Information Return of Non Arm's Length Transactions with Non Residents T106 Summary Form 2017

What is the Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form

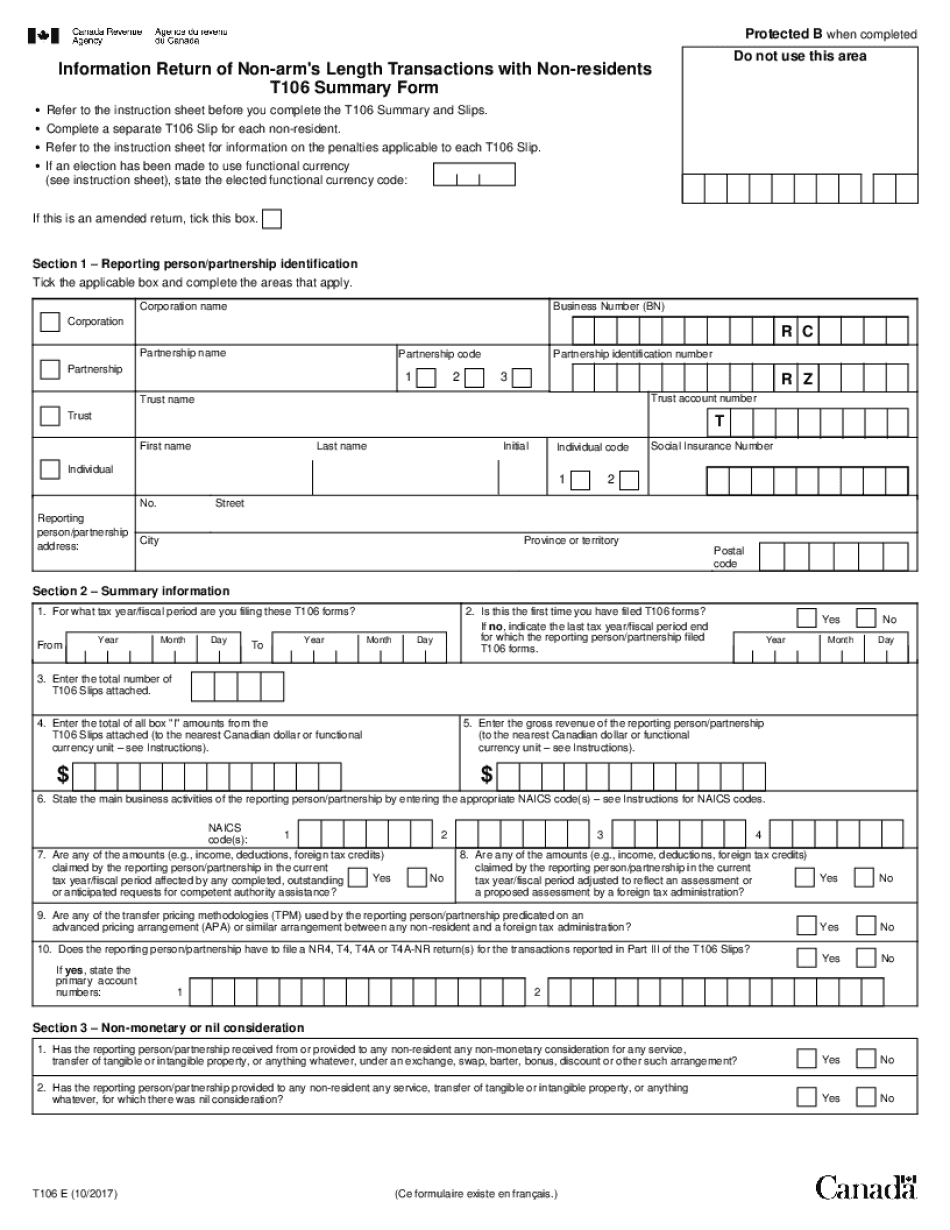

The Information Return of Non arm's Length Transactions with Non-residents, commonly referred to as the T106 form, is a critical document required by the Canada Revenue Agency (CRA). It is designed to report transactions between Canadian taxpayers and non-residents that are not conducted at arm's length. This means that the transactions may not reflect fair market value, which is essential for tax compliance. The T106 form ensures transparency and helps the CRA monitor cross-border transactions that could impact tax obligations.

Steps to complete the Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form

Completing the T106 form involves several key steps to ensure accurate reporting. First, gather all necessary information about the transactions, including details of the non-resident parties involved and the nature of the transactions. Next, fill out the form by providing the required data, such as the amounts involved and the dates of the transactions. It is important to ensure that all figures are accurate and reflect the true nature of the transactions. Lastly, review the completed form for any errors before submission to avoid potential penalties.

