Mo Pts Property Tax Credit Form 2001

What is the MO 1040P Property Tax Credit Form?

The MO 1040P Property Tax Credit Form is a tax document used by residents of Missouri to claim a credit for property taxes paid on their primary residence. This form is specifically designed for individuals who meet certain eligibility criteria, including age, disability status, and income limits. The credit aims to provide financial relief to qualifying taxpayers by reducing their overall tax burden, making home ownership more affordable.

Eligibility Criteria for the MO 1040P Property Tax Credit Form

To qualify for the MO 1040P Property Tax Credit, applicants must meet specific requirements:

- Be a resident of Missouri.

- Own or rent a home that is your primary residence.

- Meet income thresholds set by the state, which may vary each year.

- Be at least 65 years old, or be a person with a disability.

It is essential to review the latest guidelines to ensure eligibility before completing the form.

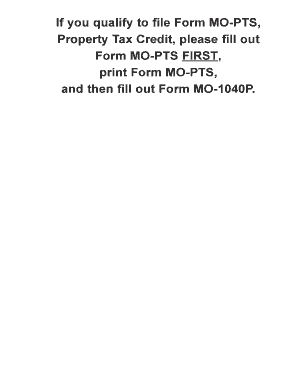

Steps to Complete the MO 1040P Property Tax Credit Form

Filling out the MO 1040P form involves several steps to ensure accuracy and compliance:

- Gather necessary documentation, including proof of property taxes paid and income statements.

- Obtain the MO 1040P form from the Missouri Department of Revenue or authorized sources.

- Fill out the form with accurate personal and property information.

- Calculate the credit amount based on the provided guidelines.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either online or via mail.

Required Documents for the MO 1040P Property Tax Credit Form

When completing the MO 1040P Property Tax Credit Form, certain documents are necessary to support your claim:

- Proof of property taxes paid, such as a receipt or tax statement.

- Income verification documents, including W-2s or 1099 forms.

- Identification, such as a driver's license or Social Security number.

Having these documents ready will help streamline the application process.

Form Submission Methods for the MO 1040P Property Tax Credit Form

Taxpayers have multiple options for submitting the MO 1040P form:

- Online submission through the Missouri Department of Revenue's website.

- Mailing the completed form to the appropriate address provided on the form.

- In-person submission at designated state offices.

Choosing the right method can depend on personal preference and the urgency of the claim.

Key Elements of the MO 1040P Property Tax Credit Form

The MO 1040P form includes several critical sections that applicants must complete:

- Personal information, including name, address, and Social Security number.

- Details about the property, such as the address and assessed value.

- Income information to determine eligibility for the credit.

- Signature and date to certify the accuracy of the information provided.

Each section must be filled out carefully to avoid delays in processing the claim.

Quick guide on how to complete mo pts property tax credit form

Complete Mo Pts Property Tax Credit Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Mo Pts Property Tax Credit Form seamlessly on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to edit and eSign Mo Pts Property Tax Credit Form effortlessly

- Find Mo Pts Property Tax Credit Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Mo Pts Property Tax Credit Form to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo pts property tax credit form

Create this form in 5 minutes!

How to create an eSignature for the mo pts property tax credit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo 1040p property form and why is it important?

The mo 1040p property form is a crucial document for property owners in Missouri, used to report and assess the value of property for tax purposes. Properly completing the mo 1040p property form ensures accurate taxation and compliance with state regulations.

-

How does airSlate SignNow assist with the mo 1040p property form?

airSlate SignNow simplifies the process of signing and sending the mo 1040p property form. Our platform allows you to easily upload, eSign, and send your documents securely, ensuring a smooth experience with your property tax documentation.

-

Are there any costs associated with using airSlate SignNow for the mo 1040p property form?

Using airSlate SignNow for the mo 1040p property form comes with a variety of pricing plans. Our cost-effective solutions cater to different business needs, allowing users to choose a plan that fits their requirements while ensuring they can manage their property documentation effectively.

-

Can I integrate airSlate SignNow with other applications for the mo 1040p property form?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage your mo 1040p property form alongside your other business tools. You can connect with CRM systems, cloud storage services, and more to streamline your document workflow.

-

What are the benefits of using airSlate SignNow for the mo 1040p property form?

Using airSlate SignNow for the mo 1040p property form enables efficient document management, ensuring timely submission and compliance. Our platform provides features like real-time tracking and reminders, preventing delays in your property tax filings.

-

Is airSlate SignNow secure for handling the mo 1040p property form?

Absolutely! airSlate SignNow prioritizes security and compliance, providing bank-level encryption for all documents, including the mo 1040p property form. You can trust our platform to keep your sensitive information safe while you manage your property tax obligations.

-

How can I access support for the mo 1040p property form using airSlate SignNow?

airSlate SignNow offers robust support options, including customer service and an extensive knowledge base. If you have questions regarding the mo 1040p property form, our support team is readily available to assist you with any inquiries or technical issues.

Get more for Mo Pts Property Tax Credit Form

Find out other Mo Pts Property Tax Credit Form

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document