission Of The Attached State Retirement Form 170 Is Mandatory with Ease

- Obtain Submission Of The Attached State Retirement Form 170 Is Mandatory and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Adjust and eSign Submission Of The Attached State Retirement Form 170 Is Mandatory and ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct submission of the attached state retirement form 170 is mandatory

Create this form in 5 minutes!

How to create an eSignature for the submission of the attached state retirement form 170 is mandatory

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the Submission Of The Attached State Retirement Form 170?

The Submission Of The Attached State Retirement Form 170 Is Mandatory for ensuring compliance with state retirement regulations. This form is crucial for processing retirement benefits and avoiding potential delays. By using airSlate SignNow, you can easily manage and submit this form electronically.

-

How does airSlate SignNow facilitate the Submission Of The Attached State Retirement Form 170?

airSlate SignNow simplifies the Submission Of The Attached State Retirement Form 170 by providing an intuitive platform for eSigning and document management. Users can upload, sign, and send the form securely, ensuring that all necessary information is included. This streamlines the process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Submission Of The Attached State Retirement Form 170?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of a secure and efficient solution for the Submission Of The Attached State Retirement Form 170. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including eSigning, document templates, and real-time tracking. These features enhance the efficiency of the Submission Of The Attached State Retirement Form 170 process. Users can also collaborate with team members and ensure that all documents are completed accurately.

-

Can I integrate airSlate SignNow with other software for the Submission Of The Attached State Retirement Form 170?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate the Submission Of The Attached State Retirement Form 170 into your existing workflows. This flexibility allows for seamless data transfer and improved efficiency.

-

What are the benefits of using airSlate SignNow for retirement form submissions?

Using airSlate SignNow for the Submission Of The Attached State Retirement Form 170 provides numerous benefits, including time savings, enhanced security, and improved accuracy. The platform ensures that your documents are signed and submitted promptly, reducing the stress associated with manual processes.

-

How secure is the Submission Of The Attached State Retirement Form 170 with airSlate SignNow?

Security is a top priority at airSlate SignNow. The Submission Of The Attached State Retirement Form 170 is protected with advanced encryption and compliance with industry standards. This ensures that your sensitive information remains confidential and secure throughout the submission process.

Get more for Submission Of The Attached State Retirement Form 170 Is Mandatory

Find out other Submission Of The Attached State Retirement Form 170 Is Mandatory

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy