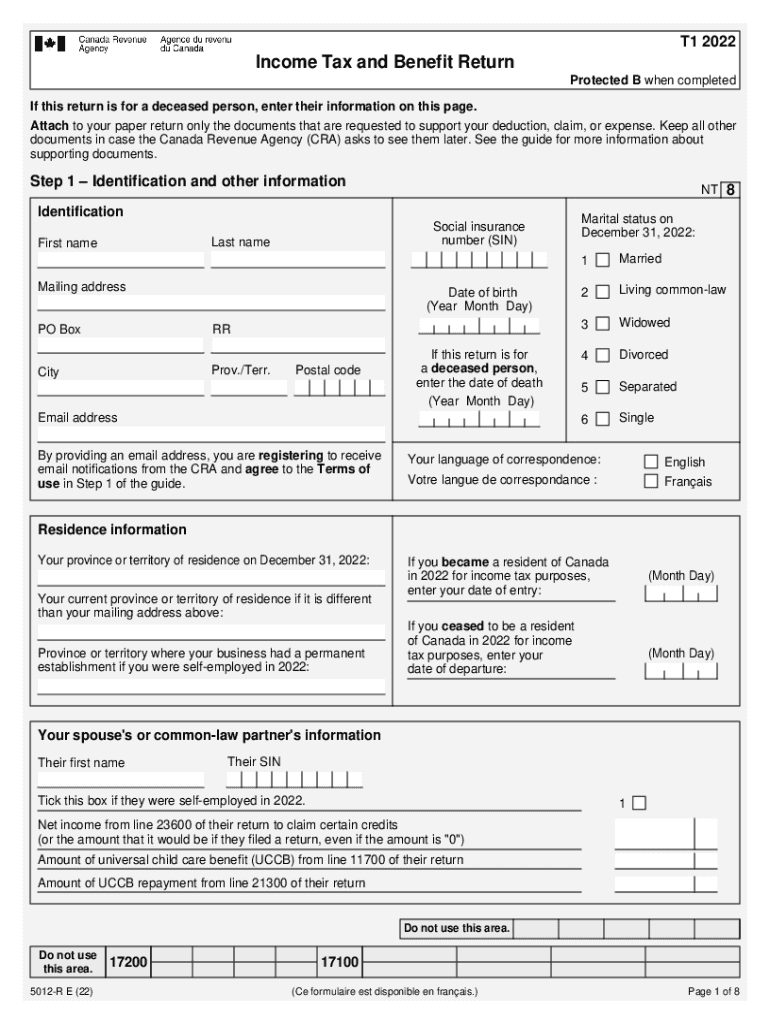

Preparing Returns for Deceased Persons Canada Ca Form

Understanding the Income Tax Benefit Return Document

The income tax benefit return document is essential for individuals and businesses seeking to report their income and claim eligible tax benefits. This document serves as a comprehensive record of income, deductions, and credits, ensuring compliance with federal and state tax regulations. It is crucial for taxpayers to accurately complete this document to maximize their benefits and avoid potential penalties.

Required Documents for Filing

To complete the income tax benefit return form, certain documents are necessary. These typically include:

- W-2 forms from employers, detailing annual income

- 1099 forms for reporting other income sources, such as freelance work

- Receipts for deductible expenses, including medical and educational costs

- Documentation for any tax credits being claimed, such as child tax credits

Gathering these documents in advance can streamline the filing process and ensure accuracy.

Steps to Complete the Income Tax Benefit Return Form

Filing the income tax benefit return form involves several key steps:

- Collect all required documents and information.

- Choose the appropriate tax form based on your filing status.

- Fill out the form, ensuring all income and deductions are accurately reported.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, following the IRS guidelines.

Following these steps can help ensure a smooth filing experience.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the income tax benefit return document. Generally, the deadline for individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers may request an extension, but it is essential to pay any taxes owed by the original deadline to avoid penalties.

IRS Guidelines for Compliance

Adhering to IRS guidelines is critical when filing the income tax benefit return document. The IRS provides detailed instructions for completing the form, including eligibility criteria for various deductions and credits. Taxpayers should familiarize themselves with these guidelines to ensure compliance and avoid potential audits or penalties.

Digital vs. Paper Version of the Form

Taxpayers have the option to file the income tax benefit return document either digitally or via paper. The digital version often allows for easier calculations and quicker submission, while the paper version may be preferred by those who are more comfortable with traditional methods. Both methods require careful attention to detail to ensure accuracy and compliance with tax laws.

Quick guide on how to complete preparing returns for deceased persons canada ca

Complete Preparing Returns For Deceased Persons Canada ca effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essentials to create, edit, and eSign your documents swiftly without delays. Handle Preparing Returns For Deceased Persons Canada ca on any device using airSlate SignNow's Android or iOS applications and simplify your document-driven processes today.

How to edit and eSign Preparing Returns For Deceased Persons Canada ca with ease

- Locate Preparing Returns For Deceased Persons Canada ca and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Select pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to finalize your edits.

- Decide how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Edit and eSign Preparing Returns For Deceased Persons Canada ca and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the preparing returns for deceased persons canada ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax benefit return document?

An income tax benefit return document is a formal record that outlines the deductions and credits you can claim on your tax return. It helps you maximize your tax benefits and ensures compliance with tax regulations. Using airSlate SignNow, you can easily create and manage these documents for efficient filing.

-

How can airSlate SignNow help with income tax benefit return documents?

airSlate SignNow streamlines the process of creating and signing income tax benefit return documents. Our platform allows you to easily fill out forms, gather necessary signatures, and store documents securely. This ensures that your tax documents are organized and accessible when you need them.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage income tax benefit return documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for your income tax benefit return documents. Additionally, our platform allows for real-time collaboration, making it easy to work with your team or tax professionals. These features enhance efficiency and accuracy in document management.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to import and export income tax benefit return documents easily, ensuring a smooth workflow. You can connect with tools you already use to enhance your tax filing process.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your income tax benefit return documents offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the document signing process, reducing the risk of errors and ensuring that your documents are legally binding. This allows you to focus more on your business and less on paperwork.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes the security of your income tax benefit return documents. We utilize advanced encryption and secure cloud storage to protect your sensitive information. You can trust that your documents are safe and compliant with industry standards.

Get more for Preparing Returns For Deceased Persons Canada ca

- Master land use permit application los angeles department of city form

- Catc certification renewal form

- In form 08

- Chp bit program form

- Bankers insurance company golden eagle bail bonds form

- State of california application for veterans points fillable form 2006

- Authorization to receive customer information or act on a

- 2013 nrci lto 01 e outdoorlightingdocx form

Find out other Preparing Returns For Deceased Persons Canada ca

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now