Mortgage Discharge Request Switching Lenders or Se Form

Understanding the Mortgage Discharge Request Switching Lenders or SE

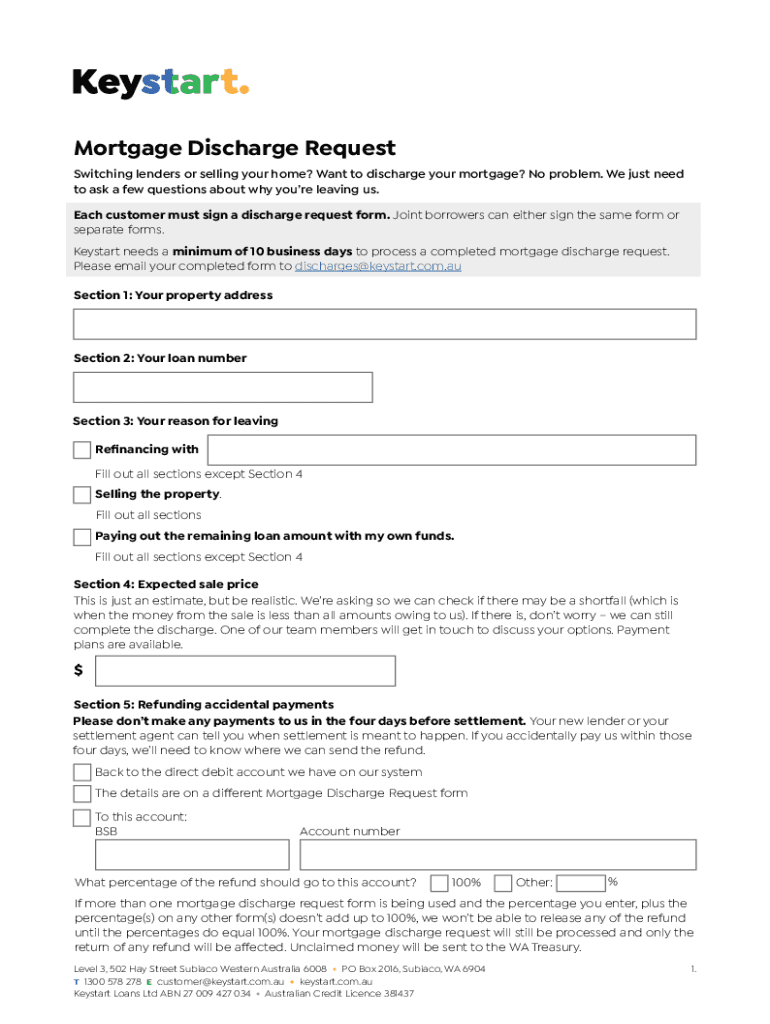

The Mortgage Discharge Request Switching Lenders or SE is a formal document used when a borrower seeks to switch their mortgage from one lender to another. This process often involves discharging the current mortgage, which legally releases the borrower from their obligations under the existing loan agreement. Understanding this form is crucial for homeowners looking to refinance or change lenders to secure better terms or rates.

Steps to Complete the Mortgage Discharge Request Switching Lenders or SE

Completing the Mortgage Discharge Request involves several key steps:

- Gather necessary information about your current mortgage, including loan number and lender details.

- Fill out the discharge request form accurately, ensuring all personal and property information is correct.

- Sign the document in the presence of a notary if required, as some states mandate notarization for legal documents.

- Submit the completed form to your current lender, adhering to any specific submission guidelines they may have.

Required Documents for the Mortgage Discharge Request

To successfully process the Mortgage Discharge Request, you will typically need to provide several documents:

- A copy of your current mortgage agreement.

- Identification proof, such as a driver's license or passport.

- Any correspondence from your new lender, if applicable.

- Additional forms as required by your current lender or state regulations.

Legal Use of the Mortgage Discharge Request Switching Lenders or SE

This form serves a legal purpose, as it formally notifies the current lender of your intention to discharge the mortgage. It is essential for protecting your rights as a borrower and ensuring that all parties are aware of the transition. Properly executing this request can help avoid potential legal issues related to the mortgage discharge process.

State-Specific Rules for the Mortgage Discharge Request

Each state may have its own regulations regarding the Mortgage Discharge Request. It is important to familiarize yourself with local laws, as some states require specific forms or additional documentation. Additionally, the processing times and fees associated with the discharge can vary by state, making it crucial to check your state’s requirements before proceeding.

Examples of Using the Mortgage Discharge Request Switching Lenders or SE

Common scenarios for using this form include:

- Refinancing a mortgage to obtain a lower interest rate.

- Switching lenders to access better customer service or loan products.

- Consolidating multiple loans into a single mortgage with a new lender.

Quick guide on how to complete mortgage discharge request switching lenders or se

Complete Mortgage Discharge Request Switching Lenders Or Se effortlessly on any device

Digital document management has grown increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and eSign your files swiftly without interruptions. Manage Mortgage Discharge Request Switching Lenders Or Se on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Mortgage Discharge Request Switching Lenders Or Se without hassle

- Find Mortgage Discharge Request Switching Lenders Or Se and then click Get Form to commence.

- Take advantage of the tools we provide to finalize your document.

- Emphasize relevant parts of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Select your preferred method to submit your form, whether by email, SMS, or a shareable link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Mortgage Discharge Request Switching Lenders Or Se and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage discharge request switching lenders or se

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Mortgage Discharge Request Switching Lenders Or Se?

A Mortgage Discharge Request Switching Lenders Or Se is a formal request to your current lender to discharge your mortgage when you are switching to a new lender. This process is essential to ensure that your existing mortgage is settled before taking on a new loan. Understanding this request can help streamline your transition between lenders.

-

How can airSlate SignNow assist with my Mortgage Discharge Request Switching Lenders Or Se?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Mortgage Discharge Request Switching Lenders Or Se documents. Our solution simplifies the paperwork process, ensuring that you can manage your mortgage discharge efficiently and securely. With our platform, you can focus on your new lending options without the hassle of traditional paperwork.

-

What are the costs associated with using airSlate SignNow for mortgage discharge requests?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those handling Mortgage Discharge Request Switching Lenders Or Se. Our cost-effective solution ensures that you can manage your documents without breaking the bank. You can choose from different subscription tiers based on your usage and requirements.

-

Are there any features specifically designed for mortgage discharge requests?

Yes, airSlate SignNow includes features tailored for Mortgage Discharge Request Switching Lenders Or Se, such as customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of your document management process, allowing you to complete your mortgage discharge requests quickly and accurately. Our platform is designed to meet the specific needs of users in the mortgage sector.

-

Can I integrate airSlate SignNow with other tools I use for mortgage management?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms commonly used in mortgage management. This allows you to streamline your workflow when handling Mortgage Discharge Request Switching Lenders Or Se and other related documents. Our integrations help you maintain a cohesive system for managing your financial documents.

-

What benefits does airSlate SignNow provide for businesses handling mortgage discharges?

Using airSlate SignNow for your Mortgage Discharge Request Switching Lenders Or Se offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document sharing, which can signNowly speed up the mortgage discharge process. Additionally, our secure environment ensures that your sensitive information is protected.

-

Is airSlate SignNow compliant with legal standards for mortgage documents?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures and document management, including those related to Mortgage Discharge Request Switching Lenders Or Se. Our platform adheres to industry regulations, ensuring that your documents are legally binding and secure. You can trust that your mortgage discharge requests will meet all necessary legal requirements.

Get more for Mortgage Discharge Request Switching Lenders Or Se

Find out other Mortgage Discharge Request Switching Lenders Or Se

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer