Declaration for Multi Day Fishing Trip FG935 State of California 2018

What is the Declaration For Multi Day Fishing Trip FG935 State Of California

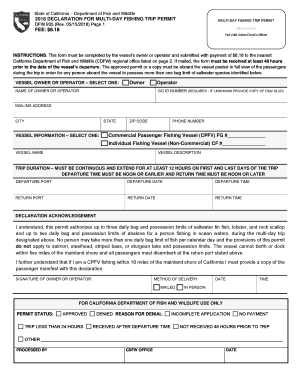

The Declaration For Multi Day Fishing Trip FG935 is a specific form utilized in California for individuals or groups planning to engage in multi-day fishing activities. This document serves as a formal declaration to comply with state regulations governing fishing practices, ensuring that participants are aware of the rules and guidelines set forth by the California Department of Fish and Wildlife. By completing this form, anglers affirm their understanding of the legal requirements and agree to adhere to them during their fishing trip.

Steps to complete the Declaration For Multi Day Fishing Trip FG935 State Of California

Completing the Declaration For Multi Day Fishing Trip FG935 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal details and specifics about the fishing trip. Next, fill out the form with clear and precise information, ensuring that all fields are completed as required. After filling out the form, review it for any errors or omissions. Once verified, sign the document electronically or manually, depending on your preference. Finally, submit the form as instructed, either online or via mail, to the appropriate state agency.

How to use the Declaration For Multi Day Fishing Trip FG935 State Of California

The Declaration For Multi Day Fishing Trip FG935 is used primarily to inform state authorities of your fishing plans and to affirm compliance with relevant regulations. To use the form effectively, ensure that you complete it accurately before your trip. Keep a copy for your records and present it if requested by fishing enforcement officers. Utilizing digital tools for signing and submitting the form can streamline the process, ensuring that your declaration is processed promptly.

Key elements of the Declaration For Multi Day Fishing Trip FG935 State Of California

Several key elements are essential to the Declaration For Multi Day Fishing Trip FG935. These include the name and contact information of the individual or group making the declaration, the dates of the fishing trip, the specific location where fishing will occur, and the type of fish targeted. Additionally, the form may require acknowledgment of understanding and compliance with California fishing regulations, including catch limits and licensing requirements. Each of these elements plays a crucial role in ensuring that the declaration is valid and legally binding.

Legal use of the Declaration For Multi Day Fishing Trip FG935 State Of California

The legal use of the Declaration For Multi Day Fishing Trip FG935 is grounded in California's fishing regulations. By submitting this form, anglers are legally affirming their commitment to follow state laws regarding fishing practices. This includes adherence to rules about fishing seasons, species restrictions, and reporting requirements. Failure to comply with the stipulations outlined in the declaration may result in penalties or legal repercussions, making it vital for users to understand their responsibilities when completing and submitting the form.

State-specific rules for the Declaration For Multi Day Fishing Trip FG935 State Of California

California has specific rules governing the Declaration For Multi Day Fishing Trip FG935 that all users must adhere to. These rules include stipulations about the types of fishing gear allowed, designated fishing areas, and seasonal restrictions. Additionally, the state mandates that all participants must possess the appropriate fishing licenses and permits. Understanding these state-specific rules is essential for ensuring a successful and compliant fishing experience, as they are designed to protect fish populations and promote sustainable fishing practices.

Quick guide on how to complete declaration for multi day fishing trip fg935 state of california

Complete Declaration For Multi Day Fishing Trip FG935 State Of California seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Declaration For Multi Day Fishing Trip FG935 State Of California on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest method to modify and eSign Declaration For Multi Day Fishing Trip FG935 State Of California effortlessly

- Obtain Declaration For Multi Day Fishing Trip FG935 State Of California and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Declaration For Multi Day Fishing Trip FG935 State Of California and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct declaration for multi day fishing trip fg935 state of california

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

Create this form in 5 minutes!

How to create an eSignature for the declaration for multi day fishing trip fg935 state of california

How to generate an electronic signature for the Declaration For Multi Day Fishing Trip Fg935 State Of California online

How to make an eSignature for the Declaration For Multi Day Fishing Trip Fg935 State Of California in Chrome

How to make an electronic signature for putting it on the Declaration For Multi Day Fishing Trip Fg935 State Of California in Gmail

How to create an electronic signature for the Declaration For Multi Day Fishing Trip Fg935 State Of California from your smart phone

How to generate an eSignature for the Declaration For Multi Day Fishing Trip Fg935 State Of California on iOS devices

How to create an electronic signature for the Declaration For Multi Day Fishing Trip Fg935 State Of California on Android devices

People also ask

-

What is the Declaration For Multi Day Fishing Trip FG935 State Of California?

The Declaration For Multi Day Fishing Trip FG935 State Of California is a specialized document required for fishing trips that last multiple days in California. This declaration ensures compliance with state regulations and enhances fishing safety. Utilizing airSlate SignNow, you can easily create and eSign this document within minutes.

-

How do I complete the Declaration For Multi Day Fishing Trip FG935 State Of California?

Completing the Declaration For Multi Day Fishing Trip FG935 State Of California is simple with airSlate SignNow. You can fill out the required information directly on the platform, ensuring all necessary details are included. Once completed, you can eSign the document, making it ready for your fishing adventure in California.

-

What are the benefits of using airSlate SignNow for my Declaration For Multi Day Fishing Trip FG935 State Of California?

Using airSlate SignNow for your Declaration For Multi Day Fishing Trip FG935 State Of California provides several benefits. It streamlines the document signing process, reduces paper waste, and allows for easy storage in the cloud. Moreover, the solution is cost-effective and user-friendly, catering to all levels of tech-savviness.

-

Is there a fee to file the Declaration For Multi Day Fishing Trip FG935 State Of California?

While there may be additional fees associated with the fishing trip itself, using airSlate SignNow simplifies the eSigning of the Declaration For Multi Day Fishing Trip FG935 State Of California at a low subscription cost. This makes it budget-friendly for both occasional and frequent anglers in California.

-

Can I integrate airSlate SignNow with other tools for my Declaration For Multi Day Fishing Trip FG935 State Of California?

Yes, airSlate SignNow offers multiple integrations with popular applications, enhancing the management of your Declaration For Multi Day Fishing Trip FG935 State Of California. You can connect it with platforms like Google Drive, Dropbox, and others for seamless document management. This integration simplifies access to your eSigned documents anytime, anywhere.

-

What information do I need to include in the Declaration For Multi Day Fishing Trip FG935 State Of California?

The Declaration For Multi Day Fishing Trip FG935 State Of California typically requires information such as the dates of the trip, location, type of fishing, and personal identification details. Ensure that all fields are accurately filled when using airSlate SignNow to avoid delays or issues. This helps maintain compliance with state fishing regulations.

-

How does airSlate SignNow ensure the security of my Declaration For Multi Day Fishing Trip FG935 State Of California?

airSlate SignNow prioritizes the security of your documents, including the Declaration For Multi Day Fishing Trip FG935 State Of California. The platform employs robust encryption protocols and secure storage options to keep your sensitive information safe. You can confidently eSign your documents knowing they are protected from unauthorized access.

Get more for Declaration For Multi Day Fishing Trip FG935 State Of California

Find out other Declaration For Multi Day Fishing Trip FG935 State Of California

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement