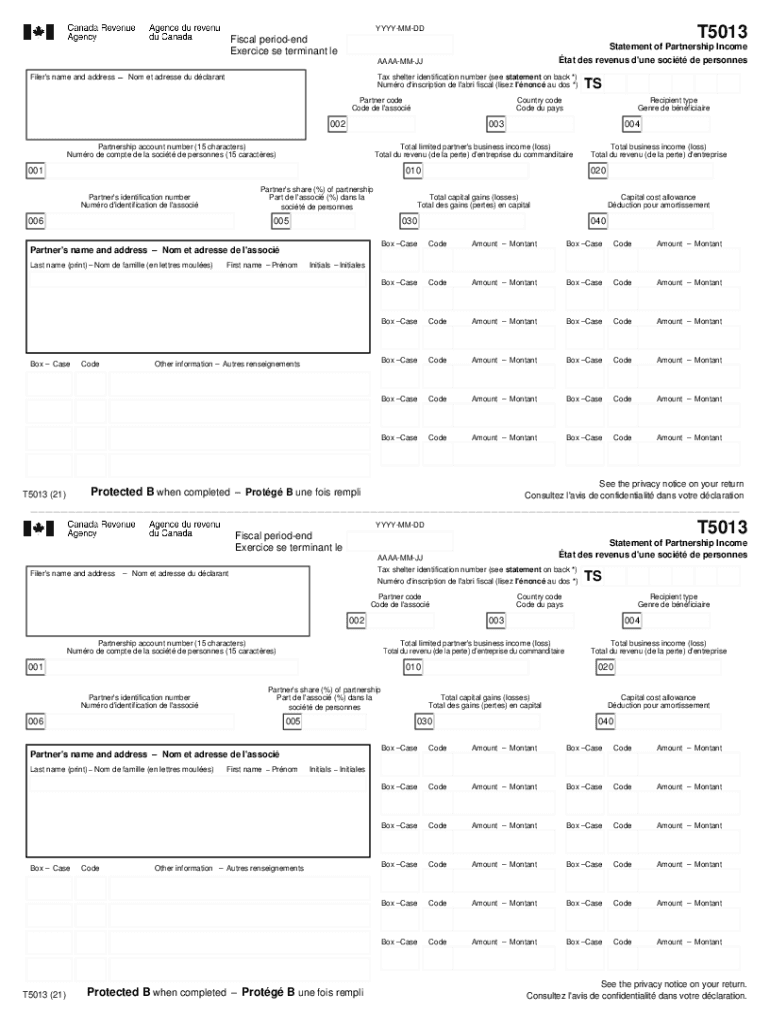

Fiscal Period End Form

Understanding the Fiscal Period End

The fiscal period end is a crucial date for businesses and partnerships, marking the conclusion of a financial reporting period. This date is significant as it determines when financial statements are prepared and when various tax obligations, including the T5013 form, are fulfilled. The fiscal period can vary depending on the entity's structure and accounting practices, typically aligning with the end of a quarter or a fiscal year.

Steps to Complete the Fiscal Period End

Completing the fiscal period end involves several key steps to ensure accurate reporting and compliance. First, gather all financial records, including income statements, balance sheets, and any relevant documentation. Next, reconcile accounts to confirm that all transactions are accurately recorded. After reconciliation, prepare the necessary financial statements, ensuring they reflect the entity's financial position as of the fiscal period end. Finally, review the statements for accuracy before submission, especially if they will be used for tax filings.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the T5013 form and the fiscal period end. Generally, the T5013 must be filed by March 31 of the year following the fiscal period end for partnerships. However, specific deadlines may vary based on the entity's structure and any applicable state regulations. Keeping a calendar of these dates can help ensure compliance and avoid penalties.

Required Documents for the Fiscal Period End

To complete the fiscal period end and file the T5013 form, several documents are necessary. These typically include financial statements, bank statements, and any supporting documentation related to income and expenses. Additionally, partnerships may need to provide information about each partner's share of income or losses, which is essential for accurate reporting on the T5013 statement partnership income.

IRS Guidelines for the T5013 Form

The Internal Revenue Service (IRS) provides specific guidelines regarding the T5013 form and its requirements. Partnerships must ensure they follow these guidelines to avoid errors that could lead to penalties. This includes understanding how to report income, deductions, and credits accurately. Familiarity with IRS publications related to partnership taxation can aid in compliance and help clarify any complex aspects of the filing process.

Penalties for Non-Compliance

Failing to file the T5013 form or inaccuracies in reporting can result in significant penalties. The IRS imposes fines for late submissions, which can accumulate over time. Additionally, incorrect information may lead to audits or further scrutiny from tax authorities. It is vital for partnerships to adhere to filing requirements and deadlines to mitigate these risks and maintain good standing with the IRS.

Quick guide on how to complete fiscal period end

Complete Fiscal Period end effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the features required to create, modify, and eSign your documents promptly without any delays. Handle Fiscal Period end on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Fiscal Period end effortlessly

- Locate Fiscal Period end and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important segments of your documents or redact sensitive information with the tools that airSlate SignNow specifically supplies for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, frustrating form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Fiscal Period end and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fiscal period end

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a T5013 form?

The T5013 form is a tax document used in Canada for reporting income from partnerships. It provides details about the income earned by the partnership and the share of that income allocated to each partner. Understanding the T5013 form is essential for accurate tax reporting.

-

How can airSlate SignNow help with T5013 forms?

airSlate SignNow simplifies the process of sending and eSigning T5013 forms. With our platform, you can easily create, send, and track these documents, ensuring that all partners receive their copies promptly. This streamlines the tax reporting process for partnerships.

-

Is there a cost associated with using airSlate SignNow for T5013 forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, allowing you to manage T5013 forms and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing T5013 forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for T5013 forms. These tools help ensure that your documents are completed accurately and efficiently. Additionally, our platform offers integrations with popular applications to enhance your workflow.

-

Can I integrate airSlate SignNow with other software for T5013 forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage T5013 forms alongside your existing tools. This integration enhances productivity and ensures that your document management process is streamlined and efficient.

-

What are the benefits of using airSlate SignNow for T5013 forms?

Using airSlate SignNow for T5013 forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and easy document sharing, which can save time during tax season. Additionally, you can ensure compliance with tax regulations effortlessly.

-

How secure is airSlate SignNow when handling T5013 forms?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your T5013 forms and sensitive information. You can trust that your documents are safe and secure while using our platform.

Get more for Fiscal Period end

- Garagemans affirmation and bill of sale garagemans affirmation form

- Of a vehicle or watercraft to or from a motor vehicle or watercraft dealer licensed by chapters 45171547 form

- Itd 3367 2018 2019 form

- Vehicle additions or deletions subject to kentucky form

- Sp66 ampamp sp66a personalized plate appilcation ampamp info sheet form

- Sfn 18609 2018 2019 form

- Temporary restricted license request nd dot ndgov form

- M 938 2 19 form

Find out other Fiscal Period end

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free