T106 Information Return of Non Arm's Length Transactions with Non 2022-2026

Understanding the T106 Information Return

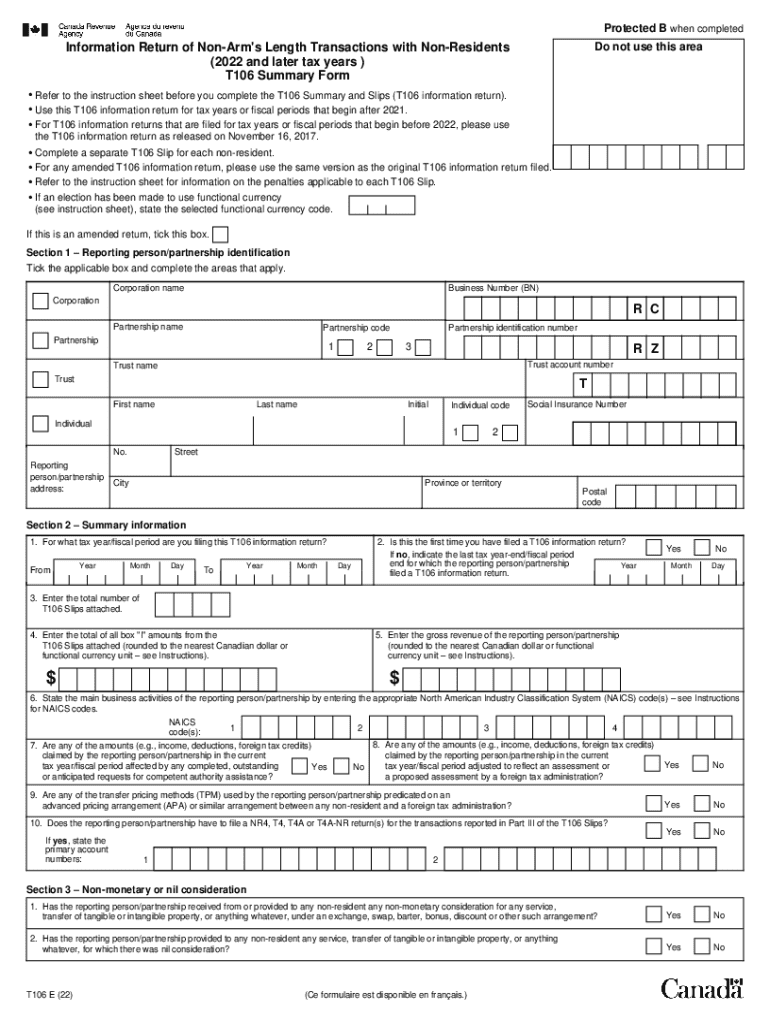

The T106 form is a crucial document for Canadian taxpayers who engage in non-arm's length transactions with non-residents. This information return is designed to report such transactions to the Canada Revenue Agency (CRA), ensuring compliance with tax regulations. The T106 is particularly relevant for businesses and individuals who have dealings with foreign entities, as it helps to disclose transactions that may not be conducted at market value.

Steps to Complete the T106 Information Return

Completing the T106 form involves several key steps:

- Gather necessary information about the non-resident entity, including its name, address, and country of residence.

- Collect details of the transactions, including dates, amounts, and descriptions of the goods or services exchanged.

- Fill out the T106 form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the CRA by the specified deadline.

Legal Use of the T106 Information Return

The T106 form serves a legal purpose by ensuring that taxpayers comply with Canadian tax laws regarding international transactions. Failure to file this form when required can result in penalties and interest charges. It is essential for businesses and individuals to understand their obligations under the Income Tax Act, as the T106 helps to prevent tax avoidance and ensures transparency in cross-border dealings.

Filing Deadlines and Important Dates

Timely filing of the T106 form is critical to avoid penalties. Generally, the T106 must be filed by the due date of the income tax return for the reporting year. For most taxpayers, this means the T106 is due six months after the end of the tax year. It's important to keep track of these deadlines to ensure compliance and avoid any potential issues with the CRA.

Required Documents for the T106 Form

To complete the T106 form, several documents may be required:

- Financial statements that detail the transactions with non-residents.

- Invoices or contracts that outline the terms of the transactions.

- Any correspondence related to the transactions that may be relevant for reporting purposes.

Having these documents ready will facilitate the completion of the T106 and help ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to file the T106 form or inaccuracies in reporting can lead to significant penalties. The CRA may impose fines based on the amount of tax that was avoided due to non-compliance. Additionally, interest may accrue on any unpaid taxes. Understanding these potential consequences emphasizes the importance of accurate and timely filing of the T106 form.

Quick guide on how to complete t106 information return of non arms length transactions with non

Prepare T106 Information Return Of Non Arm's Length Transactions With Non effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Manage T106 Information Return Of Non Arm's Length Transactions With Non on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to edit and eSign T106 Information Return Of Non Arm's Length Transactions With Non without any hassle

- Find T106 Information Return Of Non Arm's Length Transactions With Non and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your desktop.

No more issues with lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign T106 Information Return Of Non Arm's Length Transactions With Non and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t106 information return of non arms length transactions with non

Create this form in 5 minutes!

How to create an eSignature for the t106 information return of non arms length transactions with non

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t106 Canada form and why is it important?

The t106 Canada form is a tax document required for reporting certain transactions with non-residents. It is crucial for businesses to comply with Canadian tax regulations and avoid penalties. Understanding the t106 Canada form helps ensure accurate reporting and smooth tax processes.

-

How can airSlate SignNow help with t106 Canada document management?

airSlate SignNow offers a streamlined solution for managing t106 Canada documents by allowing users to easily create, send, and eSign forms. This simplifies the process of gathering necessary signatures and ensures that all documents are securely stored and accessible. With airSlate SignNow, managing your t106 Canada forms becomes efficient and hassle-free.

-

What are the pricing options for using airSlate SignNow for t106 Canada forms?

airSlate SignNow provides flexible pricing plans that cater to various business needs, including those requiring t106 Canada form management. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features needed. This cost-effective solution ensures you get the best value for managing your t106 Canada documents.

-

Are there any integrations available for t106 Canada with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow for t106 Canada forms. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. These integrations help you maintain a smooth process when handling your t106 Canada documents.

-

What features does airSlate SignNow offer for t106 Canada document signing?

airSlate SignNow provides a range of features for t106 Canada document signing, including customizable templates, in-person signing, and automated reminders. These features ensure that your documents are signed promptly and efficiently. With airSlate SignNow, managing the signing process for your t106 Canada forms is straightforward and user-friendly.

-

How secure is airSlate SignNow for handling t106 Canada documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive t106 Canada documents. The platform employs advanced encryption and compliance with industry standards to protect your data. You can trust airSlate SignNow to keep your t106 Canada forms secure throughout the signing process.

-

Can I track the status of my t106 Canada documents with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your t106 Canada documents in real-time. You can see when documents are sent, viewed, and signed, providing you with complete visibility and control over your document workflow. This feature is essential for ensuring timely compliance with t106 Canada requirements.

Get more for T106 Information Return Of Non Arm's Length Transactions With Non

- Minnesota disclosure statement form

- Minnesota disclosure statement 497312178 form

- Minnesota disclosure statement 497312179 form

- Notice of dishonored check civil and criminal keywords bad check bounced check minnesota form

- Minnesota certificate trust form

- Minnesota certificate trust 497312182 form

- Mutual wills containing last will and testaments for unmarried persons living together with no children minnesota form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children minnesota form

Find out other T106 Information Return Of Non Arm's Length Transactions With Non

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter