CT 3 ABC 2023

What is the CT 3 ABC

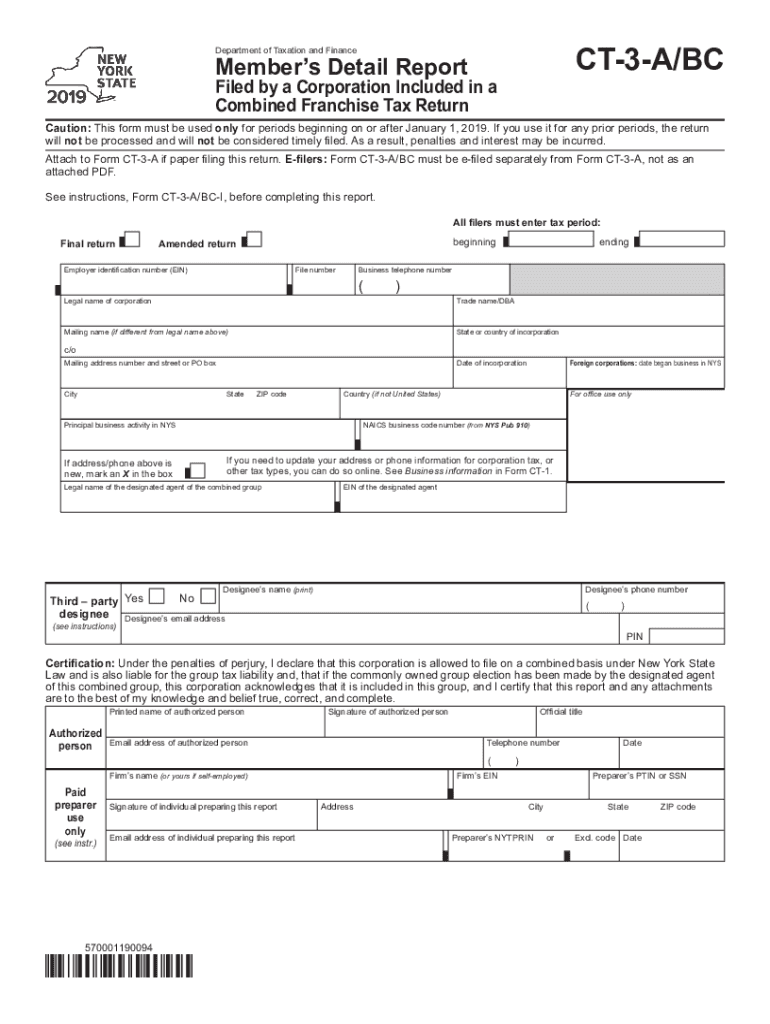

The CT 3 ABC is a tax form used by corporations in the United States to report their income, deductions, and tax liability. Specifically, it is designed for corporations that are subject to the New York City General Corporation Tax. This form allows businesses to calculate their tax obligations accurately and ensures compliance with local tax regulations. Understanding the CT 3 ABC is essential for corporations operating within New York City, as it directly impacts their financial responsibilities and reporting requirements.

How to use the CT 3 ABC

Using the CT 3 ABC involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by providing detailed information about your corporation's financial activities, including gross income and allowable deductions. It's important to follow the instructions carefully to avoid errors. Once completed, review the form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the CT 3 ABC

Completing the CT 3 ABC requires a systematic approach. Start by downloading the form from the official tax authority website or obtaining a physical copy. Follow these steps:

- Enter your corporation's name, address, and identification number at the top of the form.

- Provide details about your business activities in the designated sections.

- Calculate your total income, subtract any deductions, and determine your taxable income.

- Complete the tax calculation section to find your total tax liability.

- Sign and date the form before submission.

Ensure that all calculations are accurate, as mistakes can lead to penalties or delays in processing.

Legal use of the CT 3 ABC

The CT 3 ABC must be used in accordance with local tax laws and regulations. Corporations are legally required to file this form annually, reporting their financial information accurately. Failure to file or inaccuracies in the form can result in penalties, interest on unpaid taxes, or audits by tax authorities. It is crucial for corporations to maintain proper records and seek professional advice if needed to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the CT 3 ABC to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due on April 15. It is advisable to mark these dates on your calendar and prepare your documents in advance to ensure timely submission.

Required Documents

To complete the CT 3 ABC, several documents are typically required. These include:

- Financial statements, including income statements and balance sheets.

- Records of all income and expenses incurred during the tax year.

- Documentation supporting any deductions claimed on the form.

- Previous year's tax return for reference and consistency.

Having these documents ready will streamline the process of filling out the form and help ensure accuracy.

Quick guide on how to complete ct 3 abc

Effortlessly Prepare CT 3 ABC on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without any delays. Handle CT 3 ABC on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Alter and eSign CT 3 ABC with Ease

- Locate CT 3 ABC and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign CT 3 ABC and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 abc

Create this form in 5 minutes!

How to create an eSignature for the ct 3 abc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 3 ABC and how does it relate to airSlate SignNow?

CT 3 ABC is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, ensuring that documents are signed quickly and efficiently. By utilizing CT 3 ABC, businesses can improve their overall productivity and reduce turnaround times.

-

How much does airSlate SignNow with CT 3 ABC cost?

The pricing for airSlate SignNow with CT 3 ABC is designed to be cost-effective for businesses of all sizes. Various subscription plans are available, allowing you to choose one that fits your budget and needs. You can start with a free trial to explore the features before committing to a plan.

-

What features does CT 3 ABC offer?

CT 3 ABC includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to simplify the eSigning process and enhance document management. With CT 3 ABC, users can also integrate with other tools to create a seamless workflow.

-

What are the benefits of using CT 3 ABC for eSigning?

Using CT 3 ABC for eSigning offers numerous benefits, including increased efficiency and reduced paper usage. It allows for faster document turnaround, which can signNowly improve business operations. Additionally, CT 3 ABC ensures compliance with legal standards, providing peace of mind for users.

-

Can CT 3 ABC integrate with other software?

Yes, CT 3 ABC is designed to integrate seamlessly with various software applications, enhancing its functionality. This allows businesses to connect their existing tools and streamline their processes. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

Is CT 3 ABC secure for sensitive documents?

Absolutely, CT 3 ABC prioritizes security and compliance, ensuring that sensitive documents are protected. It employs advanced encryption methods and secure access controls to safeguard your data. Users can trust that their information is handled with the utmost care and security.

-

How can I get started with CT 3 ABC on airSlate SignNow?

Getting started with CT 3 ABC on airSlate SignNow is simple. You can sign up for a free trial on the website, which allows you to explore all the features without any commitment. Once you're ready, you can choose a subscription plan that best fits your business needs.

Get more for CT 3 ABC

Find out other CT 3 ABC

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document