Mvu 25 2013-2026

What is the MVU-25?

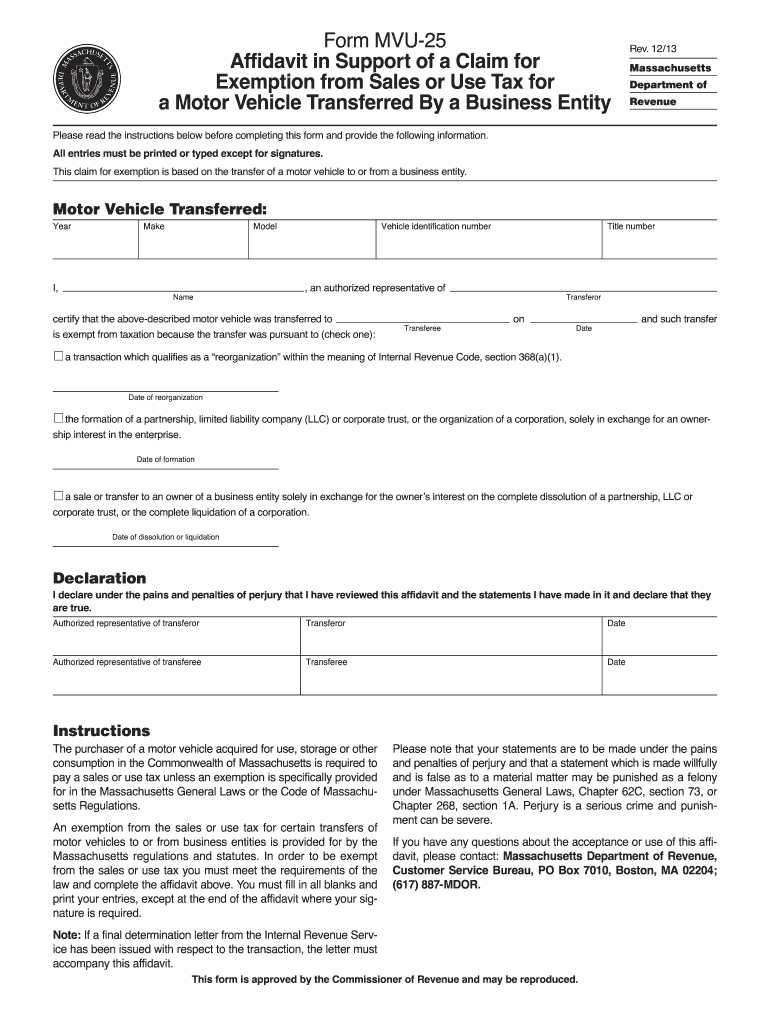

The MVU-25 is a Massachusetts form used for claiming a motor vehicle exemption. This document is essential for individuals or entities seeking to report the transfer of a motor vehicle for tax purposes. It serves to validate the exemption from certain taxes associated with the transfer of ownership, ensuring compliance with state regulations. Understanding the MVU-25 is crucial for accurate tax reporting and maintaining legal compliance in Massachusetts.

How to Use the MVU-25

To effectively use the MVU-25, individuals must first ensure they meet the eligibility criteria for the motor vehicle exemption. The form can be completed online, allowing users to fill in the necessary information easily. Key details required include the vehicle identification number (VIN), the names of the parties involved in the transfer, and the reason for the exemption. Once completed, the form must be submitted to the appropriate state authority to process the exemption claim.

Steps to Complete the MVU-25

Completing the MVU-25 involves several clear steps:

- Gather necessary information, including the VIN and details of the vehicle transfer.

- Access the MVU-25 form online through a secure platform.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy before submission.

- Submit the completed form electronically or print it for mailing, depending on your preference.

Legal Use of the MVU-25

The MVU-25 must be used in accordance with Massachusetts state law. It is legally binding when completed accurately and submitted to the appropriate authorities. This form helps ensure that individuals and businesses comply with tax obligations related to motor vehicle transfers. Misuse or incorrect submission of the MVU-25 can lead to penalties or denial of the exemption claim.

Required Documents

When completing the MVU-25, certain documents may be required to support the exemption claim. These may include:

- Proof of ownership of the vehicle, such as the title or bill of sale.

- Identification for both the seller and buyer, ensuring all parties are verified.

- Any additional documentation that supports the reason for the exemption.

Form Submission Methods

The MVU-25 can be submitted through various methods to accommodate user preferences. Options include:

- Online submission via a secure platform, which is the fastest method.

- Mailing a printed copy to the appropriate state office.

- In-person submission at designated state offices for those who prefer face-to-face interaction.

Quick guide on how to complete form mvu 25 affidavit in support of a claim for massgov

Your assistance manual on how to prepare your Mvu 25

If you're interested in learning how to create and dispatch your Mvu 25, here are some concise instructions to simplify tax declaration.

