DECLARATION for MULTI DAY FISHING TRIP PERMIT 2019-2026

What is the declaration for multi day fishing trip permit?

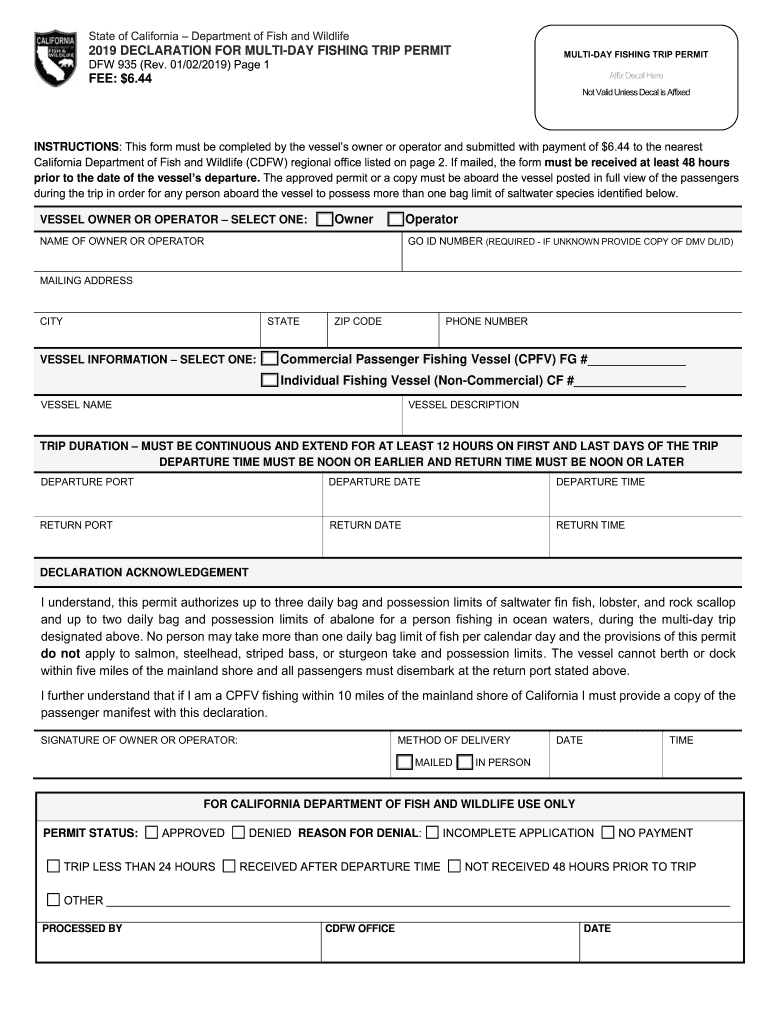

The declaration for multi day fishing trip permit is an official document required for individuals planning to engage in fishing activities over multiple days in California. This permit allows anglers to fish legally during their trip, ensuring compliance with state regulations. It is essential for those who wish to fish in various locations or for an extended period, as it provides the necessary authorization to participate in fishing activities without the need for multiple individual licenses.

How to obtain the declaration for multi day fishing trip permit

Obtaining the declaration for multi day fishing trip permit involves a straightforward process. Anglers can apply online through the California Department of Fish and Wildlife website or visit designated offices. The application typically requires personal information, including name, address, and fishing details. It is important to have a valid California fishing license before applying for this permit, as it serves as a prerequisite for the declaration.

Steps to complete the declaration for multi day fishing trip permit

To complete the declaration for multi day fishing trip permit, follow these steps:

- Gather necessary information, including your fishing license number and personal details.

- Visit the California Department of Fish and Wildlife website or a local office.

- Fill out the application form, ensuring all details are accurate.

- Submit the application online or in person, along with any required fees.

- Receive confirmation of your permit approval, which may be sent via email or postal mail.

Legal use of the declaration for multi day fishing trip permit

The legal use of the declaration for multi day fishing trip permit is crucial for ensuring compliance with California fishing regulations. This permit allows anglers to fish legally during their multi day trips, protecting them from potential fines or legal issues. It is important to carry the permit while fishing and to adhere to all state fishing laws, including size and bag limits, as outlined in the permit documentation.

Key elements of the declaration for multi day fishing trip permit

Key elements of the declaration for multi day fishing trip permit include:

- Personal Information: Name, address, and contact details of the applicant.

- Fishing License Number: A valid California fishing license number is required.

- Trip Details: Dates and locations of the planned fishing activities.

- Signature: A declaration statement affirming compliance with fishing regulations.

State-specific rules for the declaration for multi day fishing trip permit

State-specific rules for the declaration for multi day fishing trip permit can vary. It is essential for applicants to familiarize themselves with California's fishing regulations, including any specific requirements related to the type of fish being targeted, seasonal restrictions, and designated fishing areas. Compliance with these rules ensures a safe and legal fishing experience.

Quick guide on how to complete 2019 declaration for multi day fishing trip permit

Effortlessly Prepare DECLARATION FOR MULTI DAY FISHING TRIP PERMIT on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Handle DECLARATION FOR MULTI DAY FISHING TRIP PERMIT on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign DECLARATION FOR MULTI DAY FISHING TRIP PERMIT with Ease

- Locate DECLARATION FOR MULTI DAY FISHING TRIP PERMIT and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious searches for forms, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign DECLARATION FOR MULTI DAY FISHING TRIP PERMIT and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 declaration for multi day fishing trip permit

FAQs

-

What is the last day to fill out the admission form for undergraduate courses in DU 2019?

I am attaching a PDF Link in which the full information of Admission in DU for the session 2019–20 is given !http://du.ac.in/adm2019/pdf/Bull...For More, kindly visit the DU’s Official website !Home | University of Delhi

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the 2019 declaration for multi day fishing trip permit

How to make an eSignature for your 2019 Declaration For Multi Day Fishing Trip Permit in the online mode

How to create an electronic signature for your 2019 Declaration For Multi Day Fishing Trip Permit in Google Chrome

How to make an electronic signature for signing the 2019 Declaration For Multi Day Fishing Trip Permit in Gmail

How to make an electronic signature for the 2019 Declaration For Multi Day Fishing Trip Permit from your mobile device

How to generate an electronic signature for the 2019 Declaration For Multi Day Fishing Trip Permit on iOS

How to create an eSignature for the 2019 Declaration For Multi Day Fishing Trip Permit on Android OS

People also ask

-

What is a one day fishing license in California?

A one day fishing license in California is a permit that allows anglers to fish in the state's waters for a single day. This license is perfect for those who are visiting California or casual anglers who only plan to fish for a short time. The one day fishing license California is affordable and convenient, allowing you to enjoy California's rich fishing experiences without committing to an annual license.

-

How much does a one day fishing license cost in California?

The cost of a one day fishing license in California varies based on whether you are a resident or non-resident. Typically, residents pay a lower fee compared to non-residents. It's advisable to check the official California Department of Fish and Wildlife website for the most current pricing details on the one day fishing license California.

-

Where can I purchase a one day fishing license in California?

You can purchase a one day fishing license in California through various outlets including sporting goods stores, bait shops, or online via the California Department of Fish and Wildlife website. Online purchases offer a convenient option for obtaining your license quickly. Make sure to have your identification on hand when buying the one day fishing license California.

-

What are the benefits of a one day fishing license in California?

The primary benefit of a one day fishing license in California is the flexibility it offers to anglers who may not fish regularly. It allows you to explore California's diverse fishing locations without the commitment of an annual license. Additionally, you can take advantage of the great fishing spots that California has to offer with just a simple one day fishing license California.

-

Can I fish in all California waters with a one day fishing license?

Yes, a one day fishing license in California generally permits you to fish in most public waters including lakes, rivers, and coastal areas. However, some specific restrictions may apply in certain regions or for special fishing areas. Always verify the regulations for the area where you plan to fish with your one day fishing license California.

-

Are there specific fishing regulations to follow with a one day fishing license in California?

Yes, even with a one day fishing license in California, anglers must adhere to the state's fishing regulations. These include size limits, bag limits, and specific fishing seasons for various fish species. Familiarizing yourself with these rules will ensure a legal and enjoyable fishing experience with your one day fishing license California.

-

Is a one day fishing license in California valid for all types of fishing?

A one day fishing license in California is valid for most types of recreational fishing, including freshwater and saltwater fishing. However, specific permits may be required for certain activities such as lobster fishing or fishing in designated marine protected areas. Make sure to check the requirements based on your intended fishing type before purchasing your one day fishing license California.

Get more for DECLARATION FOR MULTI DAY FISHING TRIP PERMIT

- Annual medical statement of personnel precinct 4 form

- Tax credits overpayment dispute form

- Expression of cell wall related genes in basal and biomed central form

- Imaging centers billing for out of state interpretations can expect form

- State of connecticut firefighter testing consortium ct gov form

- Workplace contract template form

- Workflow contract template form

- Workplace love contract template form

Find out other DECLARATION FOR MULTI DAY FISHING TRIP PERMIT

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now