UC 020 FF UI Tax Wage Listing Continuation 2017

What is the UC 020 FF UI Tax Wage Listing Continuation

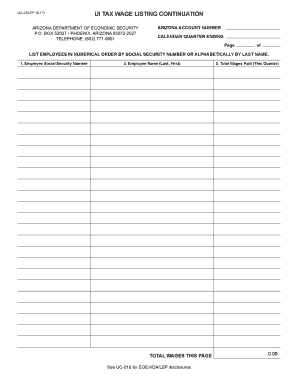

The UC 020 FF UI Tax Wage Listing Continuation is a crucial form used in the United States for reporting wages paid to employees for unemployment compensation purposes. This form is typically required by state unemployment agencies to ensure accurate tracking of wages and contributions to unemployment insurance programs. It serves as a continuation of the wage listing process, allowing employers to provide detailed information about employee earnings over a specified period. Proper completion of this form is essential for compliance with state regulations and for maintaining eligibility for unemployment benefits.

How to use the UC 020 FF UI Tax Wage Listing Continuation

Using the UC 020 FF UI Tax Wage Listing Continuation involves several steps to ensure accurate reporting of wages. Employers must first gather all relevant payroll information, including employee names, Social Security numbers, and the total wages paid during the reporting period. Once this information is compiled, it should be entered into the form accurately. It is important to review the completed form for any errors before submission, as inaccuracies can lead to compliance issues or delays in processing unemployment claims.

Steps to complete the UC 020 FF UI Tax Wage Listing Continuation

Completing the UC 020 FF UI Tax Wage Listing Continuation involves a systematic approach:

- Collect necessary employee data, including names, Social Security numbers, and wage amounts.

- Fill out the form with accurate wage details for each employee.

- Double-check all entries for accuracy to prevent errors.

- Submit the form to the appropriate state unemployment agency by the specified deadline.

Following these steps helps ensure compliance and facilitates the processing of unemployment benefits.

Legal use of the UC 020 FF UI Tax Wage Listing Continuation

The UC 020 FF UI Tax Wage Listing Continuation is legally mandated for employers in the United States. It is used to report wages for unemployment insurance purposes, which is a requirement under state and federal law. Employers must ensure that the information provided is truthful and accurate to avoid potential legal repercussions, including fines or penalties for non-compliance. Adhering to the legal requirements associated with this form is essential for maintaining good standing with state unemployment agencies.

Required Documents

To complete the UC 020 FF UI Tax Wage Listing Continuation, employers must have several documents on hand:

- Payroll records detailing employee wages.

- Employee identification information, such as Social Security numbers.

- Previous UC 020 forms, if applicable, for reference.

Having these documents ready ensures a smooth completion process and helps prevent errors.

Filing Deadlines / Important Dates

Filing deadlines for the UC 020 FF UI Tax Wage Listing Continuation vary by state, but it is generally required to be submitted quarterly. Employers should check with their respective state unemployment agencies for specific deadlines. Missing these deadlines can result in penalties or delays in processing unemployment claims, making it crucial to stay informed about important dates.

Quick guide on how to complete uc 020 ff ui tax wage listing continuation

Complete UC 020 FF UI Tax Wage Listing Continuation effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage UC 020 FF UI Tax Wage Listing Continuation on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to modify and eSign UC 020 FF UI Tax Wage Listing Continuation with ease

- Find UC 020 FF UI Tax Wage Listing Continuation and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or mask sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate producing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign UC 020 FF UI Tax Wage Listing Continuation to guarantee exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uc 020 ff ui tax wage listing continuation

Create this form in 5 minutes!

How to create an eSignature for the uc 020 ff ui tax wage listing continuation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UC 020 FF UI Tax Wage Listing Continuation?

The UC 020 FF UI Tax Wage Listing Continuation is a crucial document for businesses to report employee wages for unemployment insurance purposes. It ensures compliance with state regulations and helps maintain accurate records. Utilizing airSlate SignNow can streamline the process of preparing and submitting this important form.

-

How can airSlate SignNow help with the UC 020 FF UI Tax Wage Listing Continuation?

airSlate SignNow simplifies the process of completing and eSigning the UC 020 FF UI Tax Wage Listing Continuation. Our platform allows users to easily fill out the necessary fields, add signatures, and securely send the document to relevant parties. This efficiency reduces the time spent on paperwork and enhances compliance.

-

Is there a cost associated with using airSlate SignNow for the UC 020 FF UI Tax Wage Listing Continuation?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solutions ensure that you can manage documents like the UC 020 FF UI Tax Wage Listing Continuation without breaking the bank. Explore our pricing options to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing the UC 020 FF UI Tax Wage Listing Continuation?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for forms like the UC 020 FF UI Tax Wage Listing Continuation. These tools enhance productivity and ensure that all necessary steps are completed efficiently. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software for the UC 020 FF UI Tax Wage Listing Continuation?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, allowing you to manage the UC 020 FF UI Tax Wage Listing Continuation alongside your existing tools. This connectivity ensures that your workflow remains uninterrupted and that all data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the UC 020 FF UI Tax Wage Listing Continuation?

Using airSlate SignNow for the UC 020 FF UI Tax Wage Listing Continuation provides numerous benefits, including enhanced efficiency, reduced errors, and improved compliance. Our platform allows for quick document preparation and secure eSigning, which saves time and resources. This ultimately leads to a more streamlined process for your business.

-

Is airSlate SignNow secure for handling the UC 020 FF UI Tax Wage Listing Continuation?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your UC 020 FF UI Tax Wage Listing Continuation and other sensitive documents are protected. We utilize advanced encryption and secure storage solutions to safeguard your data. You can trust that your information is safe with us.

Get more for UC 020 FF UI Tax Wage Listing Continuation

- Unseen passage for class 3 form

- Online registration benazir income support programme form

- Unemployment certificate format by gazetted officer

- Siyaya learnerships 2021 form

- Ksd tvet college online application 2021 form

- Lto dropping process form

- Better conflicts better outcomes better worldcom 565716761 form

- Nmsa form

Find out other UC 020 FF UI Tax Wage Listing Continuation

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy