& Loan Association Tax Return 2017

What is the & Loan Association Tax Return

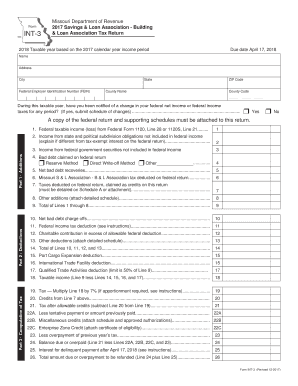

The & Loan Association Tax Return is a specialized tax form used by savings and loan associations to report their income, expenses, and tax obligations to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax laws and regulations specific to financial institutions. It captures vital information about the association's financial activities, including interest income, dividends, and other relevant financial data.

How to use the & Loan Association Tax Return

To use the & Loan Association Tax Return, organizations must first gather all necessary financial records for the tax year. This includes income statements, balance sheets, and any other documentation that supports the reported figures. Once all information is compiled, the form can be filled out, ensuring that all sections are completed accurately. After completing the form, it must be submitted to the IRS by the designated deadline, either electronically or by mail.

Steps to complete the & Loan Association Tax Return

Completing the & Loan Association Tax Return involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the form accurately, ensuring all required sections are completed.

- Double-check all figures for accuracy to prevent errors.

- Submit the completed form to the IRS by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the & Loan Association Tax Return typically align with the federal tax calendar. Generally, the form must be filed by March fifteenth for corporations. However, if the association operates on a fiscal year, the deadline may differ. It is crucial to stay informed about any changes in tax law that may affect these dates.

Required Documents

When preparing the & Loan Association Tax Return, several documents are required to ensure accurate reporting. These include:

- Income statements detailing all sources of income.

- Balance sheets that outline assets, liabilities, and equity.

- Records of any deductions or credits the association may claim.

- Prior year tax returns for reference and consistency.

Penalties for Non-Compliance

Failure to file the & Loan Association Tax Return on time or inaccuracies in the submitted information can result in penalties. The IRS may impose fines based on the duration of the delay and the amount of tax owed. Additionally, non-compliance can lead to increased scrutiny during audits, which may result in further financial implications for the association.

Quick guide on how to complete amp loan association tax return

Prepare & Loan Association Tax Return effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the proper form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without complications. Handle & Loan Association Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest way to modify and electronically sign & Loan Association Tax Return with ease

- Obtain & Loan Association Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign & Loan Association Tax Return and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct amp loan association tax return

Create this form in 5 minutes!

How to create an eSignature for the amp loan association tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the & Loan Association Tax Return?

The & Loan Association Tax Return is crucial for financial institutions as it ensures compliance with tax regulations. It provides a comprehensive overview of the financial activities of loan associations, helping them maintain transparency and accountability. Properly managing this return can also enhance the credibility of your organization.

-

How does airSlate SignNow simplify the & Loan Association Tax Return process?

airSlate SignNow streamlines the & Loan Association Tax Return process by allowing users to easily create, send, and eSign documents. Our platform reduces the time spent on paperwork, enabling you to focus on your core business activities. With user-friendly features, you can manage your tax returns efficiently and securely.

-

What are the pricing options for using airSlate SignNow for & Loan Association Tax Return?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling & Loan Association Tax Returns. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Can airSlate SignNow integrate with accounting software for & Loan Association Tax Return?

Yes, airSlate SignNow seamlessly integrates with various accounting software to facilitate the & Loan Association Tax Return process. This integration allows for easy data transfer and ensures that all financial information is accurately reflected in your tax returns. Streamlining these processes can save you time and reduce errors.

-

What features does airSlate SignNow offer for managing & Loan Association Tax Return documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for & Loan Association Tax Return documents. These tools enhance your workflow, making it easier to manage and monitor the status of your tax returns. Additionally, our platform ensures that all documents are stored securely.

-

How can airSlate SignNow benefit my business in handling & Loan Association Tax Return?

Using airSlate SignNow for your & Loan Association Tax Return can signNowly improve efficiency and reduce administrative burdens. Our platform allows for quick document turnaround and enhances collaboration among team members. This means you can focus more on strategic initiatives rather than getting bogged down by paperwork.

-

Is airSlate SignNow secure for handling sensitive & Loan Association Tax Return information?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your & Loan Association Tax Return information is protected. We utilize advanced encryption and secure storage solutions to safeguard your documents. You can trust that your sensitive data is in safe hands while using our platform.

Get more for & Loan Association Tax Return

Find out other & Loan Association Tax Return

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document