Federal Cash Transactions Report Code 210 Form

What is the Federal Cash Transactions Report Code 210

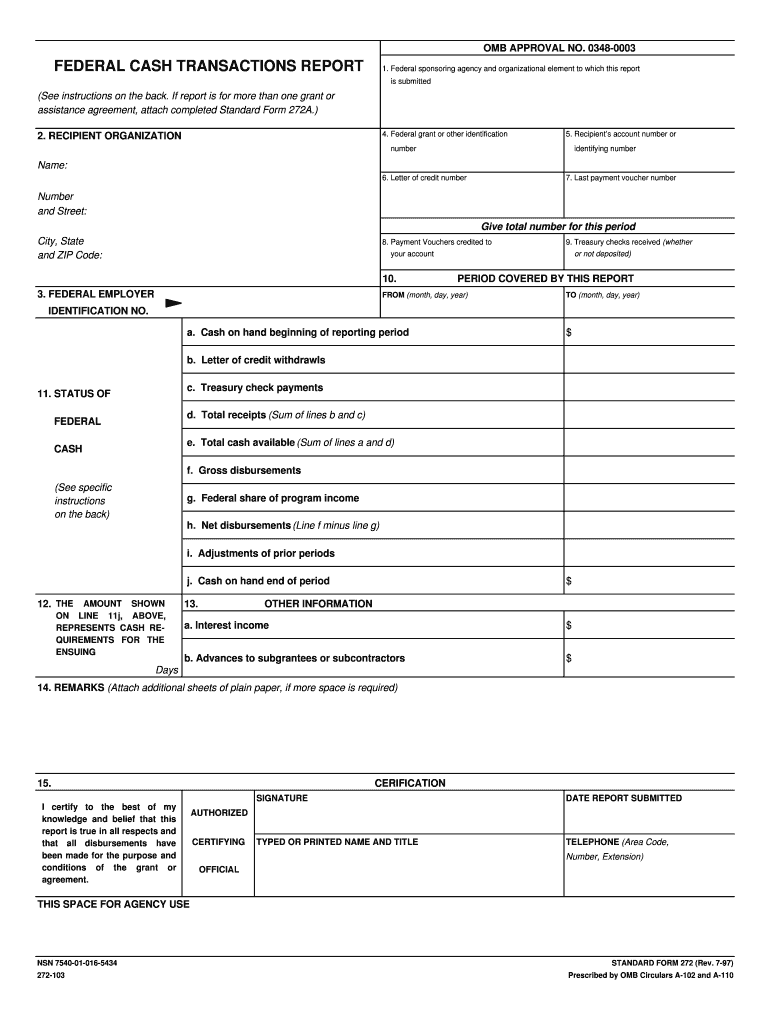

The Federal Cash Transactions Report Code 210 is a specific form required by the U.S. government to report large cash transactions. This report is essential for maintaining transparency in financial activities, particularly those involving cash amounts exceeding $10,000. It is primarily utilized by businesses and financial institutions to comply with federal regulations aimed at preventing money laundering and other illicit activities.

The report captures critical information about the transaction, including the identities of both the sender and receiver, the amount involved, and the nature of the transaction. Understanding the purpose and requirements of this report is crucial for any entity engaged in significant cash transactions.

How to use the Federal Cash Transactions Report Code 210

Using the Federal Cash Transactions Report Code 210 involves several key steps. First, ensure that your organization is compliant with the reporting requirements set forth by the Financial Crimes Enforcement Network (FinCEN). Next, gather all necessary information related to the cash transaction, including details about the parties involved and the transaction specifics.

Once you have compiled the required information, complete the form accurately. It is important to double-check all entries to avoid errors that could lead to penalties. After completing the report, submit it to the appropriate federal agency, ensuring you adhere to any specified deadlines.

Steps to complete the Federal Cash Transactions Report Code 210

Completing the Federal Cash Transactions Report Code 210 involves a systematic approach:

- Identify the transaction: Confirm that the cash transaction meets the threshold of $10,000 or more.

- Gather information: Collect details about the transaction, including the names and addresses of the parties involved, the date, and the amount.

- Fill out the form: Accurately enter all required information into the report, ensuring clarity and correctness.

- Review the report: Check for any errors or omissions before finalizing the document.

- Submit the report: Send the completed form to the designated federal agency, either electronically or via mail.

Legal use of the Federal Cash Transactions Report Code 210

The Federal Cash Transactions Report Code 210 serves a legal purpose by ensuring compliance with federal laws aimed at combating money laundering and other financial crimes. Businesses and financial institutions are legally obligated to file this report when they engage in cash transactions that exceed the $10,000 threshold.

Failure to submit the report or inaccuracies in the information provided can lead to significant legal repercussions, including fines and penalties. Understanding the legal implications of this report is essential for any organization handling large cash transactions.

Key elements of the Federal Cash Transactions Report Code 210

Several key elements must be included in the Federal Cash Transactions Report Code 210 to ensure compliance and accuracy:

- Transaction amount: Clearly state the total cash involved in the transaction.

- Parties involved: Provide the names, addresses, and identification numbers of both the sender and receiver.

- Date of transaction: Specify when the cash transaction occurred.

- Nature of transaction: Describe the purpose of the cash exchange.

Including all these elements is vital for the report's validity and for meeting federal reporting standards.

Filing Deadlines / Important Dates

Filing deadlines for the Federal Cash Transactions Report Code 210 are critical to ensure compliance. Generally, the report must be submitted within fifteen days of the cash transaction. It is advisable to keep track of any changes in regulations or deadlines, as these can vary based on specific circumstances or updates from federal agencies.

Staying informed about important dates related to this report can help avoid penalties and ensure that your organization remains compliant with federal requirements.

Quick guide on how to complete federal cash transactions report code 210

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that task.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Alter and eSign [SKS] and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Cash Transactions Report Code 210

Create this form in 5 minutes!

How to create an eSignature for the federal cash transactions report code 210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Federal Cash Transactions Report Code 210?

The Federal Cash Transactions Report Code 210 is a specific reporting requirement for businesses that handle cash transactions. It helps organizations maintain compliance with federal regulations by accurately documenting cash inflows and outflows. Understanding this report is crucial for businesses to avoid penalties and ensure financial transparency.

-

How can airSlate SignNow assist with the Federal Cash Transactions Report Code 210?

airSlate SignNow provides an efficient platform for businesses to electronically sign and manage documents related to the Federal Cash Transactions Report Code 210. With its user-friendly interface, you can easily prepare, send, and store necessary documentation, ensuring compliance and reducing administrative burdens.

-

What are the pricing options for using airSlate SignNow for the Federal Cash Transactions Report Code 210?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to features that support the Federal Cash Transactions Report Code 210. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the Federal Cash Transactions Report Code 210?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the Federal Cash Transactions Report Code 210. These tools streamline the process, making it easier to create and manage reports while ensuring compliance with federal regulations.

-

Are there any integrations available with airSlate SignNow for the Federal Cash Transactions Report Code 210?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, enhancing your ability to manage the Federal Cash Transactions Report Code 210. These integrations allow for automatic data transfer, reducing manual entry errors and improving overall efficiency in your reporting processes.

-

What are the benefits of using airSlate SignNow for the Federal Cash Transactions Report Code 210?

Using airSlate SignNow for the Federal Cash Transactions Report Code 210 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform simplifies the signing process, allowing you to focus on your core business activities while ensuring that all necessary documentation is handled correctly.

-

Is airSlate SignNow secure for handling the Federal Cash Transactions Report Code 210?

Absolutely! airSlate SignNow prioritizes security and compliance, employing advanced encryption and security protocols to protect your documents related to the Federal Cash Transactions Report Code 210. You can trust that your sensitive financial information is safe and secure while using our platform.

Get more for Federal Cash Transactions Report Code 210

Find out other Federal Cash Transactions Report Code 210

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF