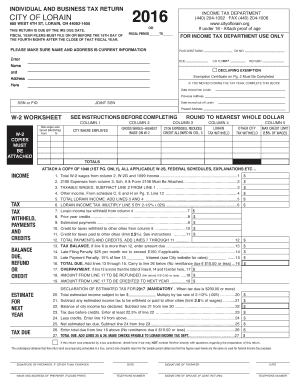

INDIVIDUAL and BUSINESS TAX RETURN 2022

Quick guide on how to complete individual and business tax return

Prepare INDIVIDUAL AND BUSINESS TAX RETURN effortlessly on any gadget

Web-based document administration has become increasingly favored by enterprises and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without interruptions. Manage INDIVIDUAL AND BUSINESS TAX RETURN on any device using airSlate SignNow applications for Android or iOS, and enhance any document-centric procedure today.

How to modify and eSign INDIVIDUAL AND BUSINESS TAX RETURN with ease

- Locate INDIVIDUAL AND BUSINESS TAX RETURN and click Get Form to begin.

- Take advantage of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to preserve your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your choice. Edit and eSign INDIVIDUAL AND BUSINESS TAX RETURN while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual and business tax return

Create this form in 5 minutes!

How to create an eSignature for the individual and business tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W-2 form and why is it important?

A W-2 form is a tax document that employers must provide to their employees, detailing annual wages and the taxes withheld. It is essential for employees to accurately file their income tax returns. Understanding the W-2 form is crucial for both employers and employees to ensure compliance with tax regulations.

-

How can airSlate SignNow help with W-2 forms?

airSlate SignNow simplifies the process of sending and eSigning W-2 forms. With our platform, businesses can easily create, send, and manage W-2 forms electronically, ensuring a faster and more efficient workflow. This not only saves time but also enhances security and compliance.

-

Is there a cost associated with using airSlate SignNow for W-2 forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution allows you to manage W-2 forms and other documents without breaking the bank. You can choose a plan that fits your budget while enjoying all the essential features.

-

What features does airSlate SignNow offer for managing W-2 forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows specifically for W-2 forms. These tools help streamline the document management process, making it easier for businesses to handle their tax documents efficiently. Additionally, our platform ensures compliance with legal standards.

-

Can I integrate airSlate SignNow with other software for W-2 forms?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and HR software, making it easy to manage W-2 forms alongside your existing systems. This integration capability enhances your workflow and ensures that all your documents are in sync.

-

How secure is airSlate SignNow when handling W-2 forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect sensitive information on W-2 forms. Our platform complies with industry standards to ensure that your documents are safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for W-2 forms?

Using airSlate SignNow for W-2 forms offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform allows for quick eSigning and easy tracking of document status, which can signNowly streamline your tax preparation process. This ultimately leads to a more organized and productive workplace.

Get more for INDIVIDUAL AND BUSINESS TAX RETURN

- Verizon assumption of liability form

- Residential rebate program new york state electric ampampamp gas form

- Wedding coordinators information sheet

- Application for crisc certification isaca isaca form

- Nit 391 ninl erp tenderdocenterprise resource planning form

- Utv bill of sale form

- Tnbainc form

- Do the math order form scholastic

Find out other INDIVIDUAL AND BUSINESS TAX RETURN

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy