Iht405 2018-2026

What is the IHT405?

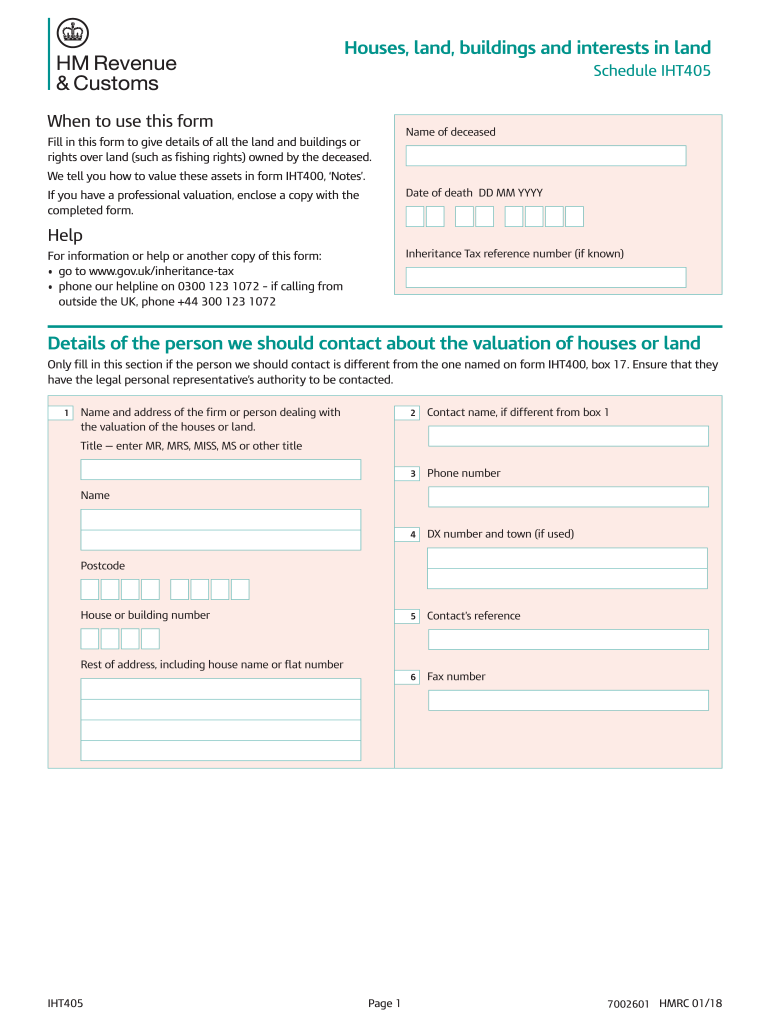

The IHT405 form, also known as the Inheritance Tax Account, is a critical document used in the United Kingdom to report the value of an estate when someone passes away. This form is essential for calculating any inheritance tax obligations. It provides details about the deceased's assets, liabilities, and other relevant financial information. Completing the IHT405 accurately is vital to ensure compliance with tax regulations and to facilitate the proper administration of the estate.

How to use the IHT405

Using the IHT405 form involves several key steps. First, gather all necessary financial information about the deceased, including property values, bank accounts, investments, and debts. Next, fill out the form with accurate details, ensuring that all sections are completed. It is crucial to double-check the information for accuracy, as any discrepancies can lead to complications. Once completed, the form should be submitted to HM Revenue and Customs (HMRC) as part of the estate administration process.

Steps to complete the IHT405

Completing the IHT405 form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents related to the deceased's estate.

- Begin filling out the IHT405, starting with the personal details of the deceased.

- List all assets, including real estate, bank accounts, and personal belongings, along with their values.

- Document any liabilities, such as outstanding debts or mortgages.

- Review the completed form for accuracy, ensuring all required fields are filled out.

- Submit the form to HMRC, either online or by mail, as per the guidelines.

Legal use of the IHT405

The IHT405 form must be used in accordance with UK inheritance tax laws. It serves as an official declaration of the estate's value and is necessary for the assessment of any inheritance tax owed. Failing to use the form correctly can result in penalties or legal complications. It is advisable to consult with a legal professional or tax advisor to ensure compliance with all legal requirements when completing the form.

Required Documents

To complete the IHT405 form, several documents are necessary. These typically include:

- The deceased's will or a statement of intestacy.

- Proof of ownership for all assets, such as property deeds and bank statements.

- Documentation of any debts or liabilities.

- Personal identification for the executor or administrator of the estate.

Form Submission Methods

The IHT405 form can be submitted through various methods. Individuals can choose to file the form online via the HMRC website or send a physical copy through the mail. When submitting online, ensure that all information is entered accurately to avoid delays. If mailing the form, it is recommended to use a secure method and keep a copy for personal records.

Penalties for Non-Compliance

Non-compliance with the IHT405 requirements can lead to significant penalties. If the form is not submitted on time or contains inaccurate information, HMRC may impose fines or additional tax charges. In severe cases, legal action may be taken against the executor or administrator of the estate. It is crucial to adhere to all deadlines and ensure the accuracy of the information provided to avoid these consequences.

Quick guide on how to complete tell hmrc about houses land buildings and interest in land for inheritance tax tell hmrc about houses land buildings and

A succinct guide on how to craft your Iht405

Locating the appropriate template can prove to be a difficulty when you need to submit official international documents. Even when you possess the required form, it might be tedious to swiftly prepare it in accordance with all the specifications if you opt for printed copies instead of managing everything digitally. airSlate SignNow is the web-based eSignature platform that aids you in navigating all of that. It allows you to obtain your Iht405 and efficiently finalize and endorse it on-site without needing to reprint documents in the event of an error.

Here are the procedures you should follow to create your Iht405 with airSlate SignNow:

- Hit the Get Form button to immediately add your document to our editor.

- Begin with the first vacant field, input your information, and continue with the Next tool.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most essential details.

- Click on Image and upload one if your Iht405 necessitates it.

- Leverage the right-side pane to add extra sections for you or others to fill out if needed.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude modifying the form by clicking the Done button and selecting your file-sharing preferences.

Once your Iht405 is ready, you can distribute it according to your preferences - send it to your recipients via email, SMS, fax, or even print it directly from the editor. Additionally, you can securely store all your completed documents in your account, organized in folders according to your liking. Don’t spend valuable time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct tell hmrc about houses land buildings and interest in land for inheritance tax tell hmrc about houses land buildings and

FAQs

-

How do I make the best out of a house loan of 30-35 lakhs for buying land and building home in Rajasthan, India in terms of EMI, loan tenure, interest rate type, etc.?

EMI CALCULATOR APP

-

West Virginia Private Party Property Oral Agreement? My grandfather just passed away and my grandmother is in a nursing home (severe dementia). My dad and aunts are working to sell their Charleston, WV home. 20 or so years ago, my now deceased grandfather's neighbor gave him a slice of land between their properties to build a driveway on (obviously never expecting to get that land back, as it goes up to my grandparents' house and the neighbors would have no use for the land, as it is up on a hi

Roy is correct about the law of adverse possession. If your grandparents were using the property openly and treating it as their own for a period of seven consecutive years (WV Code 55-4-16) and the neighbor neither made any attempt to stop them, nor filed a document (say in the county clerk's office) saying that he had granted a revocable right-of-way which attached not to the property but was given to the property owners at that particular time, then the new owner's demand for money is probably spurious.Forget about the oral agreement. With everybody deceased or not in their right mind (your grandmother in the nursing home), it's not worth the paper it's written on. However, since all you have is an oral agreement, and you have no proof, you may have to go hire a lawyer and go to court to claim your adverse possession rights. Then this would all be a question of fact for the jury. It may be that the new owners can bring witnesses who say that all that was granted was a right-of-way, and that it is jointly owned. You may have witnesses to the original oral agreement between your grandfather and the previous owner. Regardless, the new owner can attach a $10,000 lien to your property if you just ignore this or keep telling him that he is wrong. So you might want to seek an attorney's advice to see what your options are.

Create this form in 5 minutes!

How to create an eSignature for the tell hmrc about houses land buildings and interest in land for inheritance tax tell hmrc about houses land buildings and

How to make an electronic signature for your Tell Hmrc About Houses Land Buildings And Interest In Land For Inheritance Tax Tell Hmrc About Houses Land Buildings And online

How to make an eSignature for the Tell Hmrc About Houses Land Buildings And Interest In Land For Inheritance Tax Tell Hmrc About Houses Land Buildings And in Google Chrome

How to generate an eSignature for signing the Tell Hmrc About Houses Land Buildings And Interest In Land For Inheritance Tax Tell Hmrc About Houses Land Buildings And in Gmail

How to generate an eSignature for the Tell Hmrc About Houses Land Buildings And Interest In Land For Inheritance Tax Tell Hmrc About Houses Land Buildings And straight from your mobile device

How to make an eSignature for the Tell Hmrc About Houses Land Buildings And Interest In Land For Inheritance Tax Tell Hmrc About Houses Land Buildings And on iOS

How to generate an electronic signature for the Tell Hmrc About Houses Land Buildings And Interest In Land For Inheritance Tax Tell Hmrc About Houses Land Buildings And on Android OS

People also ask

-

What is the iht405 form?

The iht405 form is a specific document required for reporting certain estates for inheritance tax purposes in the UK. Understanding the iht405 form is crucial for managing estate transactions efficiently. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining your workflow.

-

How can airSlate SignNow help with the iht405 form?

AirSlate SignNow simplifies the process of preparing and signing the iht405 form. With our platform, you can automate document workflows, reduce errors, and ensure compliance while sending documents for eSignature. This leads to faster processing times and improved organization for any estate-related document.

-

Is there a cost associated with using airSlate SignNow for the iht405 form?

Yes, there is a cost associated with using airSlate SignNow, but our plans are affordable and vary based on the features you need. With our pricing, you will receive access to advanced tools tailored for efficiently managing documents like the iht405 form. Investing in airSlate SignNow can save you time and resources in the long run.

-

Can I integrate airSlate SignNow with other software for managing iht405 forms?

Absolutely! AirSlate SignNow offers robust integrations with various software tools that enhance your document management processes. By integrating with your existing systems, you can effortlessly handle the iht405 form alongside other critical documents, thereby improving productivity and workflow.

-

What features does airSlate SignNow offer for working with the iht405 form?

AirSlate SignNow provides a plethora of features, including eSigning, document templates, and cloud storage specifically for forms like iht405. These features streamline the completion process and provide easy access to your documents, ensuring you never miss an important detail during estate management.

-

Can multiple users collaborate on the iht405 form with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the iht405 form simultaneously. This feature means you can easily share documents, track changes, and gather signatures from various parties without the hassle of back-and-forth emails. Collaborative features enhance communication and efficiency.

-

How does airSlate SignNow ensure the security of my iht405 form?

Security is a priority at airSlate SignNow. We utilize bank-level encryption and secure servers to protect your documents, including the iht405 form. Users can rest assured that their sensitive data remains confidential and secure during the signing and document management process.

Get more for Iht405

- Pharmacy council form

- Probationary period performance appraisal form centenary centenary

- Rti application form download pdf maharashtra

- Age level literacy tests literacy testing com form

- Human participants form 4 society for science amp the public georgiacenter uga

- Snap 9b form

- Payroll calculation worksheet lfs pro form

- College learning agreement form

Find out other Iht405

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed