Brass Payroll Deduction Form Fill Online, Printable, Fillable

What is the Brass Payroll Deduction Form?

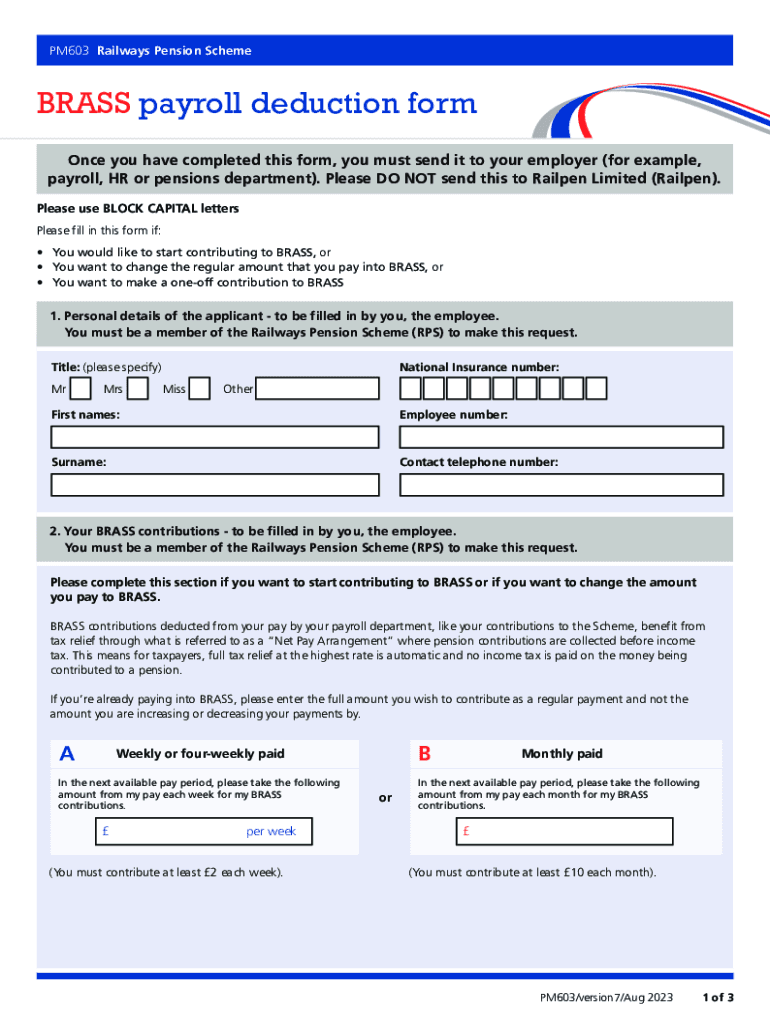

The Brass Payroll Deduction Form is a document used by employers to authorize payroll deductions for various purposes, such as benefits, retirement contributions, or charitable donations. This form ensures that employees can manage their deductions in a clear and organized manner. By filling out this form, employees provide consent for specific amounts to be deducted from their paychecks, thereby simplifying the payroll process for both employees and employers.

How to Obtain the Brass Payroll Deduction Form

To obtain the Brass Payroll Deduction Form, employees can typically request it from their human resources department or payroll administrator. Many companies also provide the form on their internal websites or employee portals. If the form is not readily available, employees may need to reach out directly to HR or payroll for assistance. Additionally, some online resources may offer downloadable versions of the form for convenience.

Steps to Complete the Brass Payroll Deduction Form

Completing the Brass Payroll Deduction Form involves a few straightforward steps:

- Begin by entering your personal information, including your name, employee ID, and department.

- Specify the type of deduction you are authorizing, such as health insurance or retirement savings.

- Indicate the amount or percentage to be deducted from each paycheck.

- Review the terms and conditions associated with the deductions.

- Sign and date the form to confirm your authorization.

Once completed, submit the form to your HR or payroll department for processing.

Key Elements of the Brass Payroll Deduction Form

Understanding the key elements of the Brass Payroll Deduction Form is essential for accurate completion. Important components include:

- Employee Information: Personal details of the employee, including name and identification number.

- Deduction Type: The specific deductions being authorized, such as health benefits or retirement plans.

- Deduction Amount: The exact dollar amount or percentage to be deducted from each paycheck.

- Authorization Signature: The employee's signature confirming consent for the deductions.

- Date: The date on which the form is signed, which is important for record-keeping.

Legal Use of the Brass Payroll Deduction Form

The Brass Payroll Deduction Form is legally binding once signed by the employee. It serves as proof of consent for the employer to deduct specified amounts from the employee's pay. Employers must ensure compliance with federal and state labor laws when implementing payroll deductions. This includes providing employees with clear information regarding the deductions and ensuring that they are not taking place without proper authorization.

Examples of Using the Brass Payroll Deduction Form

There are several scenarios in which the Brass Payroll Deduction Form is commonly used:

- Employees may use the form to authorize deductions for health insurance premiums.

- It can be utilized for retirement plan contributions, such as 401(k) or pension plans.

- Charitable contributions can also be set up through payroll deductions using this form.

- Some employees may authorize deductions for union dues or other membership fees.

These examples illustrate the versatility of the Brass Payroll Deduction Form in managing various payroll-related deductions.

Quick guide on how to complete brass payroll deduction form fill online printable fillable

Streamline Brass Payroll Deduction Form Fill Online, Printable, Fillable effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to craft, modify, and electronically sign your documents swiftly without delays. Manage Brass Payroll Deduction Form Fill Online, Printable, Fillable on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and electronically sign Brass Payroll Deduction Form Fill Online, Printable, Fillable with ease

- Obtain Brass Payroll Deduction Form Fill Online, Printable, Fillable and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure private information with tools that airSlate SignNow provides specifically for that aim.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, such as email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Revise and electronically sign Brass Payroll Deduction Form Fill Online, Printable, Fillable while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the brass payroll deduction form fill online printable fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a brass payroll deduction form?

A brass payroll deduction form is a document used by employers to authorize payroll deductions for various purposes, such as benefits or contributions. This form ensures that employees understand and agree to the deductions from their paychecks. Using airSlate SignNow, you can easily create and manage these forms digitally.

-

How can airSlate SignNow help with brass payroll deduction forms?

airSlate SignNow streamlines the process of creating, sending, and signing brass payroll deduction forms. Our platform allows you to customize forms, track their status, and ensure compliance with legal requirements. This efficiency saves time and reduces paperwork for your HR department.

-

Is there a cost associated with using airSlate SignNow for brass payroll deduction forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost depends on the features you choose, such as the number of users and the level of customization for your brass payroll deduction forms. We provide a cost-effective solution that can fit any budget.

-

What features does airSlate SignNow offer for managing brass payroll deduction forms?

airSlate SignNow provides features like customizable templates, electronic signatures, and real-time tracking for brass payroll deduction forms. Additionally, you can integrate with other software tools to enhance your workflow. These features make it easy to manage payroll deductions efficiently.

-

Can I integrate airSlate SignNow with other payroll systems for brass payroll deduction forms?

Absolutely! airSlate SignNow offers integrations with various payroll systems, allowing you to seamlessly manage brass payroll deduction forms. This integration ensures that all deductions are accurately reflected in your payroll processing, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for brass payroll deduction forms?

Using airSlate SignNow for brass payroll deduction forms provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. The digital platform allows for quick access and easy modifications, ensuring that your payroll processes run smoothly. Additionally, it enhances employee satisfaction by simplifying the signing process.

-

How secure is airSlate SignNow when handling brass payroll deduction forms?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your brass payroll deduction forms and sensitive employee information. You can trust that your data is safe and compliant with industry standards.

Get more for Brass Payroll Deduction Form Fill Online, Printable, Fillable

- Jv 682 findings and orders after hearing to modify delinquency jurisdiction to transition jurisdiction for child younger than form

- Welfare and institutions code 690 form

- S lo para informaci n no entregue a la corte california courts courts ca

- Instrucciones orden de rest tuci n y resumen del courts ca form

- Jv 732 jv 732 commitment to the california department of corrections and rehabilitation division of juvenile justice judicial form

- Who is httpswwwazdorgovfile4287 form

- Questionnaire civil form

- Mc 002 juror questionnaire for criminal casescapital case supplement judicial council forms courts ca

Find out other Brass Payroll Deduction Form Fill Online, Printable, Fillable

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document