Lorain City Tax Forms 2011

What is the Lorain City Tax Forms

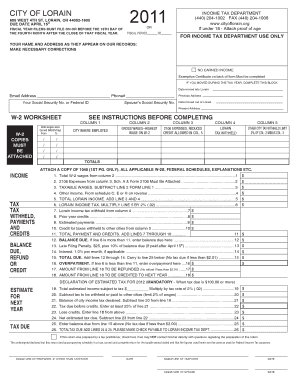

The Lorain City Tax Forms are official documents required for filing income taxes within the city of Lorain, Ohio. These forms are essential for residents and businesses to report their earnings and calculate the taxes owed to the city. The forms include various types, such as the Lorain City income tax form, which is specifically designed for individual taxpayers, and other variants that cater to different business entities. Understanding these forms is crucial for compliance with local tax regulations.

How to use the Lorain City Tax Forms

Using the Lorain City Tax Forms involves several steps to ensure accurate completion and submission. First, identify the correct form based on your tax situation, whether you are an individual or a business entity. Next, gather all necessary financial documents, such as W-2s or 1099s, to provide accurate information. Fill out the form carefully, ensuring that all sections are completed. Once the form is filled, it can be submitted online, by mail, or in person at the Lorain tax office, depending on your preference.

Steps to complete the Lorain City Tax Forms

Completing the Lorain City Tax Forms requires attention to detail. Follow these steps:

- Download the appropriate form from the city of Lorain's official website.

- Review the instructions provided with the form to understand the requirements.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income accurately, using supporting documents as needed.

- Calculate any deductions or credits you may qualify for.

- Sign and date the form to certify its accuracy.

Legal use of the Lorain City Tax Forms

The legal use of the Lorain City Tax Forms is governed by local tax laws and regulations. These forms must be completed accurately to ensure compliance with the city’s tax requirements. Digital submissions are legally valid, provided they meet the standards set by the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant legislation. Using a reliable eSignature platform can enhance the legal standing of your submitted forms.

Filing Deadlines / Important Dates

Filing deadlines for the Lorain City Tax Forms are crucial to avoid penalties. Typically, the deadline for individual taxpayers is April 15, aligning with federal tax deadlines. Businesses may have different deadlines based on their fiscal year. It is important to check the city of Lorain's official announcements for any changes or extensions to these deadlines, especially in light of special circumstances that may arise.

Required Documents

To complete the Lorain City Tax Forms, certain documents are necessary. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation for deductions, such as receipts or statements.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete lorain city tax forms

Prepare Lorain City Tax Forms with ease on any device

Online document administration has become increasingly popular with businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Lorain City Tax Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to alter and eSign Lorain City Tax Forms effortlessly

- Locate Lorain City Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal significance as a traditional ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method for sharing your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Lorain City Tax Forms and guarantee excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lorain city tax forms

Create this form in 5 minutes!

How to create an eSignature for the lorain city tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Lorain city tax forms and why are they important?

Lorain city tax forms are official documents required for filing taxes within Lorain, Ohio. They are essential for ensuring compliance with local tax laws and regulations, allowing residents and businesses to report their income accurately and secure potential rebates or credits.

-

How can airSlate SignNow help with Lorain city tax forms?

airSlate SignNow streamlines the process of handling Lorain city tax forms by allowing you to easily send, sign, and store these documents electronically. With its user-friendly interface, you can ensure that all necessary signatures are collected efficiently, reducing the time spent on manual paperwork.

-

What features does airSlate SignNow offer for managing Lorain city tax forms?

airSlate SignNow includes features like customizable templates, cloud storage, and real-time tracking of document status, making it ideal for managing Lorain city tax forms. These features simplify the organization and retrieval of your tax-related documents, ensuring you never misplace important paperwork.

-

Is there a cost associated with using airSlate SignNow for Lorain city tax forms?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for all users. Pricing plans are available to suit different needs, making it an affordable solution for individuals and businesses needing to handle Lorain city tax forms efficiently.

-

Can I integrate airSlate SignNow with other applications for managing Lorain city tax forms?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage Lorain city tax forms alongside your other business applications, ensuring a smooth workflow.

-

What benefits does airSlate SignNow provide when handling Lorain city tax forms?

By using airSlate SignNow for Lorain city tax forms, you benefit from reduced processing time, improved accuracy, and enhanced security for sensitive tax information. Additionally, electronic signatures save you the hassle of printing, signing, and scanning documents, allowing for a more environmentally friendly approach.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital forms?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even to those unfamiliar with digital forms. Comprehensive tutorials and customer support are available to assist users in navigating the platform for managing Lorain city tax forms effortlessly.

Get more for Lorain City Tax Forms

Find out other Lorain City Tax Forms

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template