Ontario Senior Homeowners' Property Tax Grant on BEN Form

Understanding the Ontario Senior Homeowners' Property Tax Grant

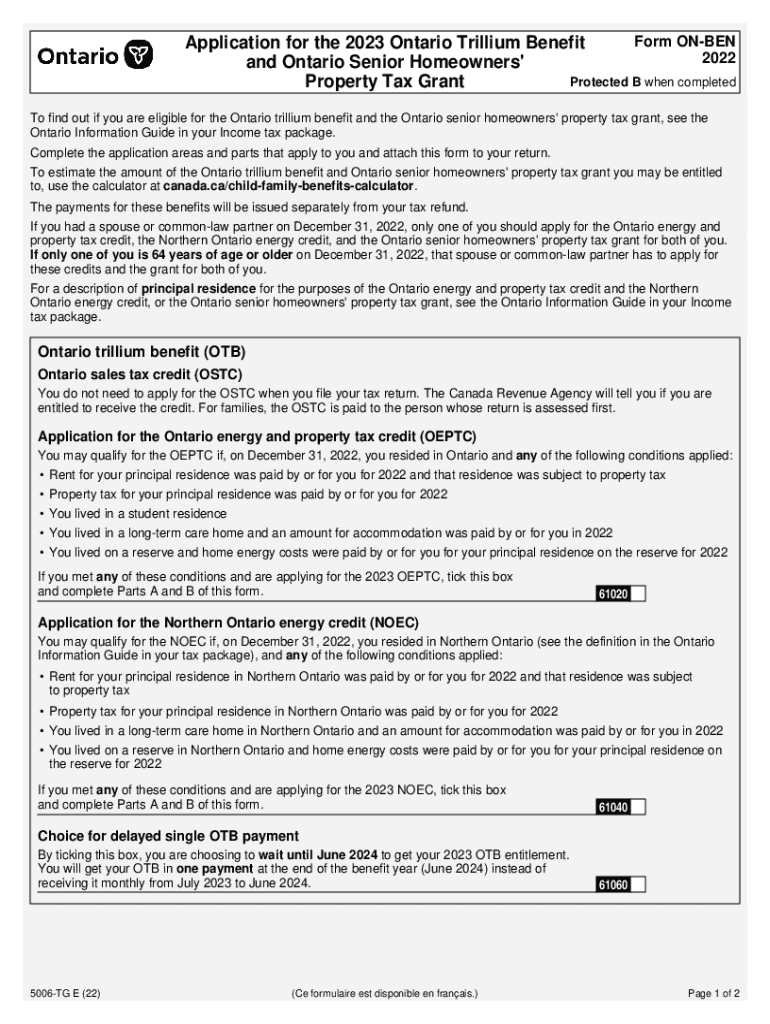

The Ontario Senior Homeowners' Property Tax Grant (ON BEN) is a financial assistance program designed to help senior homeowners in Ontario manage their property tax expenses. This grant aims to alleviate the financial burden of property taxes for eligible seniors, ensuring they can maintain their homes without excessive financial strain. The program is particularly beneficial for those on fixed incomes, providing a crucial source of support to help them stay in their residences.

Eligibility Criteria for the Grant

To qualify for the Ontario Senior Homeowners' Property Tax Grant, applicants must meet specific criteria. Generally, applicants must be at least sixty-five years old, own their home, and reside in Ontario. Additionally, the property must be their principal residence, and they must have paid property taxes in the year for which they are applying for the grant. Income thresholds may also apply, ensuring that the grant assists those who need it most.

Application Process for the Grant

Applying for the Ontario Senior Homeowners' Property Tax Grant involves a straightforward process. Eligible seniors can obtain the application form from the provincial government’s website or local municipal offices. The completed form must include all required documentation, such as proof of age and property tax receipts. Once submitted, the application will be reviewed, and eligible applicants will receive their grant directly through their property tax account.

Steps to Complete the Application

Completing the application for the Ontario Senior Homeowners' Property Tax Grant involves several key steps:

- Gather necessary documents, including proof of age and property tax bills.

- Obtain the application form from the official website or local government office.

- Fill out the application form accurately, ensuring all required information is included.

- Submit the application via mail or in person at the designated local office.

- Await confirmation of grant approval, which will be communicated through official channels.

Important Dates and Filing Deadlines

It is essential for applicants to be aware of important dates related to the Ontario Senior Homeowners' Property Tax Grant. Applications are typically accepted annually, with specific deadlines set by the provincial government. These deadlines ensure that seniors receive their grants in a timely manner, allowing them to benefit from the financial support when they need it most. Keeping track of these dates can help prevent missed opportunities for assistance.

Required Documents for Application

When applying for the Ontario Senior Homeowners' Property Tax Grant, several documents are required to verify eligibility. Applicants must provide:

- Proof of age, such as a birth certificate or government-issued ID.

- Property tax receipts for the year of application.

- Any additional documentation requested by the provincial government to confirm eligibility.

Legal Use of the Grant

The Ontario Senior Homeowners' Property Tax Grant is intended solely for helping eligible seniors manage their property tax obligations. It is essential for recipients to use the funds as intended, ensuring compliance with the regulations set forth by the provincial government. Misuse of the grant can lead to penalties or disqualification from future assistance programs.

Quick guide on how to complete ontario senior homeowners property tax grant on ben

Complete Ontario Senior Homeowners' Property Tax Grant ON BEN effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Ontario Senior Homeowners' Property Tax Grant ON BEN on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Ontario Senior Homeowners' Property Tax Grant ON BEN with minimal effort

- Obtain Ontario Senior Homeowners' Property Tax Grant ON BEN and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ontario Senior Homeowners' Property Tax Grant ON BEN to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ontario senior homeowners property tax grant on ben

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the trillium benefit of using airSlate SignNow?

The trillium benefit of using airSlate SignNow lies in its ability to streamline document management and eSigning processes. By simplifying workflows, businesses can save time and reduce errors, ultimately enhancing productivity. This cost-effective solution ensures that your team can focus on what matters most while maintaining compliance.

-

How does airSlate SignNow's pricing structure reflect the trillium benefit?

airSlate SignNow offers a competitive pricing structure that highlights the trillium benefit of affordability without compromising on features. With various plans available, businesses can choose the option that best fits their needs and budget. This ensures that even small businesses can access powerful eSigning capabilities.

-

What features contribute to the trillium benefit of airSlate SignNow?

Key features that contribute to the trillium benefit of airSlate SignNow include customizable templates, real-time tracking, and secure cloud storage. These features enhance user experience and ensure that documents are managed efficiently. By leveraging these tools, businesses can optimize their document workflows.

-

Can airSlate SignNow integrate with other software to enhance the trillium benefit?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing the trillium benefit of your existing tools. Whether you use CRM systems, project management tools, or cloud storage solutions, airSlate SignNow can connect with them to create a unified workflow. This integration capability maximizes efficiency and productivity.

-

What are the security measures that support the trillium benefit of airSlate SignNow?

The trillium benefit of airSlate SignNow is further supported by robust security measures, including encryption and compliance with industry standards. This ensures that your documents are protected throughout the signing process. Businesses can trust that sensitive information remains confidential and secure.

-

How does airSlate SignNow improve collaboration, reflecting the trillium benefit?

airSlate SignNow improves collaboration by allowing multiple users to access and sign documents simultaneously, showcasing the trillium benefit of teamwork. This feature is particularly useful for remote teams and organizations with diverse stakeholders. Enhanced collaboration leads to faster decision-making and project completion.

-

What customer support options are available to maximize the trillium benefit?

To maximize the trillium benefit, airSlate SignNow provides various customer support options, including live chat, email support, and extensive online resources. This ensures that users can get assistance whenever they need it, enhancing their overall experience. Reliable support contributes to smoother operations and user satisfaction.

Get more for Ontario Senior Homeowners' Property Tax Grant ON BEN

- Phlebotomy examination form

- Aflac initial disability claim form s00224 2009

- Fmla paperwork 2020 form

- Full surrender request form for north american company for life and health insurance

- Depression symptoms form

- Humana forms for providers pdf

- Printable substance abuse worksheets form

- Excess flood application form

Find out other Ontario Senior Homeowners' Property Tax Grant ON BEN

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed