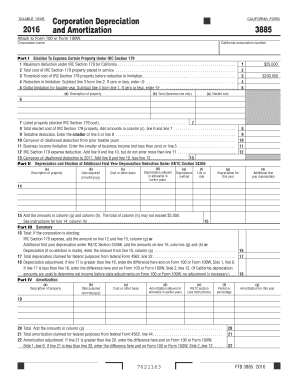

Ca 3885 Form 2016

What is the Ca 3885 Form

The Ca 3885 Form is a document used in California for various tax-related purposes, primarily concerning the reporting of income and deductions. This form is essential for individuals and businesses to ensure compliance with state tax laws. It serves as a means for taxpayers to report their financial information accurately to the California Franchise Tax Board. Understanding the purpose and requirements of the Ca 3885 Form is crucial for proper tax filing and avoiding penalties.

How to use the Ca 3885 Form

Using the Ca 3885 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductions, and any other relevant information. Next, fill out the form with the required details, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it for any errors before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, making it easier to fill out and eSign the document securely.

Steps to complete the Ca 3885 Form

Completing the Ca 3885 Form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents, such as income statements and deduction receipts.

- Access the Ca 3885 Form online or obtain a physical copy from the California Franchise Tax Board.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check calculations and verify that all necessary fields are filled.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form by the designated deadline, either online or via mail.

Legal use of the Ca 3885 Form

The legal use of the Ca 3885 Form is governed by California tax laws and regulations. It is important to ensure that the form is filled out accurately to avoid potential legal issues. An incorrectly completed form may lead to penalties, audits, or additional tax liabilities. By adhering to the guidelines set forth by the California Franchise Tax Board, taxpayers can ensure that their submissions are legally valid and recognized by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Ca 3885 Form are critical for compliance with state tax regulations. Typically, the form must be submitted by April 15 of the tax year, aligning with the federal tax filing deadline. However, it is important to check for any updates or changes to these deadlines, as extensions may be available under certain circumstances. Staying informed about important dates ensures that taxpayers can avoid late fees and penalties associated with delayed submissions.

Form Submission Methods (Online / Mail / In-Person)

The Ca 3885 Form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online through the California Franchise Tax Board's website, which offers a secure and efficient way to submit forms electronically. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its advantages, and taxpayers should select the one that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete ca 3885 2016 form

Complete Ca 3885 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage Ca 3885 Form on any platform via airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ca 3885 Form with ease

- Locate Ca 3885 Form and click Get Form to initiate.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or mask sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Ca 3885 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca 3885 2016 form

Create this form in 5 minutes!

How to create an eSignature for the ca 3885 2016 form

How to create an electronic signature for the Ca 3885 2016 Form online

How to create an electronic signature for your Ca 3885 2016 Form in Chrome

How to make an electronic signature for putting it on the Ca 3885 2016 Form in Gmail

How to generate an eSignature for the Ca 3885 2016 Form straight from your smartphone

How to generate an electronic signature for the Ca 3885 2016 Form on iOS devices

How to create an eSignature for the Ca 3885 2016 Form on Android devices

People also ask

-

What is the CA 3885 Form and why is it important?

The CA 3885 Form is a tax form used in California to report business income and expenses. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations and to avoid penalties. Understanding how to fill out the CA 3885 Form correctly can also maximize potential deductions.

-

How can airSlate SignNow help with the CA 3885 Form?

AirSlate SignNow simplifies the process of eSigning and sending the CA 3885 Form. With our user-friendly platform, you can easily upload, sign, and share your completed forms electronically, streamlining your workflow and saving time. This makes managing your tax documents more efficient and organized.

-

Is there a cost associated with using airSlate SignNow for the CA 3885 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our affordable plans provide access to features that facilitate the signing and sending of documents like the CA 3885 Form. You can choose a plan that suits your budget and requirements.

-

What features does airSlate SignNow offer for managing the CA 3885 Form?

AirSlate SignNow includes features such as document templates, reminders, and secure cloud storage to help you manage the CA 3885 Form efficiently. Additionally, our platform allows multiple users to collaborate seamlessly, ensuring that all necessary signatures are obtained promptly.

-

Can I integrate airSlate SignNow with other software for handling the CA 3885 Form?

Absolutely! AirSlate SignNow integrates with various business applications, allowing you to streamline your processes when handling the CA 3885 Form. Whether you're using accounting software or project management tools, our integrations can enhance your workflow.

-

What are the benefits of using airSlate SignNow for the CA 3885 Form?

Using airSlate SignNow for the CA 3885 Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible, giving you peace of mind while managing your tax forms.

-

Is airSlate SignNow secure for handling sensitive documents like the CA 3885 Form?

Yes, airSlate SignNow prioritizes security and compliance when dealing with documents such as the CA 3885 Form. Our platform employs advanced encryption and authentication measures to protect your sensitive information, ensuring your data is safe throughout the signing process.

Get more for Ca 3885 Form

- Consent for radiation therapy to the vaginal cuffcervixuterus with intracavitary brachytherapy 577130 hartford hospital consent form

- Savbond1bpdtreasgov form

- Request to reissue united states treasury direct treasurydirect form

- Ds1663far design mode us department of state state form

- Cobra appeal form

- Me back form

- Icici bank rtgs application form download pdf file

- Dd form 844

Find out other Ca 3885 Form

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement