Form 290 Arizona 2019-2026

What is the Form 290 Arizona

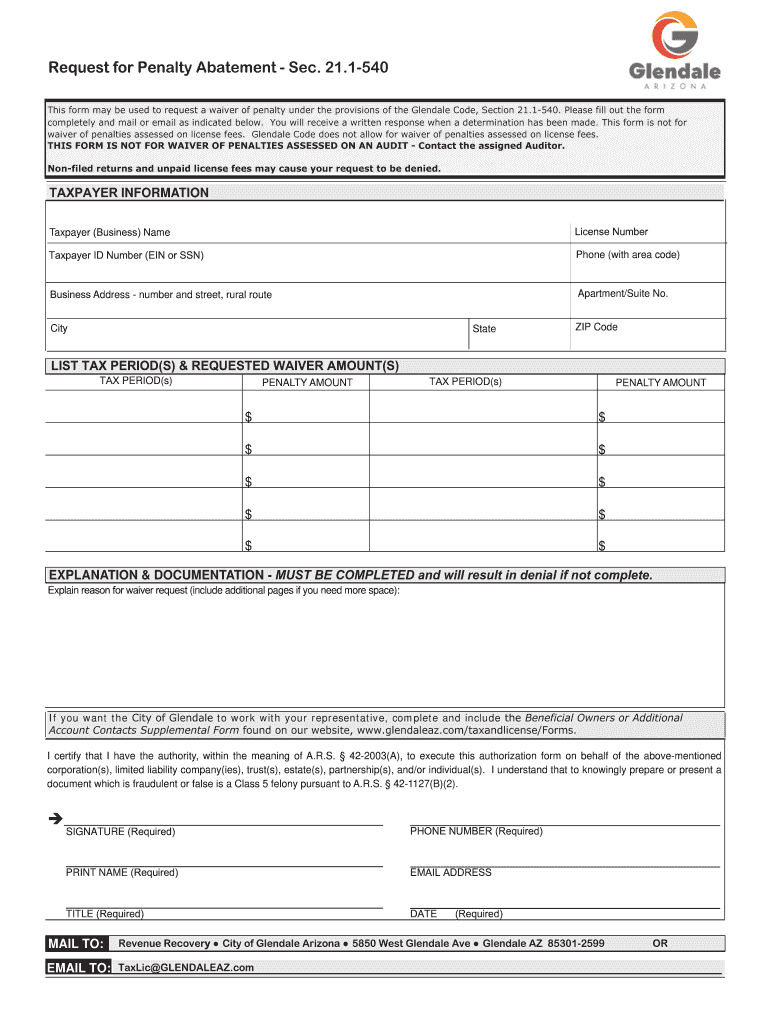

The Form 290 Arizona, also known as the Arizona Request for Penalty Abatement, is a document used by taxpayers to request the reduction or elimination of penalties imposed by the Arizona Department of Revenue. This form is particularly relevant for individuals and businesses that have incurred penalties due to late filing or payment of taxes. By submitting this form, taxpayers can provide reasons for their request, which may include circumstances such as illness, natural disasters, or other valid reasons that prevented timely compliance.

How to use the Form 290 Arizona

To effectively use the Form 290 Arizona, taxpayers should first gather all necessary documentation that supports their request for penalty abatement. This may include tax returns, payment records, and any relevant correspondence with the Arizona Department of Revenue. Once the form is completed with accurate information and supporting details, it should be submitted according to the specified guidelines. It is essential to ensure that all sections of the form are filled out completely to avoid delays in processing.

Steps to complete the Form 290 Arizona

Completing the Form 290 Arizona involves several key steps:

- Begin by downloading the form from the Arizona Department of Revenue website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Clearly state the penalties you are requesting to be abated and provide a detailed explanation of the circumstances that led to the penalties.

- Attach any supporting documents that substantiate your reasons for the request, such as medical records or proof of natural disasters.

- Review the completed form for accuracy before submission.

Required Documents

When submitting the Form 290 Arizona, it is important to include specific documents that support your request. Required documents may include:

- Copies of any relevant tax returns.

- Proof of payment or correspondence related to the penalties.

- Documentation that verifies the circumstances causing the delay, such as medical records or official notices of natural disasters.

Eligibility Criteria

To qualify for penalty abatement using the Form 290 Arizona, taxpayers must meet certain eligibility criteria. Generally, these criteria include:

- Demonstrating reasonable cause for the failure to file or pay taxes on time.

- Providing evidence that the taxpayer has complied with tax obligations in the past.

- Submitting the request within the appropriate time frame after the penalty has been assessed.

Form Submission Methods

The Form 290 Arizona can be submitted through various methods to accommodate different preferences. Taxpayers can choose to:

- Submit the form online through the Arizona Department of Revenue’s e-filing system.

- Mail the completed form to the designated address provided by the Department of Revenue.

- Deliver the form in person at a local Department of Revenue office.

Quick guide on how to complete form 290 arizona

Prepare Form 290 Arizona effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your files swiftly without delays. Manage Form 290 Arizona on any device using airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

How to modify and eSign Form 290 Arizona with ease

- Find Form 290 Arizona and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 290 Arizona and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 290 arizona

Create this form in 5 minutes!

How to create an eSignature for the form 290 arizona

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting an Arizona request penalty abatement?

To submit an Arizona request penalty abatement, you need to complete the appropriate forms and provide a valid reason for your request. It's essential to include any supporting documentation that can strengthen your case. Using airSlate SignNow can streamline this process by allowing you to eSign and send documents quickly.

-

How much does it cost to file an Arizona request penalty abatement?

The cost to file an Arizona request penalty abatement can vary depending on the specific circumstances of your case. While there may be no direct fees for the request itself, associated costs may arise from professional services or document preparation. Utilizing airSlate SignNow can help reduce costs by simplifying the document management process.

-

What features does airSlate SignNow offer for Arizona request penalty abatement?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing your Arizona request penalty abatement. These tools help ensure that your documents are completed accurately and submitted on time. Additionally, the platform is user-friendly, making it accessible for all users.

-

How can airSlate SignNow benefit my Arizona request penalty abatement process?

Using airSlate SignNow can signNowly enhance your Arizona request penalty abatement process by providing a seamless way to prepare, sign, and send documents. The platform's efficiency reduces the time spent on paperwork, allowing you to focus on your case. Moreover, the secure storage of documents ensures that your sensitive information is protected.

-

Can I integrate airSlate SignNow with other tools for my Arizona request penalty abatement?

Yes, airSlate SignNow offers integrations with various tools and applications that can assist in your Arizona request penalty abatement process. This includes CRM systems, cloud storage services, and productivity tools. These integrations help streamline your workflow and keep all your documents organized in one place.

-

What types of documents can I manage for an Arizona request penalty abatement using airSlate SignNow?

You can manage a variety of documents related to your Arizona request penalty abatement using airSlate SignNow, including forms, supporting evidence, and correspondence with tax authorities. The platform allows you to create, edit, and eSign these documents efficiently. This versatility ensures that all necessary paperwork is handled effectively.

-

Is airSlate SignNow secure for handling my Arizona request penalty abatement documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling your Arizona request penalty abatement documents. The platform employs advanced encryption and security protocols to protect your data. You can confidently manage sensitive information knowing that it is secure.

Get more for Form 290 Arizona

- Aer lingus form

- Pdffiller return to work form

- Form cg1 2005 capital gains tax return for 2005 revenue

- Export value declaration form

- Indian visa application form

- Government of jharkhand commercial taxes department form jvat 110 application for amendment in registration certificate change

- Mmb vessel survey form no 6

- Pmgdisha affidavit form

Find out other Form 290 Arizona

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe