941x Form 2015

What is the 941x Form

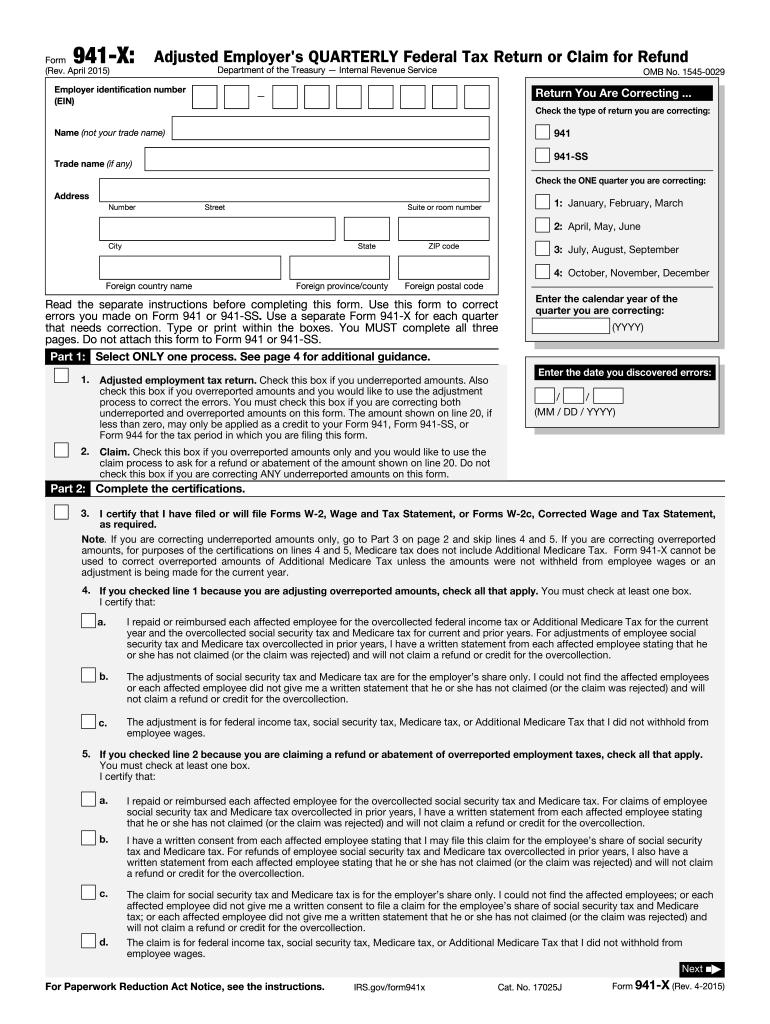

The 941x Form, officially known as the Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund, is a tax form used by employers in the United States to correct errors on previously filed Form 941. This form is essential for businesses that need to amend their payroll tax filings, ensuring accurate reporting of withheld federal income tax, Social Security tax, and Medicare tax. The 941x Form allows employers to make adjustments for overreported or underreported amounts, ensuring compliance with IRS regulations.

How to use the 941x Form

Using the 941x Form involves several straightforward steps. First, gather all relevant information from the original Form 941 that needs correction. Next, complete the 941x Form by indicating the specific lines that require adjustments and providing the correct figures. It is crucial to explain the reason for the changes in the designated section of the form. After completing the form, review it carefully for accuracy before submitting it to the IRS. Employers can file the 941x Form electronically or via mail, depending on their preference and the method used for the original filing.

Steps to complete the 941x Form

Completing the 941x Form requires careful attention to detail. Begin by entering your employer information, including your name, address, and Employer Identification Number (EIN). Then, identify the quarter for which you are making corrections. Next, review the original amounts reported on your Form 941 and enter the corrected amounts on the 941x Form. Be sure to include a clear explanation for each adjustment in the provided section. Finally, sign and date the form before submitting it to the IRS, ensuring that all information is accurate and complete to avoid delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the 941x Form are crucial for compliance with IRS regulations. Generally, the 941x Form must be filed within three years from the date the original Form 941 was filed or within two years from the date the tax was paid, whichever is later. It is important to note that timely filing helps avoid penalties and interest on any unpaid taxes. Employers should keep track of these deadlines to ensure that any necessary corrections are submitted promptly.

Legal use of the 941x Form

The 941x Form is legally recognized as a valid method for correcting payroll tax filings. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated time frames. Compliance with IRS guidelines is essential, as improper use of the form can lead to penalties or audits. Employers should maintain thorough records of all submitted forms and any correspondence with the IRS related to corrections made using the 941x Form.

Key elements of the 941x Form

Several key elements are essential when completing the 941x Form. These include the employer's identification details, the quarter being amended, and the specific lines that require correction. Each line on the form corresponds to the original Form 941, allowing for clear adjustments. Additionally, a detailed explanation for each correction is necessary to provide context for the changes made. Accurate calculations and thorough documentation are vital to ensure the integrity of the filing process.

Quick guide on how to complete 941x 2015 form

Complete 941x Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily access the right template and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Manage 941x Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The simplest way to edit and eSign 941x Form effortlessly

- Find 941x Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Edit and eSign 941x Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941x 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 941x 2015 form

How to make an electronic signature for the 941x 2015 Form online

How to generate an electronic signature for your 941x 2015 Form in Chrome

How to make an electronic signature for signing the 941x 2015 Form in Gmail

How to generate an eSignature for the 941x 2015 Form from your smartphone

How to generate an eSignature for the 941x 2015 Form on iOS devices

How to create an electronic signature for the 941x 2015 Form on Android OS

People also ask

-

What is the 941x Form and why is it important for businesses?

The 941x Form is a crucial tax form used by businesses to amend previously filed quarterly employment tax returns. It's essential for correcting errors related to payroll taxes and ensuring compliance with IRS regulations. Using the 941x Form correctly can help businesses avoid penalties and maintain accurate tax records.

-

How can airSlate SignNow help with the 941x Form?

airSlate SignNow simplifies the process of completing and submitting the 941x Form by providing an easy-to-use eSignature platform. You can fill out the form digitally, sign it, and send it securely all in one place. This streamlines the amendment process and enhances accuracy, making tax compliance much easier.

-

Is airSlate SignNow a cost-effective solution for managing the 941x Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 941x Form and other documents. With flexible pricing plans, businesses can choose the option that best fits their needs without overspending. This ensures that you can efficiently handle your tax forms while keeping costs under control.

-

What features does airSlate SignNow offer for the 941x Form?

airSlate SignNow provides features like customizable templates, real-time collaboration, and secure eSigning that enhance the process of managing the 941x Form. You can easily create, edit, and share your forms, ensuring that all relevant parties can access and sign them quickly. This improves efficiency and reduces turnaround times.

-

Are there integrations available for managing the 941x Form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easier to manage the 941x Form alongside your other financial documents. This integration allows you to pull in data and maintain consistency across your forms. Such connectivity enhances workflow and reduces data entry errors.

-

Can I track the status of my 941x Form with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities for your 941x Form, allowing you to see when the document has been viewed, signed, and completed. This level of transparency is crucial for maintaining compliance and ensuring that all necessary actions are taken promptly.

-

What security measures does airSlate SignNow have for the 941x Form?

airSlate SignNow prioritizes security, offering features such as encryption and secure cloud storage for your 941x Form. This protects sensitive information from unauthorized access while ensuring that your documents are safely stored and easily accessible. You can trust that your data is secure with airSlate SignNow.

Get more for 941x Form

- Sample philosophical vaccine refusal form herb allure

- Dti form for partnership

- Financial affidavit short form online fillable

- Hhs 342 report of survey form

- Owcp 1168 form

- Dhs instructions for eft form

- State of ct form 211

- Print grade 5 unit 1 home link lesson 3 being assertive name it can be scary speaking up or talking to someone you dont know form

Find out other 941x Form

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word