Filing Deadlines / Important Dates

Timely filing of the T106 form is crucial to avoid penalties. The filing deadline for the T106 is typically within the six months following the end of the taxpayer's fiscal year. For example, if your fiscal year ends on December 31, the T106 must be filed by June 30 of the following year. It is advisable to keep track of these dates and set reminders to ensure compliance with CRA regulations.

Legal use of the Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form

The T106 form serves a legal purpose by ensuring that all non-arm's length transactions are reported to the CRA as required by Canadian tax law. Accurate completion and timely submission of this form help maintain compliance and avoid legal repercussions. Failure to file the T106 can result in significant penalties, including fines and increased scrutiny from tax authorities.

Key elements of the Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form

Key elements of the T106 form include the identification of the non-resident parties, the nature of the transactions, and the amounts involved. Additionally, the form requires details about the relationship between the parties to determine the arm's length nature of the transactions. These elements are crucial for the CRA to assess the validity of the reported transactions and ensure proper tax treatment.

Examples of using the Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form

Examples of situations requiring the T106 form include transactions involving loans, sales of goods, or services provided between a Canadian company and a non-resident entity where the terms differ from those that would be agreed upon by unrelated parties. For instance, if a Canadian business sells products to a foreign affiliate at a price lower than market value, this transaction must be reported on the T106 form to comply with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The T106 form can be submitted through various methods to accommodate taxpayer preferences. It can be filed online using the CRA's secure portal, which allows for immediate processing and confirmation of receipt. Alternatively, taxpayers may choose to mail the completed form to the appropriate CRA address. In-person submissions are generally not available for this form, so online and mail options are the primary methods for filing.

Quick guide on how to complete information return of non arms length transactions with non residents t106 summary form

Accomplish Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly option compared to conventional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without interruptions. Manage Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form on any platform with airSlate SignNow apps for Android or iOS and enhance any document-based process today.

How to modify and eSign Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form with ease

- Locate Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information return of non arms length transactions with non residents t106 summary form

Create this form in 5 minutes!

How to create an eSignature for the information return of non arms length transactions with non residents t106 summary form

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the t106 feature in airSlate SignNow?

The t106 feature in airSlate SignNow enables users to streamline their document signing process. This tool allows for quick electronic signatures, ensuring that your agreements are finalized efficiently. With t106, you save time and eliminate the hassle of printing and faxing documents.

-

How much does the t106 solution cost?

The pricing for the t106 solution varies based on the plan you choose. airSlate SignNow offers flexible subscription options that cater to businesses of all sizes. Visit our pricing page to find the plan that best meets your needs and budget.

-

What are the benefits of using the t106 feature?

The t106 feature provides numerous benefits, including enhanced efficiency and cost savings. Users can easily send, sign, and manage documents from any device, which increases productivity. Additionally, t106 ensures compliance and security, making your document processes more reliable.

-

Is it easy to integrate t106 with existing software?

Absolutely! Integrating the t106 feature with your existing software is straightforward. airSlate SignNow supports various third-party applications, allowing for seamless synchronization. This means you can enhance your current workflows without extensive changes.

-

Can I track the status of my documents with t106?

Yes, tracking the status of your documents is one of the key features of t106. You can monitor when a document is viewed, signed, or completed right from the airSlate SignNow dashboard. This transparency helps you stay informed throughout the signing process.

-

What types of documents can I sign using t106?

The t106 feature is versatile and allows for signing various types of documents, including contracts, agreements, and forms. Whether you're in real estate, healthcare, or finance, airSlate SignNow's t106 can cater to your specific needs. This flexibility makes it ideal for diverse business requirements.

-

Is there a mobile app for using t106?

Yes, airSlate SignNow offers a mobile app that supports the t106 feature. This app allows you to send and sign documents on the go, ensuring that you can manage your documents from anywhere. The mobile experience is user-friendly, making it easy to handle tasks while traveling.

Get more for Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form

- Wa deceased form

- Identity theft by known imposter package washington form

- Washington assets form

- Essential documents for the organized traveler package washington form

- Essential documents for the organized traveler package with personal organizer washington form

- Postnuptial agreements package washington form

- Letters of recommendation package washington form

- Washington construction or mechanics lien package individual washington form

Find out other Information Return Of Non arm's Length Transactions With Non residents T106 Summary Form

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now