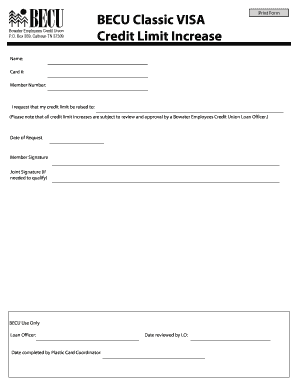

Becu Credit Card Limit Form

Understanding the BECU Credit Card Limit

The BECU credit card limit refers to the maximum amount of credit that a cardholder can access on their BECU credit card. This limit is determined based on several factors, including the cardholder's creditworthiness, income, and overall financial profile. It's important for users to understand their credit limit as it affects their purchasing power and credit utilization ratio, which can impact credit scores.

How to Use the BECU Credit Card Limit Wisely

Using the BECU credit card limit effectively involves managing spending within the established limit to maintain a healthy credit score. Cardholders should aim to keep their balances low relative to their limit, ideally below thirty percent. Regularly monitoring transactions and making timely payments can help avoid interest charges and potential fees.

Steps to Obtain a BECU Credit Card Limit Increase

To request a credit limit increase on a BECU credit card, cardholders typically need to follow a few steps:

- Review your current credit card usage and payment history.

- Gather necessary financial information, including income and employment details.

- Log in to your BECU account or contact customer service to initiate the request.

- Submit the request and wait for a decision, which may take a few minutes to several days.

Legal Considerations for BECU Credit Card Limits

When managing a BECU credit card limit, it is essential to adhere to legal guidelines governing credit use in the United States. This includes understanding consumer protection laws that prevent discriminatory practices in credit lending and ensuring compliance with the Fair Credit Reporting Act, which governs how credit information is collected and reported.

Eligibility Criteria for BECU Credit Card Limits

Eligibility for a BECU credit card limit is determined by several factors, including credit score, income level, and existing debt. BECU typically requires applicants to have a good credit history and may consider other financial obligations when assessing credit limit requests. Understanding these criteria can help potential cardholders prepare for the application process.

Examples of Using the BECU Credit Card Limit

Cardholders can utilize their BECU credit card limit in various ways, such as:

- Making everyday purchases like groceries and gas.

- Paying for larger expenses, such as travel or home repairs.

- Utilizing the card for online shopping to earn rewards or cash back.

By using the credit card responsibly, cardholders can build their credit history and improve their credit score over time.

Quick guide on how to complete becu credit card limit

Effortlessly Prepare Becu Credit Card Limit on Any Device

Managing documents online has gained traction among both organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers since you can obtain the necessary form and securely store it online. airSlate SignNow provides all the essential tools required to create, edit, and eSign your documents quickly and without interruptions. Handle Becu Credit Card Limit on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centered workflow today.

The Easiest Way to Edit and eSign Becu Credit Card Limit Effortlessly

- Locate Becu Credit Card Limit and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools specifically designed by airSlate SignNow for such purposes.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, and errors that require the printing of new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Edit and eSign Becu Credit Card Limit to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the becu credit card limit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary function of airSlate SignNow?

airSlate SignNow is designed to empower businesses to send and eSign documents efficiently. With its user-friendly interface, you can streamline your document workflows and enhance productivity. For more information, you can signNow out to us at 8442328562.

-

How does airSlate SignNow ensure document security?

Security is a top priority for airSlate SignNow. We utilize advanced encryption methods to protect your documents during transmission and storage. If you have further questions about our security measures, please call us at 8442328562.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to be cost-effective while providing essential features for document management. For detailed pricing information, feel free to contact us at 8442328562.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow. This includes popular tools like Google Drive, Salesforce, and more. For a complete list of integrations, please signNow out to us at 8442328562.

-

What are the key benefits of using airSlate SignNow?

Using airSlate SignNow can signNowly reduce the time spent on document management. It allows for quick eSigning and document sharing, which can lead to faster business transactions. For more insights on the benefits, contact us at 8442328562.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage your documents on the go. This ensures that you can send and eSign documents anytime, anywhere. For more details, please call us at 8442328562.

-

How can I get support for airSlate SignNow?

airSlate SignNow provides comprehensive customer support to assist you with any inquiries. You can signNow our support team via phone or email for prompt assistance. For immediate help, call us at 8442328562.

Get more for Becu Credit Card Limit

- Preventing mechanics liens contractors state license board cagov form

- Hospital presumptive eligibility statement of medicaid form

- Maryland insurance administration service request form

- Boyd k rutherford lt governor maryland state archives form

- Insurance education waiver applicationaffidavit of employer form

- The maryland insurance administration mia is an independent state agency that regulates marylands insurance industry and form

- Center street westminster md 21157 phone 410 876 4813 fax 410 876 4957 form

- Policy on reasonable accommodation miami dade county form

Find out other Becu Credit Card Limit

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile