Deposit Term Form

What is the Deposit Term

A deposit term refers to the length of time that funds are held in a term account, typically ranging from a few months to several years. During this period, the account holder agrees not to withdraw the funds, allowing them to earn a fixed interest rate. This arrangement benefits both the bank and the account holder, as the bank can use the deposited funds for lending, while the account holder enjoys guaranteed returns on their investment.

How to Use the Deposit Term

Utilizing a deposit term effectively involves understanding your financial goals and selecting a term that aligns with them. Consider the interest rate offered, the duration of the term, and your liquidity needs. If you anticipate needing access to your funds before the term ends, it may be wise to choose a shorter deposit term or explore other account options. Additionally, be aware of any penalties for early withdrawal, which can affect your overall returns.

Steps to Complete the Deposit Term

Completing a deposit term involves several straightforward steps:

- Research and compare interest rates from different financial institutions.

- Choose the appropriate deposit term based on your financial goals.

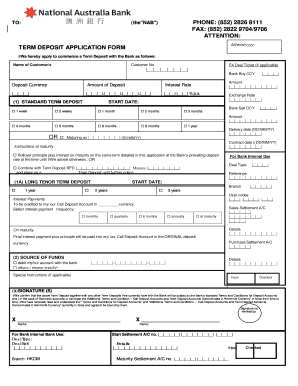

- Fill out the term deposit application form, providing necessary personal and financial information.

- Submit the application along with the initial deposit amount.

- Review and understand the terms and conditions, including interest calculation and withdrawal penalties.

Key Elements of the Deposit Term

Several key elements define a deposit term:

- Interest Rate: The fixed rate at which your deposit will earn interest over the term.

- Term Length: The duration for which the funds will be locked in, typically ranging from one month to five years.

- Minimum Deposit: The minimum amount required to open a term account, which can vary by institution.

- Early Withdrawal Penalties: Fees incurred if funds are withdrawn before the term ends.

Eligibility Criteria

To open a term account, individuals generally need to meet specific eligibility criteria. These may include being at least eighteen years old, having a valid Social Security number, and providing proof of identity and residency. Some financial institutions may also require a minimum initial deposit to establish the account. It is advisable to check with the chosen bank or credit union for their specific requirements.

Application Process & Approval Time

The application process for a term account typically involves filling out an application form, either online or in person. After submission, approval times can vary based on the institution's policies. Generally, if all required documents are in order, approval can take anywhere from a few minutes to a couple of business days. Once approved, the account holder will receive confirmation and details regarding their deposit term.

Quick guide on how to complete deposit term

Complete Deposit Term effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Deposit Term on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Deposit Term effortlessly

- Obtain Deposit Term and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your edits.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Deposit Term and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deposit term

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a term account in airSlate SignNow?

A term account in airSlate SignNow refers to a subscription plan that allows users to access our eSigning features for a specified duration. This plan is designed to provide businesses with flexibility and cost-effectiveness, ensuring they can manage their document signing needs efficiently.

-

How much does a term account cost?

The pricing for a term account in airSlate SignNow varies based on the features and duration selected. We offer competitive rates that cater to different business sizes, ensuring that you get the best value for your investment in eSigning solutions.

-

What features are included in a term account?

A term account in airSlate SignNow includes essential features such as unlimited eSignatures, document templates, and advanced security options. Additionally, users can benefit from integrations with popular applications, making document management seamless and efficient.

-

What are the benefits of using a term account?

Using a term account with airSlate SignNow provides numerous benefits, including cost savings, access to premium features, and enhanced document workflow. This plan is ideal for businesses looking to streamline their signing processes while maintaining compliance and security.

-

Can I upgrade my term account at any time?

Yes, you can upgrade your term account at any time to access additional features and capabilities. airSlate SignNow allows for easy upgrades, ensuring that your eSigning solution can grow alongside your business needs.

-

Is there a free trial available for the term account?

Yes, airSlate SignNow offers a free trial for the term account, allowing prospective customers to explore our eSigning features without any commitment. This trial period helps you assess how our solution can meet your document signing requirements.

-

What integrations are available with a term account?

A term account in airSlate SignNow supports various integrations with popular tools such as Google Drive, Salesforce, and Microsoft Office. These integrations enhance your workflow by allowing you to manage documents and eSignatures directly within your preferred applications.

Get more for Deposit Term

Find out other Deposit Term

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document