Az Form 290 Fillable 2016

What is the AZ Form 290 Fillable

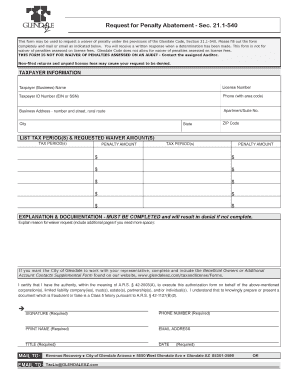

The AZ Form 290 is a document used in Arizona for various administrative purposes, primarily related to tax reporting and compliance. This form is designed to facilitate the collection of specific information from taxpayers, ensuring that all necessary details are provided for accurate processing. The fillable version of this form allows users to complete it digitally, making it easier to manage and submit. This feature is especially beneficial for individuals and businesses looking to streamline their paperwork.

How to Use the AZ Form 290 Fillable

Using the AZ Form 290 fillable version is straightforward. First, download the form from an official source or access it through a digital platform that supports form filling. Once opened, users can enter their information directly into the designated fields. It is essential to review all entries for accuracy before saving the completed form. After filling it out, the form can be printed or submitted electronically, depending on the submission requirements.

Steps to Complete the AZ Form 290 Fillable

Completing the AZ Form 290 fillable involves several key steps:

- Download the form from a reliable source.

- Open the form in a compatible PDF reader or form-filling software.

- Fill in the required fields with accurate information, including personal details and any relevant financial data.

- Double-check all entries for completeness and correctness.

- Save the completed form to your device.

- Submit the form according to the specified guidelines, either online or by mail.

Legal Use of the AZ Form 290 Fillable

The AZ Form 290 must be used in accordance with state regulations and guidelines. This form serves legal purposes, such as verifying taxpayer information and ensuring compliance with Arizona tax laws. Failure to use the form correctly or to submit it on time can result in penalties or other legal implications. It is advisable to familiarize oneself with the legal requirements surrounding this form to avoid any issues.

Key Elements of the AZ Form 290 Fillable

Several key elements are essential when filling out the AZ Form 290. These include:

- Personal Information: Name, address, and Social Security number or taxpayer identification number.

- Financial Details: Income information, deductions, and any applicable credits.

- Signature: A declaration that the information provided is accurate, often requiring a signature or electronic verification.

- Submission Instructions: Clear guidelines on how and where to submit the completed form.

Form Submission Methods

The AZ Form 290 can be submitted through various methods, depending on the specific requirements outlined by the Arizona Department of Revenue. Common submission methods include:

- Online Submission: Many users prefer to submit the form electronically through a secure portal.

- Mail: The form can be printed and sent via postal service to the designated address.

- In-Person: Some individuals may choose to deliver the form directly to a local tax office.

Quick guide on how to complete az form 290 fillable

Prepare Az Form 290 Fillable effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Az Form 290 Fillable on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Az Form 290 Fillable with ease

- Find Az Form 290 Fillable and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Az Form 290 Fillable to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct az form 290 fillable

Create this form in 5 minutes!

How to create an eSignature for the az form 290 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 290 and how can airSlate SignNow help with it?

Form 290 is a document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing form 290 by providing an intuitive platform that allows users to easily create, send, and eSign the document securely.

-

Is there a cost associated with using airSlate SignNow for form 290?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the management of form 290, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for managing form 290?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for form 290. These tools enhance efficiency and ensure that your documents are processed quickly and accurately.

-

Can I integrate airSlate SignNow with other applications for form 290?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 290 alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

How does airSlate SignNow ensure the security of form 290?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your form 290 and other sensitive documents, ensuring that your data remains safe and confidential.

-

What are the benefits of using airSlate SignNow for form 290?

Using airSlate SignNow for form 290 offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. The platform's user-friendly interface makes it easy for anyone to manage their documents efficiently.

-

Can I track the status of my form 290 with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your form 290. You can easily monitor the status of your document, ensuring that you are always informed about its progress and completion.

Get more for Az Form 290 Fillable

- 6292 form

- 4693a form

- Publication 5427 ru 6 2020 tax scam alert russian version form

- Form 15268 sp rev 10 2020 economic impact payment eip non filers customizable for partners spanish version

- 3415 form

- Line by line instructions free file fillable forms irs

- 947 sp form

- Form 14095 rev 8 2020 the health coverage tax credit hctc reimbursement request

Find out other Az Form 290 Fillable

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy