Form INT 3 Missouri Department of Revenue MO Gov 2020

What is the Form INT 3 Missouri Department Of Revenue MO gov

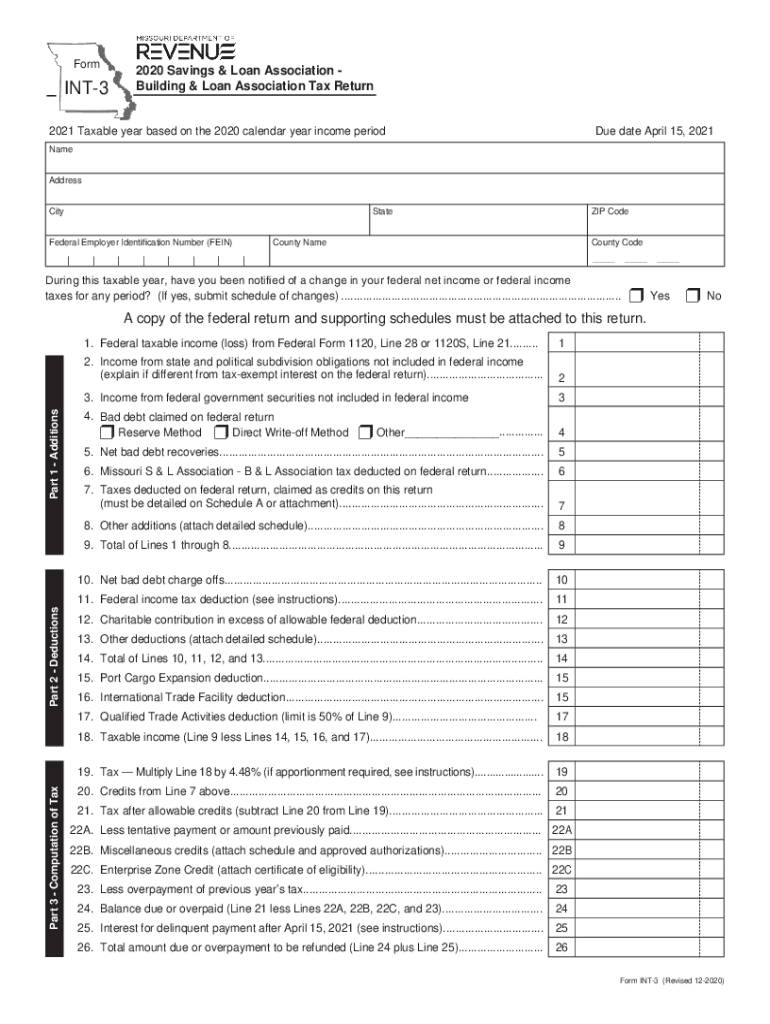

The Form INT 3 is a specific document issued by the Missouri Department of Revenue. It is primarily used for reporting income earned by non-residents and is essential for ensuring compliance with state tax regulations. This form allows individuals and entities who earn income in Missouri but reside elsewhere to accurately report their earnings and pay any necessary taxes. Understanding the purpose of this form is crucial for non-residents to avoid potential penalties and ensure proper tax reporting.

How to use the Form INT 3 Missouri Department Of Revenue MO gov

Using the Form INT 3 involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents that detail your income earned in Missouri. Next, fill out the form with accurate personal information, including your name, address, and Social Security number. Report your Missouri-source income in the designated sections, ensuring that all figures are correct. After completing the form, review it for accuracy before submitting it to the Missouri Department of Revenue by the specified deadline.

Steps to complete the Form INT 3 Missouri Department Of Revenue MO gov

Completing the Form INT 3 requires a systematic approach. Begin by downloading the form from the Missouri Department of Revenue website. Follow these steps:

- Enter your personal information, including your name and address.

- Provide your Social Security number or tax identification number.

- Detail your income earned in Missouri, ensuring to include all necessary figures.

- Calculate any taxes owed based on the provided income.

- Sign and date the form to certify its accuracy.

After completing these steps, submit the form according to the guidelines provided by the Missouri Department of Revenue.

Legal use of the Form INT 3 Missouri Department Of Revenue MO gov

The Form INT 3 is legally required for non-residents earning income in Missouri. Failing to file this form can lead to penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of not submitting this form, as it serves as a formal declaration of income to the state. Proper use of the form ensures compliance with Missouri tax laws and protects taxpayers from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form INT 3 are critical to avoid penalties. Typically, the form must be submitted by the same deadline as the federal tax return, which is usually April 15. However, if you are unable to meet this deadline, it is advisable to check for any extensions that may apply. Staying informed about these important dates ensures timely compliance with state tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Form INT 3 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Some taxpayers may have the option to file electronically through the Missouri Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Taxpayers may also choose to submit the form in person at designated Department of Revenue offices.

Choosing the right submission method can help streamline the filing process and ensure that the form is received on time.

Quick guide on how to complete form int 3 missouri department of revenue mo gov

Effortlessly Prepare Form INT 3 Missouri Department Of Revenue MO gov on Any Device

Managing documents online has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any delays. Handle Form INT 3 Missouri Department Of Revenue MO gov on any device using airSlate SignNow's Android or iOS applications and enhance your document-based workflow today.

How to Edit and Electronically Sign Form INT 3 Missouri Department Of Revenue MO gov with Ease

- Locate Form INT 3 Missouri Department Of Revenue MO gov and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or errors requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of choice. Modify and electronically sign Form INT 3 Missouri Department Of Revenue MO gov to guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form int 3 missouri department of revenue mo gov

Create this form in 5 minutes!

How to create an eSignature for the form int 3 missouri department of revenue mo gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form INT 3 from the Missouri Department of Revenue?

Form INT 3 is a tax form used by the Missouri Department of Revenue for reporting certain income types. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. Using airSlate SignNow can simplify the process of filling out and submitting Form INT 3 Missouri Department Of Revenue MO gov.

-

How can airSlate SignNow help with Form INT 3?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending Form INT 3 Missouri Department Of Revenue MO gov. Our solution streamlines the document management process, allowing users to fill out and submit forms quickly and securely. This can save time and reduce errors in tax reporting.

-

Is there a cost associated with using airSlate SignNow for Form INT 3?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage Form INT 3 Missouri Department Of Revenue MO gov without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as electronic signatures, document templates, and secure cloud storage. These tools make it easier to manage Form INT 3 Missouri Department Of Revenue MO gov and other important documents. Our platform is designed to enhance productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow. You can connect our platform with tools you already use to manage Form INT 3 Missouri Department Of Revenue MO gov efficiently. This integration capability helps streamline your document processes.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form INT 3 Missouri Department Of Revenue MO gov provides numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick electronic signatures and easy document sharing, making tax season less stressful. Additionally, it helps ensure that your forms are completed accurately.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your documents, including Form INT 3 Missouri Department Of Revenue MO gov, are protected. We use advanced encryption and security protocols to safeguard your information, giving you peace of mind when managing sensitive tax documents.

Get more for Form INT 3 Missouri Department Of Revenue MO gov

- North carolina assumed form

- North carolina lighting incentive application form

- North carolina board of pharmacy ncbop homepage form

- Ardrey kell late arrival form

- Appointment policy financial policy insurance eissens dentistry form

- Rules standards and procedureslpc form

- Verification for north carolina education lottery form

- Documents subscription terms and conditionspdf form

Find out other Form INT 3 Missouri Department Of Revenue MO gov

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure