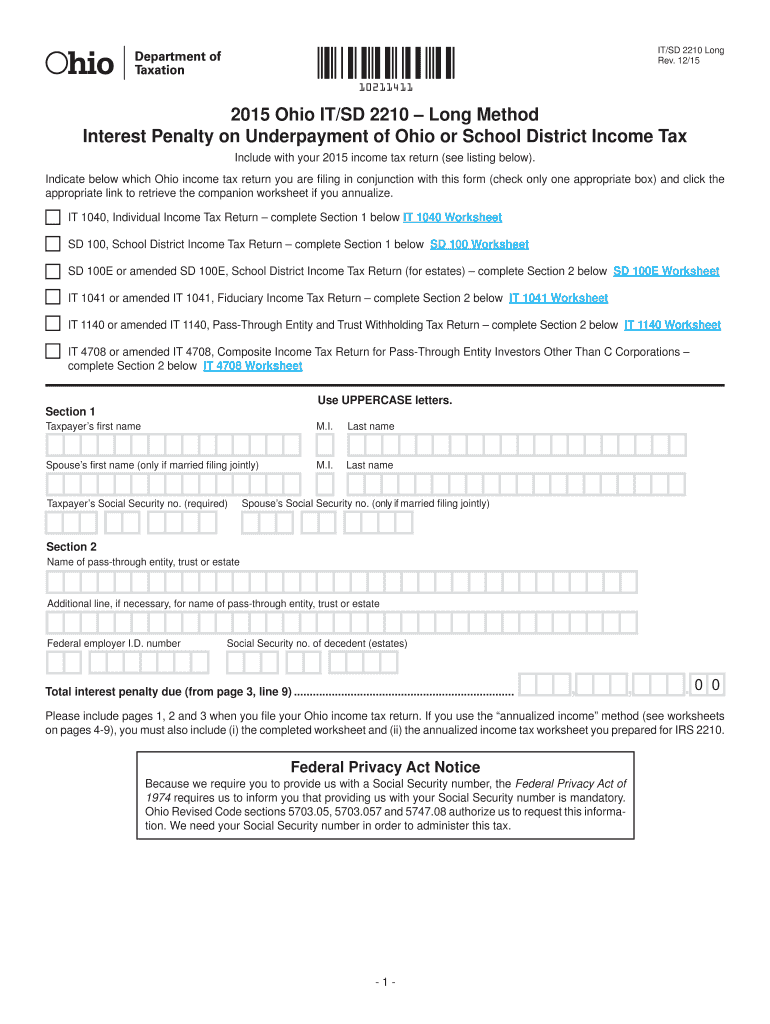

it Sd 2210 Form 2015

What is the It Sd 2210 Form

The It Sd 2210 Form is a tax form used by individuals in the United States to determine whether they owe additional tax due to underpayment of estimated tax. This form is particularly relevant for taxpayers who may not have had enough tax withheld from their income throughout the year. It helps calculate any penalties that may apply for not meeting the required payment thresholds set by the IRS.

How to use the It Sd 2210 Form

To use the It Sd 2210 Form, taxpayers must first gather their financial information, including income sources and withholding amounts. The form provides a structured way to report this information and calculate any potential penalties. Taxpayers will need to follow the instructions carefully, filling out each section accurately to ensure compliance with IRS regulations.

Steps to complete the It Sd 2210 Form

Completing the It Sd 2210 Form involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Calculate total income and estimate tax liability for the year.

- Determine the amount of tax withheld and any estimated payments made.

- Fill out the form, entering the calculated figures in the appropriate sections.

- Review the form for accuracy and completeness before submission.

Legal use of the It Sd 2210 Form

The It Sd 2210 Form is legally recognized by the IRS for assessing penalties related to underpayment of estimated taxes. It is crucial for taxpayers to use this form correctly to avoid legal issues, including fines or additional penalties. Adhering to IRS guidelines ensures that the form is accepted and that taxpayers remain compliant with federal tax laws.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when submitting the It Sd 2210 Form. Generally, the form should be filed by the tax return due date, which is typically April 15 for most individuals. If taxpayers are unable to meet this deadline, they may apply for an extension, but it is essential to understand that any owed taxes must still be paid by the original due date to avoid penalties.

Who Issues the Form

The It Sd 2210 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form along with detailed instructions on how to complete it, ensuring that taxpayers have the necessary resources to comply with tax regulations.

Quick guide on how to complete it sd 2210 2015 form

Effortlessly Complete It Sd 2210 Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Handle It Sd 2210 Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-centered task today.

How to Modify and eSign It Sd 2210 Form with Ease

- Locate It Sd 2210 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign It Sd 2210 Form and ensure seamless communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it sd 2210 2015 form

Create this form in 5 minutes!

How to create an eSignature for the it sd 2210 2015 form

How to create an electronic signature for your It Sd 2210 2015 Form in the online mode

How to create an electronic signature for your It Sd 2210 2015 Form in Chrome

How to generate an electronic signature for putting it on the It Sd 2210 2015 Form in Gmail

How to generate an electronic signature for the It Sd 2210 2015 Form from your mobile device

How to generate an eSignature for the It Sd 2210 2015 Form on iOS

How to generate an electronic signature for the It Sd 2210 2015 Form on Android devices

People also ask

-

What is the It Sd 2210 Form and how can airSlate SignNow help?

The It Sd 2210 Form is a tax document used to report underpayment of estimated tax. With airSlate SignNow, you can easily fill out, eSign, and submit the It Sd 2210 Form online, ensuring compliance and accuracy for your tax submissions. Our platform streamlines the process, making it simple and efficient.

-

Is airSlate SignNow cost-effective for handling the It Sd 2210 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the It Sd 2210 Form. Our pricing plans are designed to fit various budgets, allowing users to efficiently handle their document signing needs without breaking the bank. You can save both time and money by utilizing our intuitive platform.

-

What features does airSlate SignNow offer for the It Sd 2210 Form?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure cloud storage specifically for the It Sd 2210 Form. These features simplify the process of completing and managing your tax documents, ensuring that you have everything you need at your fingertips.

-

Can I integrate airSlate SignNow with other software for the It Sd 2210 Form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the It Sd 2210 Form alongside your existing tools. This ensures a seamless workflow whether you're using accounting software, CRMs, or other document management systems.

-

What are the benefits of using airSlate SignNow for the It Sd 2210 Form?

Using airSlate SignNow for the It Sd 2210 Form provides numerous benefits, including enhanced security, time savings, and improved accuracy. Our platform allows you to quickly eSign documents, reducing the likelihood of errors and ensuring timely submissions to tax authorities.

-

How secure is my information when using airSlate SignNow for the It Sd 2210 Form?

Security is a top priority at airSlate SignNow. When you use our platform for the It Sd 2210 Form, your personal and financial information is protected with advanced encryption protocols and secure data storage. You can trust that your documents are safe with us.

-

Can I track the status of my It Sd 2210 Form in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your It Sd 2210 Form in real-time. You will receive notifications when the document is viewed, signed, or completed, providing peace of mind and ensuring you stay informed throughout the process.

Get more for It Sd 2210 Form

Find out other It Sd 2210 Form

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free