Individual Income Tax Return and Property Tax Credit ClaimPension Exemption Short Form 2020-2026

Understanding the Missouri MO 1040P Form

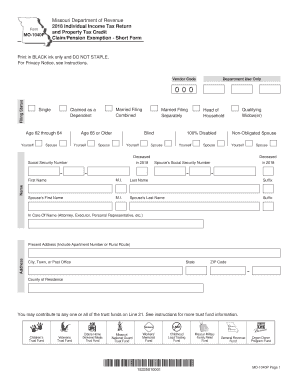

The Missouri MO 1040P form is designed for individuals to file their income tax returns and claim property tax credits. This form is particularly relevant for those seeking to benefit from the pension exemption. It serves as a streamlined method for eligible taxpayers to report their income and claim any applicable credits. The form is essential for ensuring compliance with state tax laws while maximizing potential refunds or credits.

Steps to Complete the Missouri MO 1040P Form

Completing the Missouri MO 1040P form involves several key steps:

- Gather necessary documents, including income statements and property tax receipts.

- Fill out personal information, such as name, address, and Social Security number.

- Report total income, including wages, pensions, and any other sources of income.

- Calculate the property tax credit based on eligibility and applicable exemptions.

- Review the form for accuracy before submission.

Ensuring all information is correct can help avoid delays in processing and potential penalties.

Eligibility Criteria for the Missouri MO 1040P Form

To qualify for the Missouri MO 1040P form, taxpayers must meet specific eligibility requirements. Generally, this form is available for individuals who:

- Are residents of Missouri.

- Are at least sixty-five years old or disabled.

- Have a qualifying income level as defined by state guidelines.

- Own or rent their primary residence in Missouri.

Meeting these criteria is essential for claiming any property tax credits associated with the form.

Required Documents for Filing the Missouri MO 1040P Form

When preparing to file the Missouri MO 1040P form, certain documents are necessary to ensure accurate reporting. These include:

- W-2 forms or 1099s for reporting income.

- Property tax statements to verify taxes paid.

- Documentation of any additional income sources.

- Proof of age or disability if claiming the pension exemption.

Having these documents ready can facilitate a smoother filing process.

Form Submission Methods for the Missouri MO 1040P

The Missouri MO 1040P form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Missouri Department of Revenue's website.

- Mailing the completed form to the appropriate state tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can depend on personal preference and the urgency of processing.

Key Elements of the Missouri MO 1040P Form

Understanding the key elements of the Missouri MO 1040P form is crucial for accurate completion. Important components include:

- Personal identification information.

- Income reporting sections.

- Property tax credit calculation fields.

- Signature and date lines for verification.

Each section plays a vital role in ensuring the form is filled out correctly and complies with state regulations.

Quick guide on how to complete individual income tax return and property tax credit claimpension exemption short form

Fulfill Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to edit and electronically sign Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form with ease

- Find Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form and click on Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools designed by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to store your changes.

- Decide how you'd like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs with just a few clicks from any preferred device. Modify and electronically sign Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax return and property tax credit claimpension exemption short form

Create this form in 5 minutes!

How to create an eSignature for the individual income tax return and property tax credit claimpension exemption short form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri MO 1040P form?

The Missouri MO 1040P form is a tax return document used by residents of Missouri to report their income and calculate their state tax liability. It is essential for ensuring compliance with state tax laws and can be easily managed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with the Missouri MO 1040P form?

airSlate SignNow simplifies the process of completing and submitting the Missouri MO 1040P form by allowing users to eSign documents securely and efficiently. Our platform ensures that your tax documents are handled with the utmost care and compliance.

-

Is there a cost associated with using airSlate SignNow for the Missouri MO 1040P?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions provide excellent value for managing documents like the Missouri MO 1040P, ensuring you can eSign and send documents without breaking the bank.

-

What features does airSlate SignNow offer for the Missouri MO 1040P?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the Missouri MO 1040P form. These tools enhance efficiency and ensure that your tax documents are processed smoothly.

-

Can I integrate airSlate SignNow with other software for the Missouri MO 1040P?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your Missouri MO 1040P form alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax documents like the Missouri MO 1040P?

Using airSlate SignNow for your Missouri MO 1040P offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season.

-

How secure is airSlate SignNow when handling the Missouri MO 1040P?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your Missouri MO 1040P and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

Get more for Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form

- Authorization form to release confidential information

- Release of information early childhood development maryland

- Student records review and update verification certification form

- Apprenticeship programs florida department of education form

- Partner agency referral tips form

- North carolina dietetic association ncdamemberclicksnet ncda memberclicks form

- Sampson county concealed carry permit form

- Dma 5167pdf county analysis non compliance with processing thresholds or thresholds for denials withdrawals inquires form

Find out other Individual Income Tax Return And Property Tax Credit ClaimPension Exemption Short Form

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later