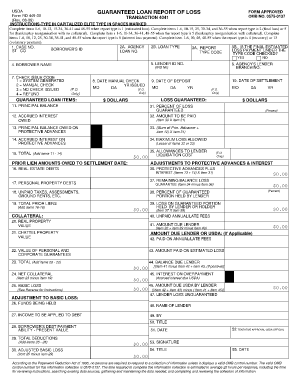

Usda Form Rd 449 30 2009

Understanding the USDA Form RD 449-30

The USDA Form RD 449-30 is an essential document used in the context of rural development programs. This form is primarily utilized to collect information from applicants seeking assistance through various USDA programs. It is crucial for ensuring that applicants meet the necessary eligibility criteria and that their information is accurately represented for processing.

This form helps streamline the application process for loans and grants aimed at improving rural communities. Understanding its purpose and the information it requires is vital for anyone looking to access USDA resources.

Steps to Complete the USDA Form RD 449-30

Completing the USDA Form RD 449-30 involves several key steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather necessary personal and financial information, including income details and asset documentation.

- Carefully read the instructions provided with the form to understand each section's requirements.

- Fill out the form, ensuring all fields are completed accurately. Double-check for any potential errors.

- Attach any required supporting documents, such as proof of income or identification.

- Review the completed form and supporting documents before submission.

Taking these steps can help facilitate a smoother application process and reduce the likelihood of delays.

How to Obtain the USDA Form RD 449-30

The USDA Form RD 449-30 can be obtained through several channels. Applicants can access the form directly from the official USDA website, where it is available for download in a printable format. Additionally, local USDA offices often have physical copies available for those who prefer to fill out the form in person.

It is advisable to ensure that you are using the most current version of the form, as updates may occur that could affect your application process.

Key Elements of the USDA Form RD 449-30

Understanding the key elements of the USDA Form RD 449-30 is essential for successful completion. The form typically includes sections that require:

- Personal identification information, such as name, address, and social security number.

- Financial information, including income sources and amounts.

- Details about the property or project for which assistance is being sought.

- Certification statements that affirm the accuracy of the information provided.

Each of these elements plays a critical role in the assessment of your application and eligibility for USDA programs.

Legal Use of the USDA Form RD 449-30

The USDA Form RD 449-30 is legally binding once submitted, meaning that the information provided must be truthful and accurate. Misrepresentation or failure to disclose relevant information can lead to penalties, including denial of assistance or legal repercussions.

It is important to understand the legal implications of submitting this form, as it is used to determine eligibility for federal assistance programs aimed at supporting rural development.

Form Submission Methods

Submitting the USDA Form RD 449-30 can be done through various methods, depending on the preferences of the applicant and the requirements of the specific program. Common submission methods include:

- Online submission through the USDA's designated portal, if available.

- Mailing the completed form and supporting documents to the appropriate USDA office.

- In-person submission at local USDA offices, where applicants can receive immediate assistance.

Choosing the right submission method can help ensure that your application is processed efficiently.

Quick guide on how to complete usda form rd 449 30

Prepare Usda Form Rd 449 30 effortlessly on any device

Digital document handling has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly and without hindrance. Manage Usda Form Rd 449 30 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign Usda Form Rd 449 30 without any hassle

- Obtain Usda Form Rd 449 30 and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Usda Form Rd 449 30 and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct usda form rd 449 30

Create this form in 5 minutes!

How to create an eSignature for the usda form rd 449 30

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the USDA Form RD 449-30?

The USDA Form RD 449-30 is a document used for various purposes related to rural development loans and grants. It is essential for applicants seeking financial assistance from the USDA. Understanding this form is crucial for ensuring compliance and successful application processing.

-

How can airSlate SignNow help with the USDA Form RD 449-30?

airSlate SignNow provides an efficient platform for completing and eSigning the USDA Form RD 449-30. With its user-friendly interface, you can easily fill out the form, add signatures, and send it securely. This streamlines the process and reduces the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the USDA Form RD 449-30?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value for the features offered, including eSigning and document management for forms like the USDA Form RD 449-30. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the USDA Form RD 449-30?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the USDA Form RD 449-30. These features enhance the efficiency of document handling and ensure that all necessary steps are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other applications for the USDA Form RD 449-30?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the USDA Form RD 449-30. This means you can connect with CRM systems, cloud storage, and other tools to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the USDA Form RD 449-30?

Using airSlate SignNow for the USDA Form RD 449-30 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the signing process, ensuring that your documents are completed quickly and securely, which is vital for timely submissions.

-

Is airSlate SignNow secure for handling the USDA Form RD 449-30?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the USDA Form RD 449-30. The platform employs advanced encryption and security protocols to protect your sensitive information, ensuring that your documents remain confidential and secure.

Get more for Usda Form Rd 449 30

- Admissions northeast state community college acalog acms form

- Employee accommodation request auburn form

- Consortium agreement form asu students arizona state

- They can occur during periods of free time strength development exercises during practices or at plu form

- Financial aidtroy university form

- Attn student service center form

- Graduate certificate in public procurement ampamp contract form

- State of tn accident report form tennessee tech university tntech

Find out other Usda Form Rd 449 30

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe