Form INT 3 Savings & Loan Association Building & Loan Association Tax Return 2022

What is the Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

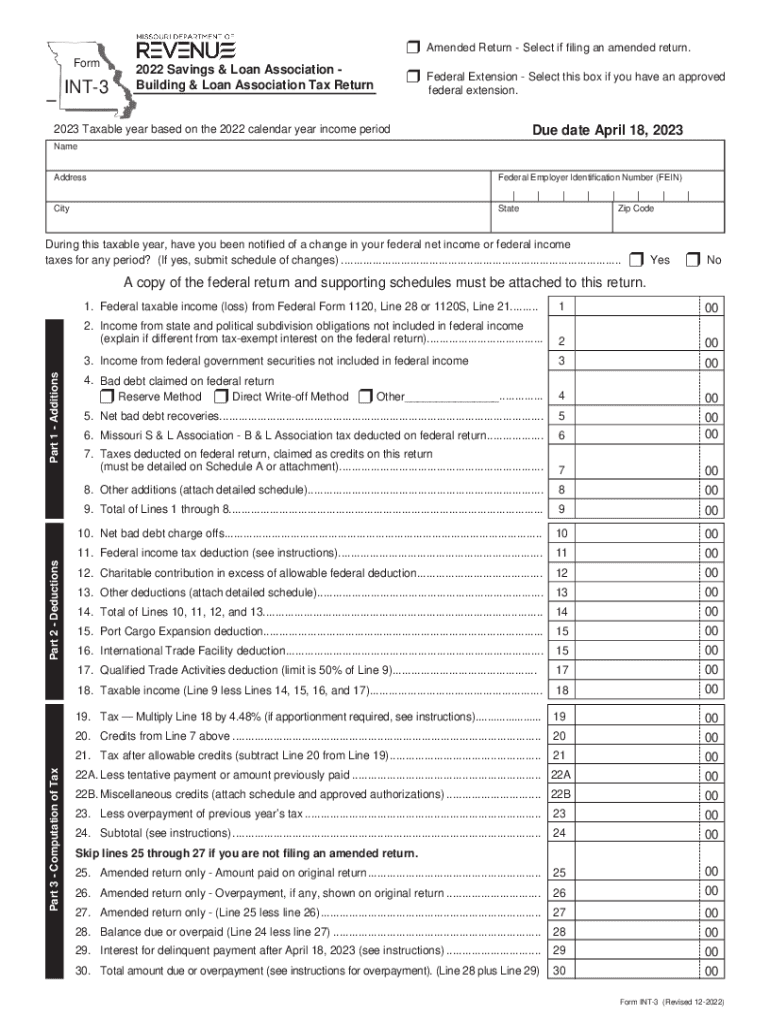

The Form INT 3 is a tax return specifically designed for Savings and Loan Associations (SLAs) and Building and Loan Associations (BLAs) in the United States. This form is used to report the income, deductions, and credits of these financial institutions, ensuring compliance with federal tax regulations. It helps the Internal Revenue Service (IRS) assess the tax obligations of these entities, which play a crucial role in providing financial services, including savings accounts and loans to members.

How to use the Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

To effectively use the Form INT 3, institutions must gather all necessary financial information, including income from loans, interest earned, and operational expenses. The form requires accurate reporting of various financial metrics, which will ultimately determine the tax liability. It is essential to follow the instructions provided with the form carefully, as inaccuracies can lead to penalties or delays in processing.

Steps to complete the Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

Completing the Form INT 3 involves several steps:

- Collect financial records, including income statements and balance sheets.

- Fill out the identification section with the association's name, address, and Employer Identification Number (EIN).

- Report total income, including interest income and fees.

- Detail allowable deductions, such as operating expenses and interest paid on borrowed funds.

- Calculate the taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable tax rate.

- Sign and date the form before submission.

Key elements of the Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

Several key elements are crucial when filling out the Form INT 3:

- Identification Information: This includes the name, address, and EIN of the association.

- Income Reporting: Accurate reporting of all sources of income is essential.

- Deductions: Institutions can claim various deductions, which must be itemized properly.

- Tax Calculation: The form requires a clear calculation of the tax owed based on reported income.

- Signature: An authorized representative must sign the form to validate the submission.

Filing Deadlines / Important Dates

Timely filing of the Form INT 3 is critical to avoid penalties. The usual deadline for submission is the fifteenth day of the third month following the end of the tax year. For institutions operating on a calendar year, this means the form is typically due by March 15. Extensions may be available, but they must be requested in advance and are not automatic.

Form Submission Methods (Online / Mail / In-Person)

The Form INT 3 can be submitted through various methods:

- Online Submission: Some associations may have the option to file electronically through authorized e-filing systems.

- Mail: The completed form can be mailed to the appropriate IRS address, as specified in the instructions.

- In-Person: Associations may also choose to deliver the form directly to an IRS office, although this is less common.

Quick guide on how to complete form int 3 savings ampamp loan association building ampamp loan association tax return

Finalize Form INT 3 Savings & Loan Association Building & Loan Association Tax Return easily on any device

Online document handling has become increasingly favored by businesses and individuals alike. It presents a fantastic eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Form INT 3 Savings & Loan Association Building & Loan Association Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The easiest way to adjust and eSign Form INT 3 Savings & Loan Association Building & Loan Association Tax Return with ease

- Obtain Form INT 3 Savings & Loan Association Building & Loan Association Tax Return and click on Get Form to begin.

- Make use of the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or conceal sensitive data with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Modify and eSign Form INT 3 Savings & Loan Association Building & Loan Association Tax Return and ensure seamless communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form int 3 savings ampamp loan association building ampamp loan association tax return

Create this form in 5 minutes!

How to create an eSignature for the form int 3 savings ampamp loan association building ampamp loan association tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form INT 3 Savings & Loan Association Building & Loan Association Tax Return?

Form INT 3 Savings & Loan Association Building & Loan Association Tax Return is a tax form used by savings and loan associations to report interest income. This form is essential for ensuring compliance with tax regulations and accurately reporting financial information to the IRS.

-

How can airSlate SignNow help with Form INT 3 Savings & Loan Association Building & Loan Association Tax Return?

airSlate SignNow provides an efficient platform for electronically signing and sending Form INT 3 Savings & Loan Association Building & Loan Association Tax Return. Our solution simplifies the document management process, ensuring that your tax returns are completed and submitted on time.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution allows you to manage Form INT 3 Savings & Loan Association Building & Loan Association Tax Return without breaking the bank, with options for monthly or annual subscriptions.

-

What features does airSlate SignNow offer for tax document management?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and document tracking. These tools streamline the process of handling Form INT 3 Savings & Loan Association Building & Loan Association Tax Return, making it easier to manage your tax documents efficiently.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, ensuring that your Form INT 3 Savings & Loan Association Building & Loan Association Tax Return is handled securely and legally. Our platform prioritizes data security and compliance to protect your sensitive information.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing you to easily manage your Form INT 3 Savings & Loan Association Building & Loan Association Tax Return alongside your other financial documents. This integration enhances your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for tax returns?

Using airSlate SignNow for your Form INT 3 Savings & Loan Association Building & Loan Association Tax Return provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus on your business rather than administrative tasks.

Get more for Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

- Certificate of taxes due for business personal property and form

- Hireright criminal history georgia release form

- Registration form rc state ethics commission ethics ga

- Rosa and blanca reading street pdf form

- Dekalb county water application form

- Gwinnett county public schools board district assignments form

- Military out of area extension application form

- Fillable online aua2015 request for internet amp network form

Find out other Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy