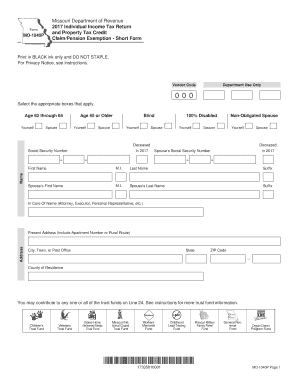

Individual Income Tax Return and Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P 2020

What is the Individual Income Tax Return And Property Tax Credit Claim Pension Exemption Short Form Form MO 1040P

The Individual Income Tax Return And Property Tax Credit Claim Pension Exemption Short Form Form MO 1040P is a specific tax form used by residents of Missouri. This form allows eligible individuals to file their income tax returns while also claiming property tax credits and pension exemptions. It is designed for those who meet certain income thresholds and have specific residency requirements. The form simplifies the process of reporting income and claiming benefits, making it a valuable tool for taxpayers seeking to maximize their tax credits and exemptions.

How to use the Individual Income Tax Return And Property Tax Credit Claim Pension Exemption Short Form Form MO 1040P

Using the MO 1040P involves several straightforward steps. First, gather all necessary financial documents, including income statements and property tax records. Next, download the form from the Missouri Department of Revenue website or obtain a physical copy. Complete the form by filling in your personal information, income details, and any applicable deductions or credits. Ensure that all entries are accurate to avoid delays in processing. Finally, submit the completed form either electronically or via mail, following the provided submission guidelines.

Steps to complete the Individual Income Tax Return And Property Tax Credit Claim Pension Exemption Short Form Form MO 1040P

Completing the MO 1040P involves a series of methodical steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, pensions, and any other earnings.

- Calculate your property tax credit by providing details about your property taxes paid.

- Claim any pension exemptions applicable to your situation, ensuring you meet all eligibility criteria.

- Review the form for accuracy, making sure all calculations are correct and all required fields are completed.

- Sign and date the form before submitting it to the appropriate tax authority.

Eligibility Criteria for the Individual Income Tax Return And Property Tax Credit Claim Pension Exemption Short Form Form MO 1040P

To qualify for using the MO 1040P, taxpayers must meet specific eligibility criteria. Generally, this includes being a resident of Missouri, having a total income below a certain threshold, and owning property for which property taxes have been paid. Additionally, individuals must be able to substantiate their claims for pension exemptions. It is crucial to review the latest guidelines from the Missouri Department of Revenue to ensure compliance with all requirements.

Form Submission Methods for the Individual Income Tax Return And Property Tax Credit Claim Pension Exemption Short Form Form MO 1040P

Taxpayers have several options for submitting the MO 1040P. The form can be filed electronically through approved e-filing systems, which may expedite processing times. Alternatively, individuals can print the completed form and mail it to the designated address provided by the Missouri Department of Revenue. In-person submission may also be available at local tax offices, allowing for direct assistance if needed. Each submission method has its own guidelines and deadlines that should be followed to ensure timely filing.

Key elements of the Individual Income Tax Return And Property Tax Credit Claim Pension Exemption Short Form Form MO 1040P

The MO 1040P includes several key elements that are essential for accurate tax reporting and credit claims. Important sections of the form cover personal identification, income reporting, property tax credit calculations, and pension exemption claims. Additionally, there are instructions for each section, guiding taxpayers through the completion process. Understanding these elements is crucial to ensure that all relevant information is provided and that the form is filled out correctly, ultimately affecting the taxpayer’s financial outcome.

Quick guide on how to complete individual income tax return and property tax credit claimpension exemption short form form mo 1040p

Easily Manage Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P on Any Device

Online document administration has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to Alter and eSign Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P Effortlessly

- Access Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the concern of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and eSign Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax return and property tax credit claimpension exemption short form form mo 1040p

Create this form in 5 minutes!

How to create an eSignature for the individual income tax return and property tax credit claimpension exemption short form form mo 1040p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P?

The Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P is a simplified tax form designed for Missouri residents. It allows eligible taxpayers to claim property tax credits and pension exemptions efficiently. This form streamlines the filing process, making it easier for individuals to manage their tax obligations.

-

How can airSlate SignNow help with the Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P. Our solution ensures that your documents are securely signed and delivered, simplifying the tax filing process. With airSlate SignNow, you can focus on your finances while we handle the paperwork.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to accommodate various needs, including those who need to file the Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs. You can choose a plan that fits your budget and usage requirements.

-

Are there any features specifically for tax document management in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P. You can easily create, edit, and store your tax documents securely. Additionally, our platform allows for collaboration, making it easier to gather necessary signatures and approvals.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your ability to manage the Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P. This integration allows for a smoother workflow, enabling you to import and export documents easily. You can streamline your tax preparation process with our versatile integrations.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing, including the Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P, offers numerous benefits. Our platform ensures secure document handling, reduces the time spent on paperwork, and enhances collaboration. Additionally, you can track the status of your documents in real-time, providing peace of mind during tax season.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive tax documents like the Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P. We utilize advanced encryption and security protocols to protect your data. You can trust that your information is secure while using our platform.

Get more for Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P

Find out other Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form Form MO 1040P

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document