Form 8655 Quickbooks 2024

Understanding Form 8655

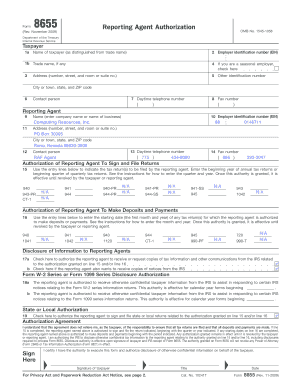

Form 8655, also known as the "Tax Information Authorization," is a crucial document used by businesses and individuals to authorize a third party to receive and discuss tax information with the IRS on their behalf. This form is particularly relevant for accountants and tax professionals who manage tax matters for clients. By completing this form, taxpayers can ensure that their representatives have the necessary permissions to handle sensitive tax information, streamlining communication with the IRS.

Steps to Complete Form 8655

Completing Form 8655 involves several key steps to ensure accuracy and compliance. First, gather the required information, including the taxpayer's name, address, and taxpayer identification number. Next, provide details about the representative, including their name, address, and phone number. It's essential to specify the type of tax information the representative is authorized to access, such as income tax or employment tax. After filling out the form, both the taxpayer and the representative must sign and date it. Finally, submit the completed form to the IRS, either electronically or via mail, depending on the specific requirements.

Legal Use of Form 8655

Form 8655 is legally binding and must be used in accordance with IRS regulations. It grants the designated representative the authority to act on behalf of the taxpayer regarding specific tax matters. This includes receiving tax information, discussing tax issues with the IRS, and representing the taxpayer in audits or appeals. It is important to note that the authorization is limited to the scope defined in the form, and it can be revoked by the taxpayer at any time by submitting a written notice to the IRS.

IRS Guidelines for Form 8655

The IRS provides specific guidelines for the use and submission of Form 8655. Taxpayers should ensure that the form is completed accurately and submitted in a timely manner to avoid any delays in processing. The IRS requires that the form be signed by both the taxpayer and the representative to validate the authorization. Additionally, taxpayers should retain a copy of the completed form for their records, as it may be needed for future reference or in case of audits.

Filing Deadlines for Form 8655

While Form 8655 does not have a specific filing deadline, it is advisable to submit it as soon as the need for a representative arises. This ensures that the representative can act on behalf of the taxpayer without unnecessary delays. Taxpayers should be aware of any relevant deadlines for their specific tax situations, as these may affect the timing of when the form should be submitted. Keeping track of important dates related to tax filings can help ensure compliance and avoid penalties.

Examples of Using Form 8655

Form 8655 can be utilized in various scenarios. For instance, a small business owner may authorize their accountant to handle all communications regarding their business taxes. Similarly, an individual taxpayer may use the form to allow a tax professional to manage their personal tax returns. These examples illustrate the versatility of Form 8655 in facilitating effective communication between taxpayers and the IRS, ensuring that tax matters are handled efficiently and accurately.

Quick guide on how to complete form 8655 quickbooks

Prepare Form 8655 Quickbooks effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage Form 8655 Quickbooks on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign Form 8655 Quickbooks effortlessly

- Find Form 8655 Quickbooks and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 8655 Quickbooks to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8655 quickbooks

Create this form in 5 minutes!

How to create an eSignature for the form 8655 quickbooks

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8655 and how can airSlate SignNow help?

Form 8655 is a tax form used to authorize an individual to act on behalf of a business for tax matters. airSlate SignNow simplifies the process of completing and signing form 8655, allowing users to easily fill out, eSign, and send the document securely.

-

Is there a cost associated with using airSlate SignNow for form 8655?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the signing process for documents like form 8655, ensuring a cost-effective solution for your business.

-

What features does airSlate SignNow offer for managing form 8655?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for form 8655. These tools enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for form 8655?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 8655 alongside your existing workflows. This integration capability enhances productivity and ensures that your documents are easily accessible.

-

How does airSlate SignNow ensure the security of form 8655?

Security is a top priority for airSlate SignNow. When handling form 8655, the platform employs advanced encryption and secure cloud storage to protect your sensitive information, ensuring compliance with industry standards.

-

What are the benefits of using airSlate SignNow for form 8655?

Using airSlate SignNow for form 8655 offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The platform's user-friendly interface makes it easy for businesses to manage their tax documents efficiently.

-

Can I track the status of my form 8655 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 8655 in real-time. You will receive notifications when the document is viewed, signed, or completed, providing you with peace of mind throughout the process.

Get more for Form 8655 Quickbooks

Find out other Form 8655 Quickbooks

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form