IFTA Quarterly Fuel Use Tax Return Ftp Zillionforms Com 2014-2026

What is the IFTA Quarterly Fuel Use Tax Return?

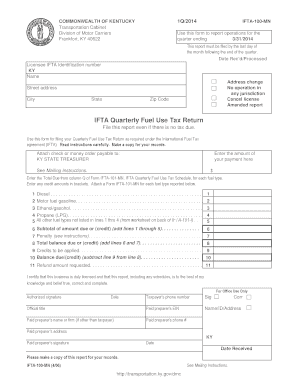

The IFTA Quarterly Fuel Use Tax Return is a tax form used by motor carriers operating in multiple jurisdictions to report fuel consumption and calculate the taxes owed to each state or province. The International Fuel Tax Agreement (IFTA) simplifies the reporting process for interstate commercial vehicle operators, allowing them to file a single return rather than separate returns in each jurisdiction. This form ensures that carriers pay the appropriate fuel tax based on the miles driven and fuel consumed in each participating jurisdiction.

Steps to complete the IFTA Quarterly Fuel Use Tax Return

Completing the IFTA Quarterly Fuel Use Tax Return involves several key steps:

- Gather necessary information, including total miles driven, fuel purchased, and fuel consumed in each jurisdiction.

- Fill out the return accurately, ensuring all figures are correct and correspond to the data collected.

- Calculate the total tax due based on the rates applicable in each jurisdiction.

- Review the completed return for accuracy and completeness before submission.

- Submit the form by the designated deadline, either electronically or via mail, as per your state’s requirements.

Key elements of the IFTA Quarterly Fuel Use Tax Return

The IFTA Quarterly Fuel Use Tax Return includes several essential elements that must be reported:

- Jurisdiction: The states or provinces where fuel was purchased and miles were driven.

- Total Miles: The total distance traveled in each jurisdiction during the reporting period.

- Fuel Purchased: The total gallons of fuel purchased in each jurisdiction.

- Fuel Tax Rate: The applicable fuel tax rate for each jurisdiction.

- Total Tax Due: The total amount of tax owed based on the calculations provided.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA Quarterly Fuel Use Tax Return are typically set on a quarterly basis. It is crucial for carriers to be aware of these dates to avoid penalties:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Form Submission Methods

The IFTA Quarterly Fuel Use Tax Return can be submitted using various methods, depending on state regulations:

- Online Submission: Many states offer electronic filing options through their tax websites.

- Mail: Carriers can print the completed form and mail it to the appropriate state agency.

- In-Person: Some jurisdictions allow for in-person submission at designated tax offices.

Penalties for Non-Compliance

Failure to file the IFTA Quarterly Fuel Use Tax Return on time or inaccuracies in reporting can lead to significant penalties. Common consequences include:

- Late filing penalties, which may accrue daily until the return is submitted.

- Interest charges on unpaid taxes.

- Potential audits or increased scrutiny from tax authorities.

Quick guide on how to complete ifta quarterly fuel use tax return ftp zillionforms com

Complete IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents quickly and without delays. Manage IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com effortlessly

- Locate IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers exclusively for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your alterations.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from a device of your choosing. Alter and eSign IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta quarterly fuel use tax return ftp zillionforms com

Create this form in 5 minutes!

How to create an eSignature for the ifta quarterly fuel use tax return ftp zillionforms com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com?

The IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com is a streamlined solution for businesses to file their fuel tax returns efficiently. It simplifies the reporting process, ensuring compliance with IFTA regulations while saving time and reducing errors.

-

How does airSlate SignNow help with the IFTA Quarterly Fuel Use Tax Return?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com. With its intuitive interface, users can quickly fill out forms, gather necessary signatures, and submit their returns without hassle.

-

What are the pricing options for using airSlate SignNow for IFTA returns?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Users can choose from monthly or annual subscriptions, ensuring they have access to the IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com at a cost-effective rate.

-

Are there any integrations available with airSlate SignNow for IFTA tax returns?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the filing process for the IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com. This allows users to import data directly, reducing manual entry and improving accuracy.

-

What features does airSlate SignNow offer for managing IFTA returns?

airSlate SignNow includes features such as document templates, automated reminders, and secure cloud storage, all designed to simplify the management of the IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com. These tools help ensure timely submissions and easy access to important documents.

-

How can airSlate SignNow improve compliance for IFTA tax filings?

By using airSlate SignNow for the IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com, businesses can ensure they meet all regulatory requirements. The platform provides guidance and prompts to help users complete their returns accurately, minimizing the risk of penalties.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any questions regarding the IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com. Support is available through various channels, including chat, email, and phone.

Get more for IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com

Find out other IFTA Quarterly Fuel Use Tax Return Ftp zillionforms com

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form