To begin, you merely need to create your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is a highly user-friendly and powerful document platform that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, and revisit to amend answers as necessary. Streamline your tax processing with advanced PDF editing, electronic signing, and easy sharing.

Follow the instructions below to finalize your Mvu 25 in just a few minutes:

- Set up your account and start handling PDFs within moments.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Mvu 25 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, tick marks).

- Employ the Sign Tool to place your legally-recognized eSignature (if needed).

- Double-check your document and correct any mistakes.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Leverage this manual to electronically file your taxes using airSlate SignNow. Be aware that paper filing can lead to return mistakes and delay refunds. Before e-filing your taxes, be sure to review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form mvu 25 affidavit in support of a claim for massgov

FAQs

-

How should a petitioner fill in Part 5 Household Size of the form I-864 Affidavit of support if he would like to sponsor 2 principal immigrants at the same time? Each family has 4 members.

Each principal beneficiary (and their family) is petitioned with a separate I-130 petition, and each I-130 petition has a separate I-864 Affidavit of Support. Each family’s I-864 does not count the other family in the “family members” in Part 3 (note that it says “Do not include any relative listed on a separate visa petition.”).If the two I-864s are filed at the same time for the two families, then each family’s I-864’s household size (Part 5) would just count the number of people immigrating in that family, which is 4 (item 1), the petitioner (item 2), and the petitioner’s spouse (item 3), dependent children (item 4), and other tax dependents (item 5), if there are any. It would not count anyone from the other family.On the other hand, if one I-864 is filed for one family, and that family has already immigrated before the second I-864 is filed for the other family, then the first family’s members will need to be counted in Part 5 item 6 (people sponsored on Form I-864 who are now lawful permanent residents) for the second family’s I-864.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

Create this form in 5 minutes!

How to create an eSignature for the form mvu 25 affidavit in support of a claim for massgov

How to create an electronic signature for your Form Mvu 25 Affidavit In Support Of A Claim For Massgov online

How to generate an electronic signature for your Form Mvu 25 Affidavit In Support Of A Claim For Massgov in Chrome

How to make an eSignature for putting it on the Form Mvu 25 Affidavit In Support Of A Claim For Massgov in Gmail

How to make an eSignature for the Form Mvu 25 Affidavit In Support Of A Claim For Massgov straight from your smartphone

How to generate an eSignature for the Form Mvu 25 Affidavit In Support Of A Claim For Massgov on iOS

How to generate an eSignature for the Form Mvu 25 Affidavit In Support Of A Claim For Massgov on Android

People also ask

-

What is Mvu 25 in the context of airSlate SignNow?

Mvu 25 refers to a specific plan offered by airSlate SignNow that is designed for businesses needing efficient document signing solutions. This plan allows users to send and eSign documents seamlessly, making it ideal for organizations looking to streamline their workflow.

-

How much does the Mvu 25 plan cost?

The Mvu 25 plan from airSlate SignNow is competitively priced to ensure businesses can access essential eSigning features without breaking the bank. Pricing may vary based on the number of users and additional features selected, so it's best to visit our pricing page for the most current information.

-

What features are included in the Mvu 25 plan?

The Mvu 25 plan includes a range of features that empower businesses to manage their document signing needs efficiently. Key features include customizable templates, automated workflows, and multi-party signing options, all designed to improve productivity and reduce turnaround time.

-

What are the benefits of choosing the Mvu 25 plan?

Choosing the Mvu 25 plan offers numerous benefits for businesses, including enhanced efficiency and reduced paper usage. With airSlate SignNow, organizations can send, sign, and manage documents electronically, leading to faster transactions and improved collaboration among teams.

-

Can the Mvu 25 plan integrate with other software?

Yes, the Mvu 25 plan supports integrations with various software applications, allowing businesses to incorporate airSlate SignNow into their existing workflows. Popular integrations include CRM systems, cloud storage services, and more, ensuring seamless operations.

-

Is there a mobile app for the Mvu 25 plan?

Absolutely! The Mvu 25 plan includes access to the airSlate SignNow mobile app, enabling users to send and eSign documents on the go. This feature ensures that businesses can stay productive, even when they are away from their desks.

-

How secure is the Mvu 25 plan for document signing?

The Mvu 25 plan prioritizes security with advanced encryption protocols and compliance with industry standards. airSlate SignNow ensures that all documents are securely stored and signed, giving businesses peace of mind regarding their sensitive information.

Get more for Mvu 25

- Bail enforcement contract form

- 4 h camp f600 a formpdf university of tennessee extension

- Dss 1678 replacement affidavit info dhhs state nc form

- Desert escrow association scholarship application name of palmspringshighschool form

- Cessna 172s skyhawk standardization manual private pilot tasks legacyflightacademy form

- Pursuant to the provisions of act 162 public acts of 1982 the undersigned corporation executes the following articles michigan form

- Wreaths across america 2016 donation form stephen holston stephenholston

- Aoc e 506 the north carolina court system nccourts form

Find out other Mvu 25

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed